Question: ... U Mobile 4G 9:12 PM 44% Back IND ASSIGNMENT 1-1 TOTAL: 100 marks INSTRUCTION: Read carefully the situations and answer ALL questions. You have

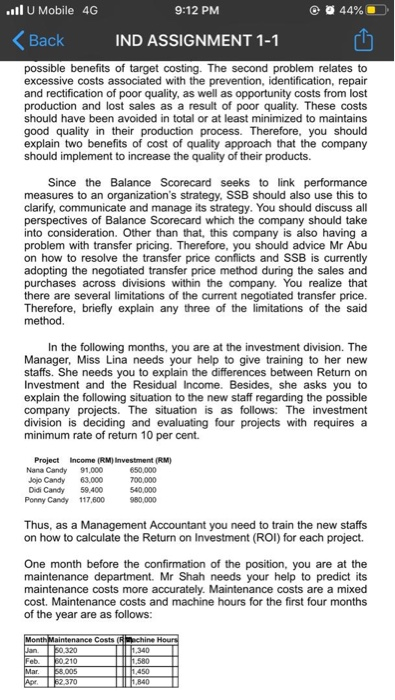

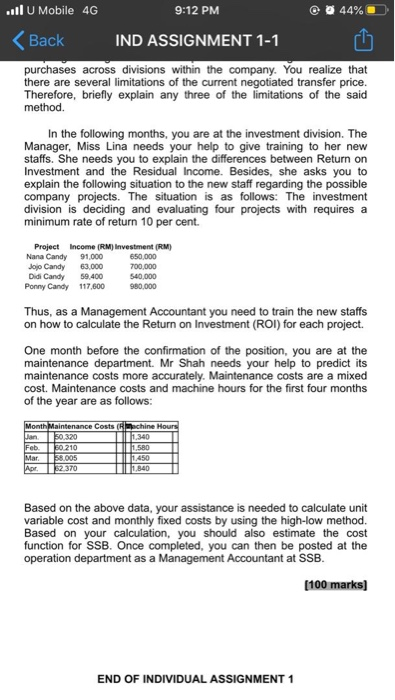

... U Mobile 4G 9:12 PM 44% Back IND ASSIGNMENT 1-1 TOTAL: 100 marks INSTRUCTION: Read carefully the situations and answer ALL questions. You have already graduated with a Bachelor of Accounting (Hons) from University Kuala Lumpur (UniKL). Today, you have an interview at the Sweet & Sour Berhad (SSB) which manufactures fruit candy. During an interview session, one of the panels has asked you about the fundamental principles of Code of Ethics as an accountant. Briefly explain to them the fundamental principles of Code of Ethics as an accountant. Other than that, the other panel has also asked about the corporate failure, current development and emerging issues in performance management. Thus, explain to them on how to predict and prevent the occurrence of corporate failure. Also, explain to them three factors that drive the changing roles of Management Accountants. Two weeks after the interview session, you have received a call from the Human Resource Manager of SSB. Your interview is a success and they offer you a position as a Management Accountant. Now, you are a one of the top-line managers with the numbers of staffs and subordinates. However, before the confirmation of the position, you must lead several departments and give your opinions when the managers require you to do so. During the first month, you are required to be at the purchasing division. The manager, Mr Norbik needs your help with regards to the management of stocks and materials. He needs your advice on how to determine to purchase materials at larger quantities with quantity discounts or smaller quantities (or at economic ordering quantity) but without discounts. To produce fruit candy, SSB buys brown sugar which is used in making the candy in 10-kg boxes that cost RM 20 each. This company uses 60,000 boxes per year and usage occurs evenly throughout the year. The average cost to carry a 10-kg box in inventory per year is RM 12 and the cost to place an order is RM 8. Now, you are required to help Mr Norbik and his team to determine the Economic Ordering Quantity (EOQ) for the brown sugar in terms of 10-kg boxes and explain to them the importance of Just-In-Time (JIT) system in purchasing the raw materials During the second and third months, you are at the operation and production department and Mr Abu is a Senior Manager. You realize that there are a few problems regarding with the production and the operation of the company. One of the problems relates to the selling price of the candy set by SSB. You have discovered that the selling price is way higher than SSB's closest competitor due to its higher production costs. Now, explain to Mr Abu and his team three possible benefits of target costing. The second problem relates to excessive costs associated with the prevention, identification, repair ... U Mobile 4G 9:12 PM 44% Back IND ASSIGNMENT 1-1 possible benefits of target costing. The second problem relates to excessive costs associated with the prevention, identification, repair and rectification of poor quality, as well as opportunity costs from lost production and lost sales as a result of poor quality. These costs should have been avoided in total or at least minimized to maintains good quality in their production process. Therefore, you should explain two benefits of cost of quality approach that the company should implement to increase the quality of their products. Since the Balance Scorecard seeks to link performance measures to an organization's strategy, SSB should also use this to clarify, communicate and manage its strategy. You should discuss all perspectives of Balance Scorecard which the company should take into consideration. Other than that, this company is also having a problem with transfer pricing. Therefore, you should advice Mr Abu on how to resolve the transfer price conflicts and SSB is currently adopting the negotiated transfer price method during the sales and purchases across divisions within the company. You realize that there are several limitations of the current negotiated transfer price. Therefore, briefly explain any three of the limitations of the said method. In the following months, you are at the investment division. The Manager, Miss Lina needs your help to give training to her new staffs. She needs you to explain the differences between Return on Investment and the Residual Income. Besides, she asks you to explain the following situation to the new staff regarding the possible company projects. The situation is as follows: The investment division is deciding and evaluating four projects with