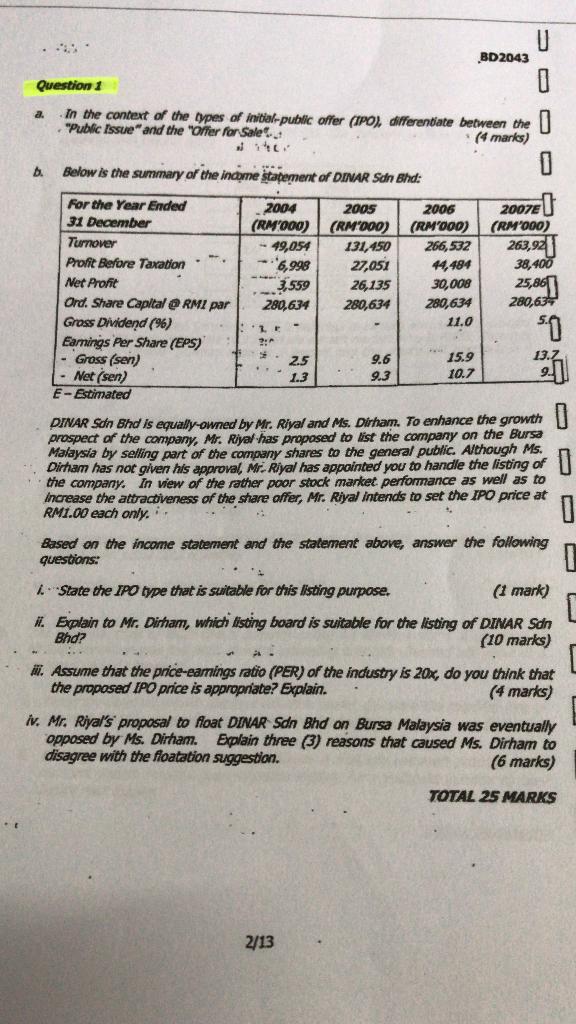

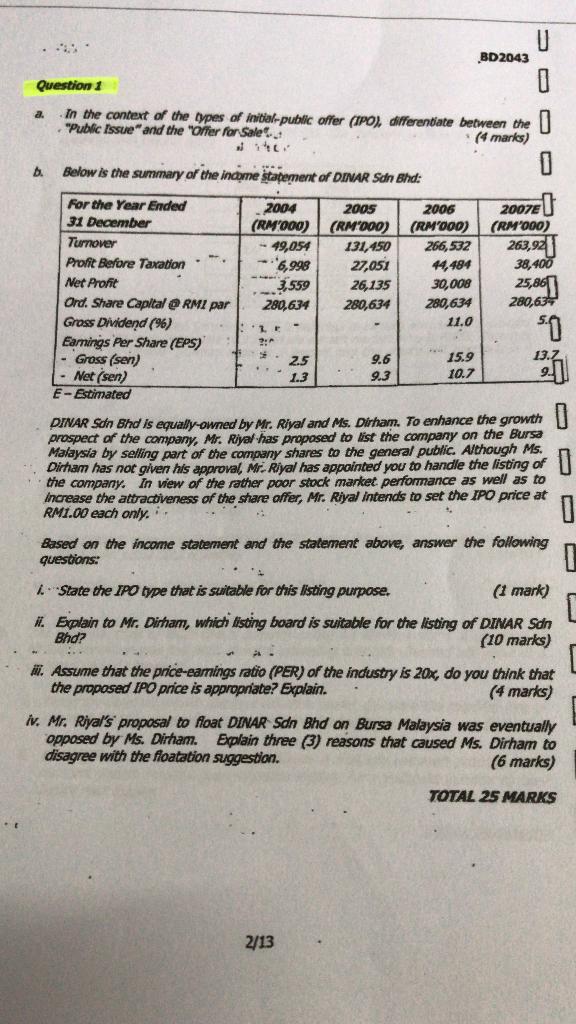

U -- BD2043 Question 1 0 a. In the context of the types of initial-public offer (IPO), differentiate between the . "Public Issue" and the "Offer for Sale 0 (4 marks) #ter 0 b. Below is the summary of the income statement of DINAR Sdn Bhd: For the Year Ended 2004 2006 31 December 2005 (RM'000) (RM'000) (RM'000) Turnover 49,054 131,450 266,532 Profit Before Taxation 6,998 27,051 44,484 Net Profit 3,559 26,135 30,008 Ord. Share Capital @ RMI par 280,634 280,634 280,634 Gross Dividend (%) 11.0 r 5.0 2.A 2.5 9.6 15.9 13.2 Earnings Per Share (EPS) - Gross (sen) -Net (sen) E-Estimated ** 1.3 9.3 10.7 DINAR Sdn Bhd is equally-owned by Mr. Riyal and Ms. Dirham. To enhance the growth prospect of the company, Mr. Riyal has proposed to list the company on the Bursa Malaysia by selling part of the company shares to the general public. Although Ms. Dirham has not given his approval, Mr. Riyal has appointed you to handle the listing of the company. In view of the rather poor stock market performance as well as to Increase the attractiveness of the share offer, Mr. Riyal intends to set the IPO price at RM1.00 each only... 0 Based on the income statement and the statement above, answer the following questions: i. State the IPO type that is suitable for this listing purpose. (1 mark) ii. Explain to Mr. Dirham, which listing board is suitable for the listing of DINAR Sdn Bhd? (10 marks) ... iii. Assume that the price-earings ratio (PER) of the industry is 20x, do you think that the proposed IPO price is appropriate? Explain. (4 marks) iv. Mr. Riyal's proposal to float DINAR Sdn Bhd on Bursa Malaysia was eventually opposed by Ms. Dirham. Explain three (3) reasons that caused Ms. Dirham to disagree with the floatation suggestion. (6 marks) TOTAL 25 MARKS 2/13 2007E (RM'000) 263,92 38,400 25,86 280,63 O U -- BD2043 Question 1 0 a. In the context of the types of initial-public offer (IPO), differentiate between the . "Public Issue" and the "Offer for Sale 0 (4 marks) #ter 0 b. Below is the summary of the income statement of DINAR Sdn Bhd: For the Year Ended 2004 2006 31 December 2005 (RM'000) (RM'000) (RM'000) Turnover 49,054 131,450 266,532 Profit Before Taxation 6,998 27,051 44,484 Net Profit 3,559 26,135 30,008 Ord. Share Capital @ RMI par 280,634 280,634 280,634 Gross Dividend (%) 11.0 r 5.0 2.A 2.5 9.6 15.9 13.2 Earnings Per Share (EPS) - Gross (sen) -Net (sen) E-Estimated ** 1.3 9.3 10.7 DINAR Sdn Bhd is equally-owned by Mr. Riyal and Ms. Dirham. To enhance the growth prospect of the company, Mr. Riyal has proposed to list the company on the Bursa Malaysia by selling part of the company shares to the general public. Although Ms. Dirham has not given his approval, Mr. Riyal has appointed you to handle the listing of the company. In view of the rather poor stock market performance as well as to Increase the attractiveness of the share offer, Mr. Riyal intends to set the IPO price at RM1.00 each only... 0 Based on the income statement and the statement above, answer the following questions: i. State the IPO type that is suitable for this listing purpose. (1 mark) ii. Explain to Mr. Dirham, which listing board is suitable for the listing of DINAR Sdn Bhd? (10 marks) ... iii. Assume that the price-earings ratio (PER) of the industry is 20x, do you think that the proposed IPO price is appropriate? Explain. (4 marks) iv. Mr. Riyal's proposal to float DINAR Sdn Bhd on Bursa Malaysia was eventually opposed by Ms. Dirham. Explain three (3) reasons that caused Ms. Dirham to disagree with the floatation suggestion. (6 marks) TOTAL 25 MARKS 2/13 2007E (RM'000) 263,92 38,400 25,86 280,63 O