Answered step by step

Verified Expert Solution

Question

1 Approved Answer

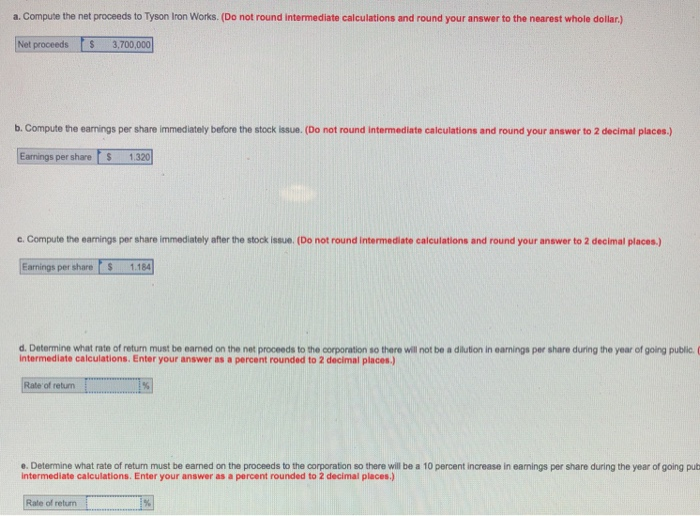

Tyson Iron Works is about to go public. It currently has aftertax earnings of $4,500,000, and 3,400,000 shares are owned by the present stockholders. The

Tyson Iron Works is about to go public. It currently has aftertax earnings of $4,500,000, and 3,400,000 shares are owned by the present stockholders. The new public issue will represent 400,000 new shares. The new shares will be priced to the public at $10 per share with a 3 percent spread on the offering price. There will also be $180,000 in out-of-pocket costs to the corporation.

D) Determine what rate of return must be earned on the net proceeds to the corporation so there will not be any dilution in earnings per share during thr year of going public

E) Determine what rate of return must be earned on the proceeds to the corporation so there will be 10 percent increase in earnings per share during the year going public

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started