requires a minimum rate of return 10 per cent. Project Income (RM) Investment (RM) Nana Candy 91,000 Jojo Candy 63.000 700,000 Didi Candy 59.400 540,000 Ponny Candy 117,600 980,000 Thus, as a Management Accountant you need to train the new staffs on how to calculate the Return on Investment (ROI) for each project. One month before the confirmation of the position, you are at the maintenance department. Mr Shah needs your help to predict its maintenance costs more accurately. Maintenance costs are a mixed cost. Maintenance costs and machine hours for the first four months of the year are as follows: 650,000 11.340 Month Maintenance Costs machine Hours Jan 130,320 Feb 90210 1.580 Mar. 58.005 1.450 52.370 1.840 ... U Mobile 4G 9:12 PM 44% Back IND ASSIGNMENT 1-1 purchases across divisions within the company. You realize that there are several limitations of the current negotiated transfer price. Therefore, briefly explain any three of the limitations of the said method. In the following months, you are at the investment division. The Manager, Miss Lina needs your help to give training to her new staffs. She needs you to explain the differences between Return on Investment and the Residual Income. Besides, she asks you to explain the following situation to the new staff regarding the possible company projects. The situation is as follows: The investment division is deciding and evaluating four projects with requires a minimum rate of return 10 per cent. Project Income (RM) Investment (RM) Nana Candy 91.000 650.000 Jojo Candy 63.000 700,000 Didi Candy 59.400 540,000 Ponny Candy 117,600 980,000 Thus, as a Management Accountant you need to train the new staffs on how to calculate the Return on Investment (ROI) for each project. One month before the confirmation of the position, you are at the maintenance department. Mr Shah needs your help to predict its maintenance costs more accurately. Maintenance costs are a mixed cost. Maintenance costs and machine hours for the first four months of the year are as follows: Month Maintenance Costs Blachine Hours Jan 30,320 11.340 Feb 50 210 1.580 Mar. 58.005 1.450 92.370 1.840 Based on the above data, your assistance is needed to calculate unit variable cost and monthly fixed costs by using the high-low method. Based on your calculation, you should also estimate the cost function for SSB. Once completed, you can then be posted at the operation department as a Management Accountant at SSB. [100 marks] END OF INDIVIDUAL ASSIGNMENT 1 ... U Mobile 4G 9:12 PM 44% Back IND ASSIGNMENT 1-1 TOTAL: 100 marks INSTRUCTION: Read carefully the situations and answer ALL questions. You have already graduated with a Bachelor of Accounting (Hons) from University Kuala Lumpur (UniKL). Today, you have an interview at the Sweet & Sour Berhad (SSB) which manufactures fruit candy. During an interview session, one of the panels has asked you about the fundamental principles of Code of Ethics as an accountant. Briefly explain to them the fundamental principles of Code of Ethics as an accountant. Other than that, the other panel has also asked about the corporate failure, current development and emerging issues in performance management. Thus, explain to them on how to predict and prevent the occurrence of corporate failure. Also, explain to them three factors that drive the changing roles of Management Accountants. Two weeks after the interview session, you have received a call from the Human Resource Manager of SSB. Your interview is a success and they offer you a position as a Management Accountant. Now, you are a one of the top-line managers with the numbers of staffs and subordinates. However, before the confirmation of the position, you must lead several departments and give your opinions when the managers require you to do so. During the first month, you are required to be at the purchasing division. The manager, Mr Norbik needs your help with regards to the management of stocks and materials. He needs your advice on how to determine to purchase materials at larger quantities with quantity discounts or smaller quantities (or at economic ordering quantity) but without discounts. To produce fruit candy, SSB buys brown sugar which is used in making the candy in 10-kg boxes that cost RM 20 each. This company uses 60,000 boxes per year and usage occurs evenly throughout the year. The average cost to carry a 10-kg box in inventory per year is RM 12 and the cost to place an order is RM 8. Now, you are required to help Mr Norbik and his team to determine the Economic Ordering Quantity (EOQ) for the brown sugar in terms of 10-kg boxes and explain to them the importance of Just-In-Time (JIT) system in purchasing the raw materials During the second and third months, you are at the operation and production department and Mr Abu is a