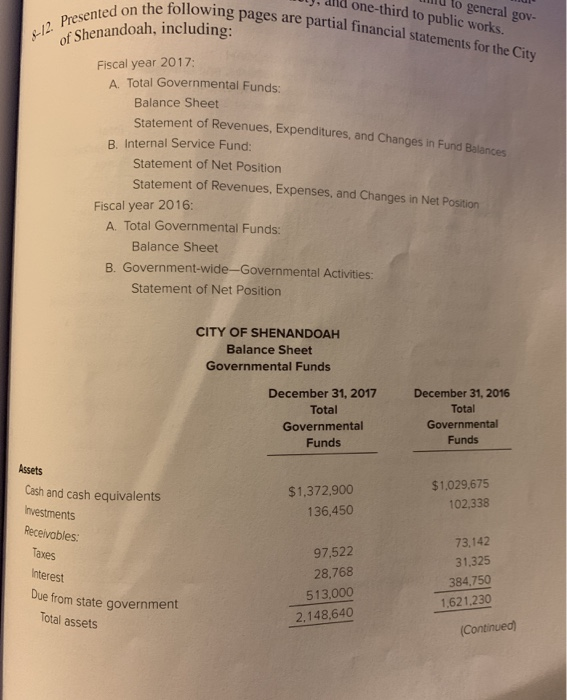

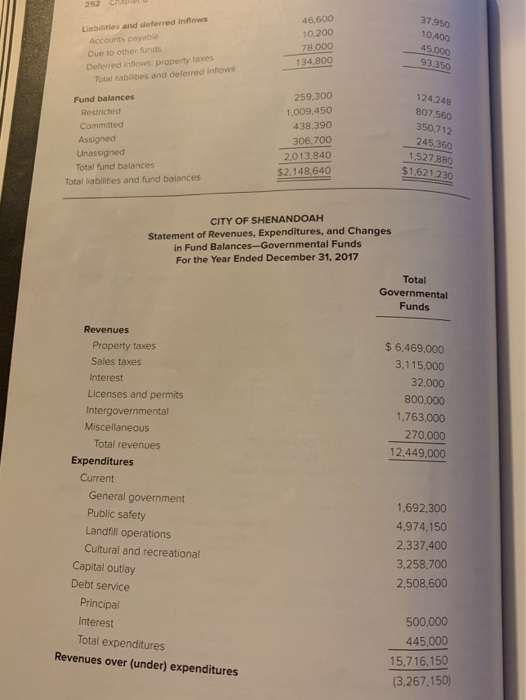

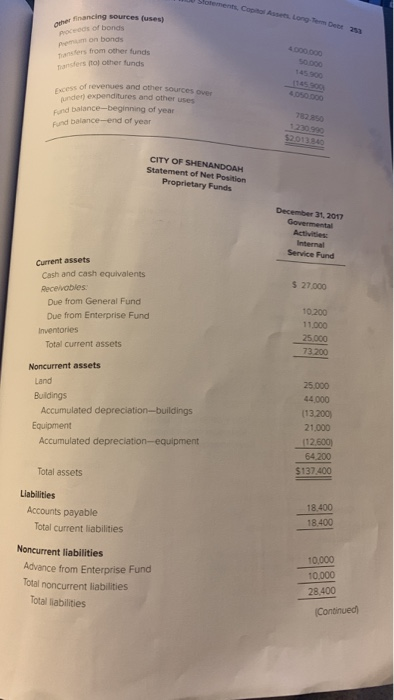

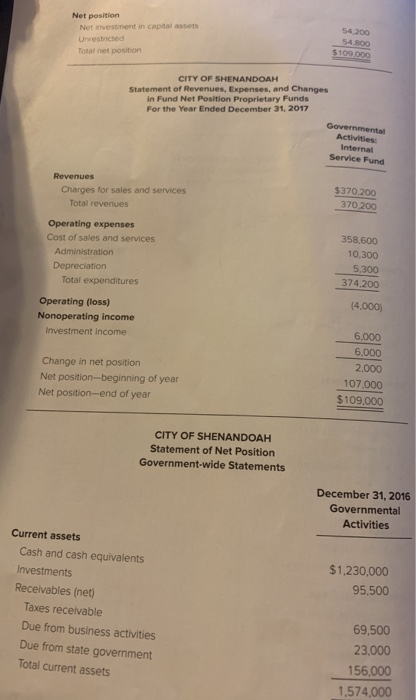

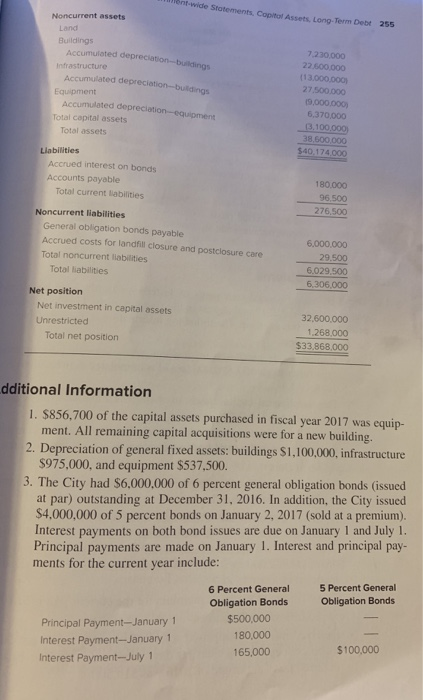

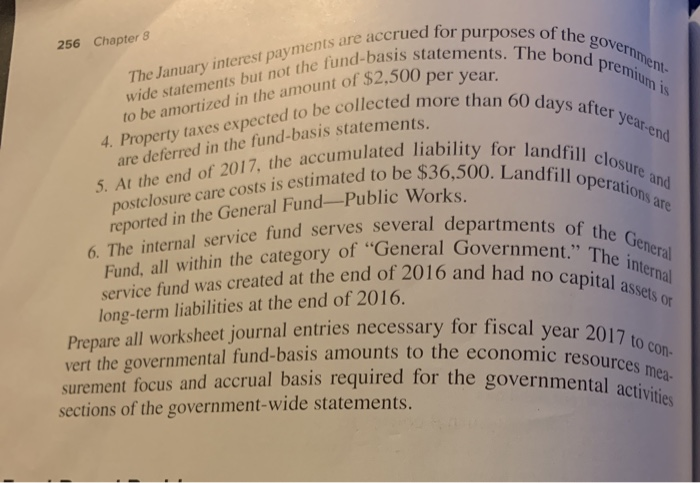

U lo general gov- ly, alld one-third to public works. the following pages are partial financial statements for 12. Presented on the foll f Shenandoah, including: Fiscal year 2017: A. Total Governmental Funds: Balance Sheet Statement of Revenues, Expenditures, and changes in Fund Bela B. Internal Service Fund: Statement of Net Position Statement of Revenues, Expenses, and Changes in Net Position Fiscal year 2016: A Total Governmental Funds: Balance Sheet B. Government-wide-Governmental Activities: Statement of Net Position CITY OF SHENANDOAH Balance Sheet Governmental Funds December 31, 2017 Total Governmental Funds December 31, 2016 Total Governmental Funds Assets Cash and cash equivalents $1,372,900 136,450 $1,029,675 102,338 Investments Receivables: Taxes Interest 97,522 28,768 513,000 2.148,640 73.142 31.325 384.750 1,621.230 Due from state government Total assets (Continued) - Lisbetes and deferred inflows Accounts payable Due to other funds Deferred inflows property taxes Total abies and deferred Infows 46,600 10.200 78.000 134,800 37.950 10400 45.000 93,350 Fund balances Restricted Committed Assigned Unassigned Total fund balances Total liabilities and fund balances 259.300 1.009.450 438,390 306.700 2,013,840 $2.148,640 124248 807,560 350.712 245,360 1.527.880 $1.621.230 CITY OF SHENANDOAH Statement of Revenues, Expenditures, and Changes in Fund Balances-Governmental Funds For the Year Ended December 31, 2017 Total Governmental Funds $ 6.469,000 3.115,000 32,000 800.000 1.763.000 270.000 12.449.000 Revenues Property taxes Sales taxes Interest Licenses and permits Intergovernmental Miscellaneous Total revenues Expenditures Current General government Public safety Landfill operations Cultural and recreational Capital outlay Debt service Principal Interest Total expenditures Revenues over (under) expenditures 1,692,300 4,974,150 2.337.400 3,258,700 2,508,600 500,000 445,000 15.716,150 (3.267.150) Statements Copco Asset Long-Term Debt 253 financing sources (usest ods of bonds on bonds fers from other funds anders al other funds of revenues and other sources under) expenditures and other uses od balance-beginning of year und balance-end of year 762 $2013 CITY OF SHENANDOAH Statement of Net Position Proprietary Funds December 31, 2017 Governmental Service Fund $ 27.000 Current assets Cash and cash equivalents Receivables Due from General Fund Due from Enterprise Fund Inventories Total current assets 10.200 11.000 25 000 73.200 Noncurrent assets Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment 25.000 44.000 (13.200 21.000 112.600 64 200 $137.400 Total assets Liabilities Accounts payable Total current liabilities 18.400 18.400 Noncurrent liabilities Advance from Enterprise Fund Total noncurrent liabilities Total abilities 10,000 10.000 28.400 Continued Net position Net investment in capital assets Urestricted Total net position 54.200 54.800 $109.000 CITY OF SHENANDOAH Statement of Revenues, Expenses, and Changes in Fund Net Position Proprietary Funds For the Year Ended December 31, 2017 Government Activities