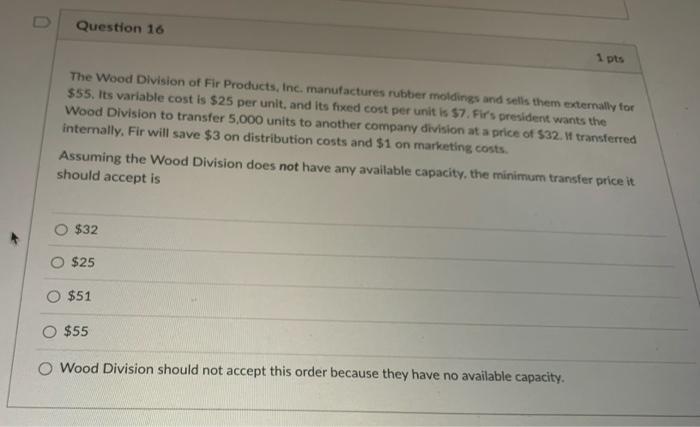

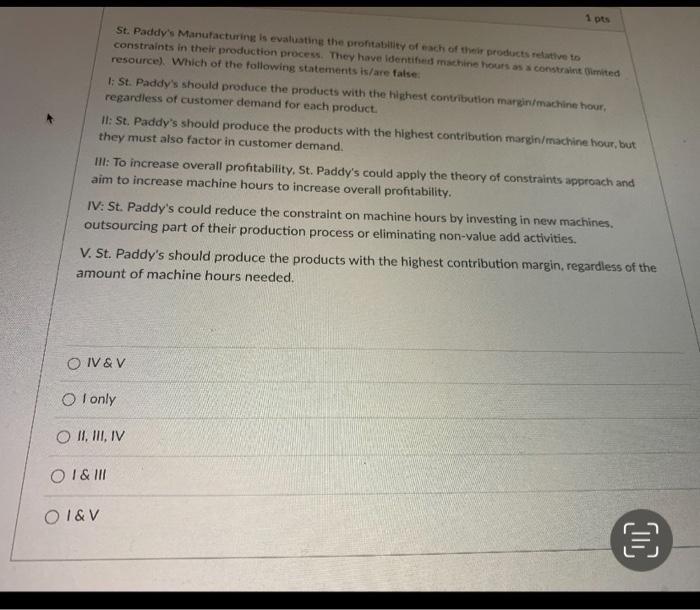

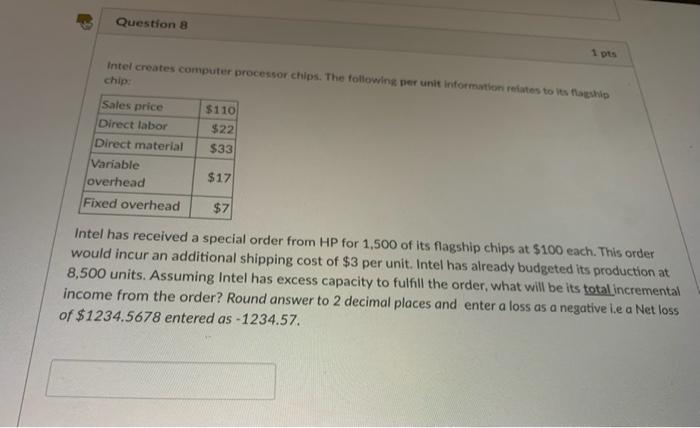

U Question 16 1 pts The Wood Division of Fir Products, Inc. manufactures rubber moldings and sells them externally for $55. Its variable cost is $25 per unit, and its fixed cost per unit is $7. Fir's president wants the Wood Division to transfer 5,000 units to another company division at a price of 532. Y transferred internally. Fir will save $3 on distribution costs and $1 on marketing costs Assuming the Wood Division does not have any available capacity, the minimum transfer price it should accept is $32 $25 O $51 O $55 O Wood Division should not accept this order because they have no available capacity. 1 pts St. Paddy's Manufacturing is evaluating the profitability of each of their products relative to constraints in their production process. They have identified machine hours as a constraint nited resource). Which of the following statements is/are false 1: St. Paddy's should produce the products with the highest contribution marginmachine hour, regardless of customer demand for each product. II: St. Paddy's should produce the products with the highest contribution margin/machine hour, but they must also factor in customer demand. III: To increase overall profitability, St. Paddy's could apply the theory of constraints approach and aim to increase machine hours to increase overall profitability. IV: St. Paddy's could reduce the constraint on machine hours by investing in new machines. outsourcing part of their production process or eliminating non-value add activities. V. St. Paddy's should produce the products with the highest contribution margin, regardless of the amount of machine hours needed. O IV & V O I only O II, III, IV O I & III 01&V ) Question 8 1 pts Intel creates computer processor chips. The followine per unit information relates to its flagship chip $110 Sales price Direct labor Direct material Variable overhead Fixed overhead $22 $33 $17 $7 Intel has received a special order from HP for 1,500 of its flagship chips at $100 each. This order would incur an additional shipping cost of $3 per unit. Intel has already budgeted its production at 8,500 units. Assuming Intel has excess capacity to fulfill the order, what will be its total incremental income from the order? Round answer to 2 decimal places and enter a loss as a negative le a Net loss of $1234.5678 entered as - 1234.57