Senior Manager. You realize that there are a few problems regarding with the production and the operation of the company. One of the problems relates to the selling price of the candy set by SSB. You have discovered that the selling price is way higher than SSB's closest competitor due to its higher production costs. Now, explain to Mr Abu and his team three possible benefits of target costing. The second problem relates to excessive costs associated with the prevention, identification, repair ... U Mobile 4G 9:12 PM 44% Back IND ASSIGNMENT 1-1 possible benefits of target costing. The second problem relates to excessive costs associated with the prevention, identification, repair and rectification of poor quality, as well as opportunity costs from lost production and lost sales as a result of poor quality. These costs should have been avoided in total or at least minimized to maintains good quality in their production process. Therefore, you should explain two benefits of cost of quality approach that the company should implement to increase the quality of their products. Since the Balance Scorecard seeks to link performance measures to an organization's strategy, SSB should also use this to clarify, communicate and manage its strategy. You should discuss all perspectives of Balance Scorecard which the company should take into consideration. Other than that, this company is also having a problem with transfer pricing. Therefore, you should advice Mr Abu on how to resolve the transfer price conflicts and SSB is currently adopting the negotiated transfer price method during the sales and purchases across divisions within the company. You realize that there are several limitations of the current negotiated transfer price. Therefore, briefly explain any three of the limitations of the said method. In the following months, you are at the investment division. The Manager, Miss Lina needs your help to give training to her new staffs. She needs you to explain the differences between Return on Investment and the Residual Income. Besides, she asks you to explain the following situation to the new staff regarding the possible company projects. The situation is as follows: The investment division is deciding and evaluating four projects with requires a minimum rate of return 10 per cent. Project Income (RM) Investment (RM) Nana Candy 91,000 Jojo Candy 63.000 700,000 Didi Candy 59.400 540,000 Ponny Candy 117,600 980,000 Thus, as a Management Accountant you need to train the new staffs on how to calculate the Return on Investment (ROI) for each project. One month before the confirmation of the position, you are at the maintenance department. Mr Shah needs your help to predict its maintenance costs more accurately. Maintenance costs are a mixed cost. Maintenance costs and machine hours for the first four months of the year are as follows: 650,000 11.340 Month Maintenance Costs machine Hours Jan 130,320 Feb 90210 1.580 Mar. 58.005 1.450 52.370 1.840 ... U Mobile 4G 9:12 PM 44% Back IND ASSIGNMENT 1-1 purchases across divisions within the company. You realize that there are several limitations of the current negotiated transfer price. Therefore, briefly explain any three of the limitations of the said method. In the following months, you are at the investment division. The Manager, Miss Lina needs your help to give training to her new staffs. She needs you to explain the differences between Return on Investment and the Residual Income. Besides, she asks you to explain the following situation to the new staff regarding the possible company projects. The situation is as follows: The investment division is deciding and evaluating four projects with requires a minimum rate of return 10 per cent. Project Income (RM) Investment (RM) Nana Candy 91.000 650.000 Jojo Candy 63.000 700,000 Didi Candy 59.400 540,000 Ponny Candy 117,600 980,000 Thus, as a Management Accountant you need to train the new staffs on how to calculate the Return on Investment (ROI) for each project. One month before the confirmation of the position, you are at the maintenance department. Mr Shah needs your help to predict its maintenance costs more accurately. Maintenance costs are a mixed cost. Maintenance costs and machine hours for the first four months of the year are as follows: Month Maintenance Costs Blachine Hours Jan 30,320 11.340 Feb 50 210 1.580 Mar. 58.005 1.450 92.370 1.840 Based on the above data, your assistance is needed to calculate unit variable cost and monthly fixed costs by using the high-low method. Based on your calculation, you should also estimate the cost function for SSB. Once completed, you can then be posted at the operation department as a Management Accountant at SSB. [100 marks] END OF INDIVIDUAL ASSIGNMENT 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts