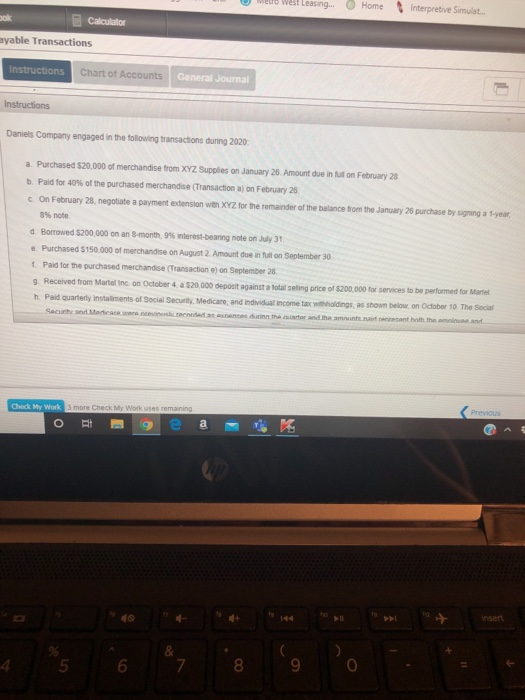

U s Well Leasing. Home Interpretive Simulat ook Calculator ayable Transactions Instructions Chart of Accounts General Journal Instructions Daniels Company engaged in the following transactions during 2020 a. Purchased $20,000 of merchandise from XYZ Supplies on January 26. Amount due in full on February 28 b. Paid for 40% of the purchased merchandise (Transaction a) on February 26 con February 28, negotiate a payment extension with XYZ for the remainder of the balance from the January 25 purchase by signing a year 8% note d Borrowed 5200,000 on an 3-month 9% interest-bearing note on July 31 e. Purchased $150,000 of merchandise on August 2. Amount due in full on September 30 Paid for the purchased merchandise (Transaction e) on September 28 9 Received from Martel Inc. on October 4. a 520.000 deposit against a total seling price of $200.000 for services to be performed for Martet h Paid quarterly installment of Social Security Medicare, and individual income tax withholdings, as shown below. on October 10 The Social Secundada warna att du ther and the m eant that Check My Work 3 more Check My Work uses remaining Previous 9 e A 4 5 6 7 8 9 0 U s Well Leasing. Home Interpretive Simulat ook Calculator ayable Transactions Instructions Chart of Accounts General Journal Instructions Daniels Company engaged in the following transactions during 2020 a. Purchased $20,000 of merchandise from XYZ Supplies on January 26. Amount due in full on February 28 b. Paid for 40% of the purchased merchandise (Transaction a) on February 26 con February 28, negotiate a payment extension with XYZ for the remainder of the balance from the January 25 purchase by signing a year 8% note d Borrowed 5200,000 on an 3-month 9% interest-bearing note on July 31 e. Purchased $150,000 of merchandise on August 2. Amount due in full on September 30 Paid for the purchased merchandise (Transaction e) on September 28 9 Received from Martel Inc. on October 4. a 520.000 deposit against a total seling price of $200.000 for services to be performed for Martet h Paid quarterly installment of Social Security Medicare, and individual income tax withholdings, as shown below. on October 10 The Social Secundada warna att du ther and the m eant that Check My Work 3 more Check My Work uses remaining Previous 9 e A 4 5 6 7 8 9 0