Answered step by step

Verified Expert Solution

Question

1 Approved Answer

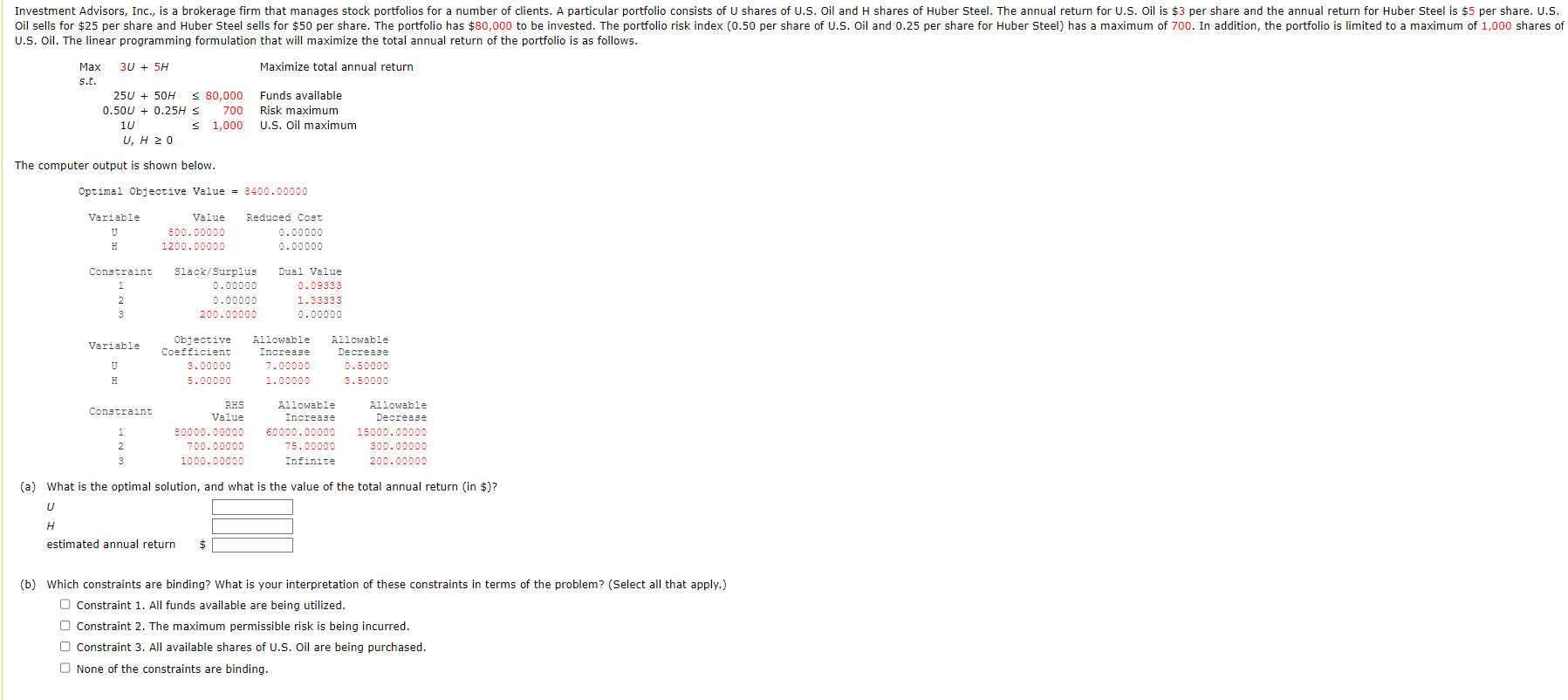

U . S . Oil. The linear programming formulation that will maximize the total annual return of the portfolio is as follows. The computer output

US Oil. The linear programming formulation that will maximize the total annual return of the portfolio is as follows.

The computer output is shown below.Variable Value Reduced Cost

b Which constraints are binding? What is your interpretation of these constraints in terms of the problem? Select all that apply.

Constraint All funds available are being utilized.

Constraint The maximum permissible risk is being incurred.

Constraint All available shares of US Oil are being purchased.

None of the constraints are binding.

c What are the dual values for the constraints? Interpret each. Round your answers to two decimal places.

constraint

Constraint has a slack of $ Additional dollars added to the available funds will not improve the total annual return.

Constraint has a dual value of If an additional dollar is added to the available funds, the total annual return is predicted to increase by $

Constraint has a dual value of If an additional dollar is added to the available funds, the total annual return is predicted to increase by $

Constraint has a dual value of If an additional dollar is added to the available funds, the total annual return is predicted to increase by $

Constraint has a dual value of If an additional dollar is added to the available funds, the total annual return is predicted to increase by $

constraint

Constraint has a slack of Allowing additional risk will not improve the total annual return.

Constraint has a dual value of If the risk index is increased by the total annual return is predicted to increase by $

Constraint has a dual value of If the risk index is increased by the total annual return is predicted to increase by $

Constraint has a dual value of If the risk index is increased by the total annual return is predicted to increase by $

Constraint has a dual value of If the risk index is increased by the total annual return is predicted to increase by $

constraint

Constraint has a slack of shares. Raising the maximum number of shares of US Oil will not improve the total annual return.

Constraint has a dual value of If the maximum number of shares of US Oil is increased by the total annual return is predicted to increase by $

Constraint has a dual value of If the maximum number of shares of US Oil is increased by the total annual return is predicted to increase by $

Constraint has a dual value of If the maximum number of shares of US Oil is increased by the total annual return is predicted to increase by $

Constraint has a dual value of If the maximum number of shares of US Oil is increased by the total annual return is predicted to increase by $

d Would it be beneficial to increase the maximum amount invested in US Oil? Why or why not?

Yes, each additional share increases the profit by $

Yes, each additional share increases the profit by $

Yes, each additional share increases the profit by $

No increasing the maximum shares does not affect the optimal value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started