Internal Service Fund Revenues Charges for sales and services Total revenues $370,200 370 200 Operating expenses Cost of sales and services Administration Depreciation Total expenditures 358,600 10,300 5,300 374.200 (4.000) Operating (loss) Nonoperating income Investment income 6,000 Change in net position Net position-beginning of year Net position-end of year 6.000 2,000 107.000 $109,000 CITY OF SHENANDOAH Statement of Net Position Government-wide Statements December 31, 2016 Governmental Activities $1,230,000 95,500 Current assets Cash and cash equivalents Investments Receivables (net) Taxes receivable Due from business activities Due from state government Total current assets 69,500 23,000 156,000 1,574,000 on-wide Statements Colt Noncurrent assets Long Term Debt 255 Land Buildings cumulated depreciation-budings infrastructure Accumulated depreciation-buda Equipment Accumulated depreciation-equipment 7.230,000 22.500.000 113.000.000 27.500.000 19,000,000) 6,370,000 3.100.000 38.600.000 $40.174000 Total capital assets Total assets Liabilities Accrued interest on bonds Accounts payable Total current liabilities 180.000 96.500 276,500 Noncurrent liabilities General obligation bonds payable Accrued costs for landfill closure and postclosure care Total noncurrent liabilities Total liabilities 6.000.000 29.500 6.029.500 6.306.000 Net position Net investment in capital assets Unrestricted Total net position 32.600.000 1.268,000 $33.868.000 dditional Information 1. $856,700 of the capital assets purchased in fiscal year 2017 was equip ment. All remaining capital acquisitions were for a new building. 2. Depreciation of general fixed assets: buildings S1,100,000, infrastructure $975,000, and equipment $537,500. 3. The City had $6,000,000 of 6 percent general obligation bonds (issued at par) outstanding at December 31, 2016. In addition, the City issued $4,000,000 of 5 percent bonds on January 2, 2017 (sold at a premium). Interest payments on both bond issues are due on January 1 and July 1 Principal payments are made on January 1. Interest and principal pay- ments for the current year include: 5 Percent General Obligation Bonds Principal Payment-January 1 Interest Payment-January 1 Interest Payment--July 1 6 Percent General Obligation Bonds $500,000 180.000 165,000 $100,000 he government- accrued for purposes of the go nd-basis statements. The bond premium is days after year-end d to be collected more than 60 days accumulated liability for landfill afill closure and ll operations are be $36,500. Landfill opera 256 Chapter 8 The January interest payments are accrued fo wide statements but not the fund-basis sta artized in the amount of $2,500 per ve 4. Property taxes expected to be collected mo are deferred in the fund-basis statements. 5. At the end of 2017, the accumulated postclosure care costs is estimated to be $365 reported in the General Fund-Public Works 6. The internal service fund serves several depar Fund, all within the category of "General G. service fund was created at the end of 2016 am long-term liabilities at the end of 2016. several departments of the of the General " The internal 1o capital assets of vear 2017 to con worksheet journal entries necessary for fiscal year 201 vert the governmental fund-basis amounts to the economic surement focus and accrual basis required for the governmen sections of the government-wide statements. economic resources mea- overnmental activities U lo general gov- ly, alld one-third to public works. the following pages are partial financial statements for 12. Presented on the foll f Shenandoah, including: Fiscal year 2017: A. Total Governmental Funds: Balance Sheet Statement of Revenues, Expenditures, and changes in Fund Bela B. Internal Service Fund: Statement of Net Position Statement of Revenues, Expenses, and Changes in Net Position Fiscal year 2016: A Total Governmental Funds: Balance Sheet B. Government-wide-Governmental Activities: Statement of Net Position CITY OF SHENANDOAH Balance Sheet Governmental Funds December 31, 2017 Total Governmental Funds December 31, 2016 Total Governmental Funds Assets Cash and cash equivalents $1,372,900 136,450 $1,029,675 102,338 Investments Receivables: Taxes Interest 97,522 28,768 513,000 2.148,640 73.142 31.325 384.750 1,621.230 Due from state government Total assets (Continued) - Lisbetes and deferred inflows Accounts payable Due to other funds Deferred inflows property taxes Total abies and deferred Infows 46,600 10.200 78.000 134,800 37.950 10400 45.000 93,350 Fund balances Restricted Committed Assigned Unassigned Total fund balances Total liabilities and fund balances 259.300 1.009.450 438,390 306.700 2,013,840 $2.148,640 124248 807,560 350.712 245,360 1.527.880 $1.621.230 CITY OF SHENANDOAH Statement of Revenues, Expenditures, and Changes in Fund Balances-Governmental Funds For the Year Ended December 31, 2017 Total Governmental Funds $ 6.469,000 3.115,000 32,000 800.000 1.763.000 270.000 12.449.000 Revenues Property taxes Sales taxes Interest Licenses and permits Intergovernmental Miscellaneous Total revenues Expenditures Current General government Public safety Landfill operations Cultural and recreational Capital outlay Debt service Principal Interest Total expenditures Revenues over (under) expenditures 1,692,300 4,974,150 2.337.400 3,258,700 2,508,600 500,000 445,000 15.716,150 (3.267.150) Statements Copco Asset Long-Term Debt 253 financing sources (usest ods of bonds on bonds fers from other funds anders al other funds of revenues and other sources under) expenditures and other uses od balance-beginning of year und balance-end of year 762 $2013 CITY OF SHENANDOAH Statement of Net Position Proprietary Funds December 31, 2017 Governmental Service Fund $ 27.000 Current assets Cash and cash equivalents Receivables Due from General Fund Due from Enterprise Fund Inventories Total current assets 10.200 11.000 25 000 73.200 Noncurrent assets Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment 25.000 44.000 (13.200 21.000 112.600 64 200 $137.400 Total assets Liabilities Accounts payable Total current liabilities 18.400 18.400 Noncurrent liabilities Advance from Enterprise Fund Total noncurrent liabilities Total abilities 10,000 10.000 28.400 Continued Net position Net investment in capital assets Urestricted Total net position 54.200 54.800 $109.000 CITY OF SHENANDOAH Statement of Revenues, Expenses, and Changes in Fund Net Position Proprietary Funds For the Year Ended December 31, 2017 Government Activities Internal Service Fund Revenues Charges for sales and services Total revenues $370,200 370 200 Operating expenses Cost of sales