Question

U manufactures refrigerators and freezers and sells them with a one-year warranty. It applies the requirements of IAS 37, Provisions, Contingent Liabilities, and Contingent Assets,

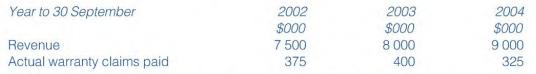

U manufactures refrigerators and freezers and sells them with a one-year warranty. It applies the requirements of IAS 37, Provisions, Contingent Liabilities, and Contingent Assets, to its financial accounts. U has made a provision for future warranty claims each year. U did not keep accurate records of previous warranty claims so when IAS 37 became effective, it estimated future warranty claims based on an estimated 10 percent of sales turnover. It also started keeping accurate records of warranty claims. U has decided to change its method of calculating the provision for warranty claims to the weighted average of the last three years' actual claims paid. A warranty claim provision of $900 000, calculated on the old basis, has already been entered in the accounts for the year ended 30 September 2004.

Prepare the accounting entries required in U's year-end accounts to reflect the above change.

Year to 30 September Revenue Actual warranty claims paid 2002 $000 7 500 375 2003 $000 8 000 400 2004 $000 9 000 325

Step by Step Solution

3.32 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Warranty expense 10 of revenue 2002 750 2003 375 2004 800 Balance Sheet Warranty pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started