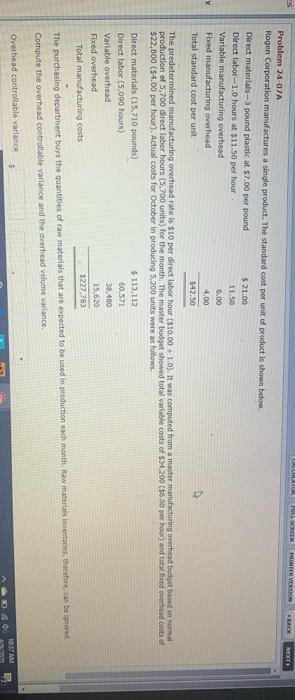

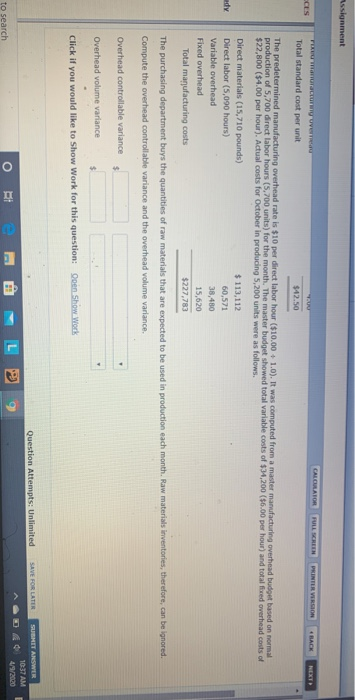

U M POLSCREEN PRINTER VERSION BACK NEXT Problem 24-07A Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials-3 pound plastic at $7.00 per pound $ 21.00 Direct labor-1.0 hours at $11.50 per hour 11.50 Variable manufacturing overhead 6.00 Fixed manufacturing overhead 4.00 Total standard cost per unit $42.50 The predetermined manufacturing overhead rate is $10 per direct labor hour ($10.00 + 1.0). It was computed from a master manufacturing overhead budout based on normal production of 5,700 direct labor hours (5,700 units) for the month. The master budget showed total variable costs of $4,200 $0.00 per hour and total foed overhead costs of $22,800 ($4.00 per hour). Actual costs for October in producing 5,200 units were as follows. Direct materials (15,710 pounds) Direct labor (5,090 hours) Variable overhead Fixed overhead Total manufacturing costs $ 113,112 60,571 38,480 15,620 $227,783 The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored. Compute the overhead controllable variance and the overhead volume variance Overhead controllable variance 10.AM MODA Assignment CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT adiacu ve Total standard cost per unit $42.50 The predetermined manufacturing overhead rate is $10 per direct labor hour ($10.00 1.0). It was computed from a master manufacturing overhead budget based on normal production of 5,700 direct labor hours (5,700 units) for the month. The master budget showed total variable costs of $,200 ($6.00 per hour and total foed overhead costs of $22,800 ($4.00 per hour). Actual costs for October in producing 5,200 units were as follows. dy Direct materials (15,710 pounds) Direct labor (5,090 hours) Variable overhead Fixed overhead Total manufacturing costs $113,112 60,571 38,480 15,620 $227,783 The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored. Compute the overhead controllable variance and the overhead volume variance. Overhead controllable variance Overhead volume variance Click if you would like to Show Work for this question: Open Show Work Question Attempts: Unlimited SAVE FOR LATER SUBMIT ANSWER AD 1037 AM A 4/9/2020 to search