and services Administration Depreciation Total expenditures 358,600 10,300 5,300 374.200 (4.000) Operating (loss) Nonoperating income Investment income 6,000 Change in net position Net position-beginning of year Net position-end of year 6.000 2,000 107.000 $109,000 CITY OF SHENANDOAH Statement of Net Position Government-wide Statements December 31, 2016 Governmental Activities $1,230,000 95,500 Current assets Cash and cash equivalents Investments Receivables (net) Taxes receivable Due from business activities Due from state government Total current assets 69,500 23,000 156,000 1,574,000 on-wide Statements Colt Noncurrent assets Long Term Debt 255 Land Buildings cumulated depreciation-budings infrastructure Accumulated depreciation-buda Equipment Accumulated depreciation-equipment 7.230,000 22.500.000 113.000.000 27.500.000 19,000,000) 6,370,000 3.100.000 38.600.000 $40.174000 Total capital assets Total assets Liabilities Accrued interest on bonds Accounts payable Total current liabilities 180.000 96.500 276,500 Noncurrent liabilities General obligation bonds payable Accrued costs for landfill closure and postclosure care Total noncurrent liabilities Total liabilities 6.000.000 29.500 6.029.500 6.306.000 Net position Net investment in capital assets Unrestricted Total net position 32.600.000 1.268,000 $33.868.000 dditional Information 1. $856,700 of the capital assets purchased in fiscal year 2017 was equip ment. All remaining capital acquisitions were for a new building. 2. Depreciation of general fixed assets: buildings S1,100,000, infrastructure $975,000, and equipment $537,500. 3. The City had $6,000,000 of 6 percent general obligation bonds (issued at par) outstanding at December 31, 2016. In addition, the City issued $4,000,000 of 5 percent bonds on January 2, 2017 (sold at a premium). Interest payments on both bond issues are due on January 1 and July 1 Principal payments are made on January 1. Interest and principal pay- ments for the current year include: 5 Percent General Obligation Bonds Principal Payment-January 1 Interest Payment-January 1 Interest Payment--July 1 6 Percent General Obligation Bonds $500,000 180.000 165,000 $100,000 he government- accrued for purposes of the go nd-basis statements. The bond premium is days after year-end d to be collected more than 60 days accumulated liability for landfill afill closure and ll operations are be $36,500. Landfill opera 256 Chapter 8 The January interest payments are accrued fo wide statements but not the fund-basis sta artized in the amount of $2,500 per ve 4. Property taxes expected to be collected mo are deferred in the fund-basis statements. 5. At the end of 2017, the accumulated postclosure care costs is estimated to be $365 reported in the General Fund-Public Works 6. The internal service fund serves several depar Fund, all within the category of "General G. service fund was created at the end of 2016 am long-term liabilities at the end of 2016. several departments of the of the General " The internal 1o capital assets of vear 2017 to con worksheet journal entries necessary for fiscal year 201 vert the governmental fund-basis amounts to the economic surement focus and accrual basis required for the governmen sections of the government-wide statements. economic resources mea- overnmental activities