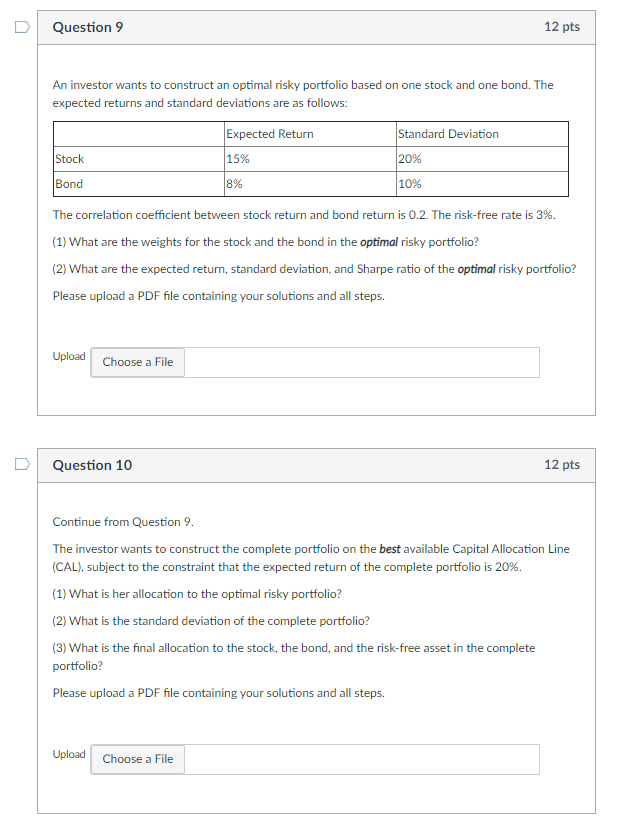

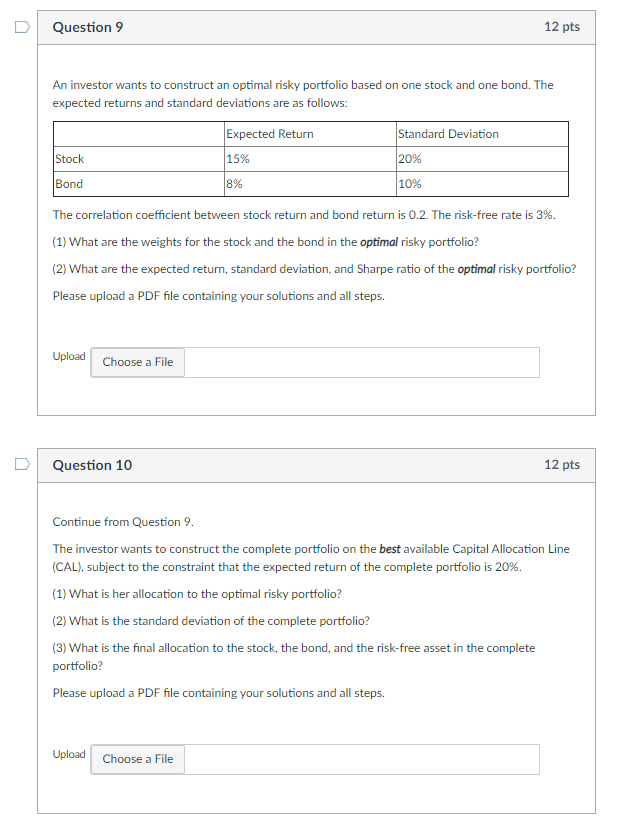

U Question 9 12 pts An investor wants to construct an optimal risky portfolio based on one stock and one bond. The expected returns and standard deviations are as follows: Expected Return Standard Deviation Stock 15% 20% Bond 8% 10% The correlation coefficient between stock return and bond return is 0.2. The risk-free rate is 3%. (1) What are the weights for the stock and the bond in the optimal risky portfolio? (2) What are the expected return, standard deviation, and Sharpe ratio of the optimal risky portfolio? Please upload a PDF file containing your solutions and all steps. Upload Choose a File U Question 10 12 pts Continue from Question 9. The investor wants to construct the complete portfolio on the best available Capital Allocation Line (CAL), subject to the constraint that the expected return of the complete portfolio is 20%. (1) What is her allocation to the optimal risky portfolio? (2) What is the standard deviation of the complete portfolio? (3) What is the final allocation to the stock, the bond, and the risk-free asset in the complete portfolio? Please upload a PDF file containing your solutions and all steps. Upload Choose a File U Question 9 12 pts An investor wants to construct an optimal risky portfolio based on one stock and one bond. The expected returns and standard deviations are as follows: Expected Return Standard Deviation Stock 15% 20% Bond 8% 10% The correlation coefficient between stock return and bond return is 0.2. The risk-free rate is 3%. (1) What are the weights for the stock and the bond in the optimal risky portfolio? (2) What are the expected return, standard deviation, and Sharpe ratio of the optimal risky portfolio? Please upload a PDF file containing your solutions and all steps. Upload Choose a File U Question 10 12 pts Continue from Question 9. The investor wants to construct the complete portfolio on the best available Capital Allocation Line (CAL), subject to the constraint that the expected return of the complete portfolio is 20%. (1) What is her allocation to the optimal risky portfolio? (2) What is the standard deviation of the complete portfolio? (3) What is the final allocation to the stock, the bond, and the risk-free asset in the complete portfolio? Please upload a PDF file containing your solutions and all steps. Upload Choose a File