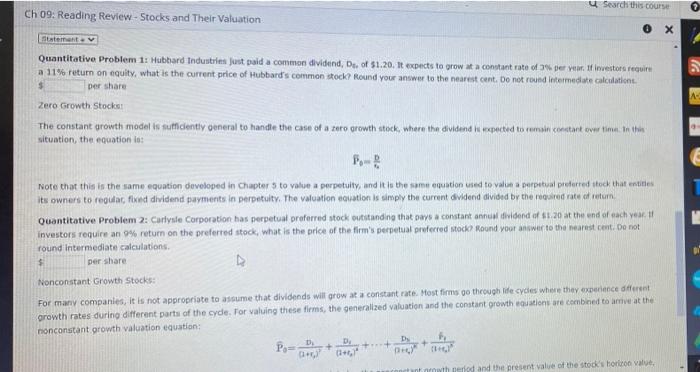

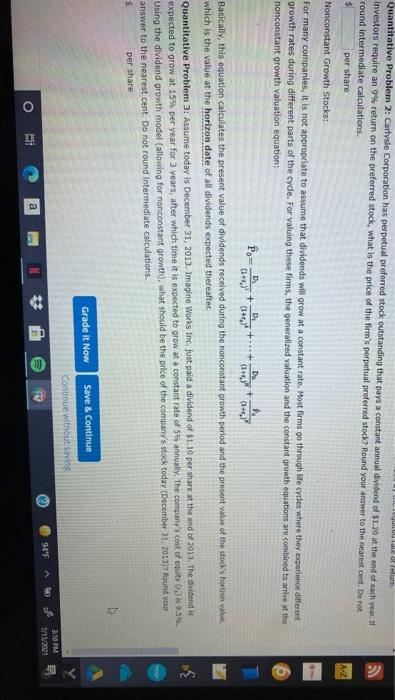

u Search this cours Ch 09: Reading Review - Stocks and Their Valuation Statement Quantitative Problem 1: Hubbard Industries just paid a common dividend, De of 1.20. It expects to grow at a constant rate of per year. If investors require a 11% return on equity, what is the current price of Hubbard's common stock Round your answer to the nearest cent. Do not round intermediate calculation Der share Zero Growth Stock The constant growth model is sufficiently oneral to handle the case of a zero growth stock, where the dividend is expected to remain contant over time. situation, the equation 10: F- A. Note that this is the same equation developed in Chapter 5 to vale a perpetuity, and it is the same equation used to vale a perpetual preferred stock that is its owners to regular fixed dividend payments in perpetuity. The valuation equation is simply the current dividend divided by the required rate of return Quantitative Problem 2: Carlyle Corporation has perpetual preferred stock outstanding that pays a constant annual dividend of 1.20 at the end of each year investors require an return on the preferred stock, what is the price of the firm's perpetual preferred todo Round your answer to the nearest cent. De not round Intermediate calculations per share Nonconstant Growth Stocks: For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life cyces where they experience different growth rates during different parts of the cyde. For valuing these firms, the generalized valuation and the constant growth equations are combined to me at the nonconstant growth valuation equation: D. Por + ++ + (1) De nth period and the present value of the stock's horizon value que of letu Quantitative Problem 2: Carlyle Corporation has perpetual preferred stock outstanding that pays a constant annual dividend of $1.20 at the end of each year. It Investors require an 9% return on the preferred stock, what is the price of the firm's perpetual preferred stock? Round your answer to the nearest cent. Do not round intermediate calculations. per share A-Z Nonconstant Growth Stocks For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life cydes where they experience different growth rates during different parts of the cyde. For valuing these firms, the generalized valuation and the constant growth equations are combined to arrive at the nonconstant growth valuation equation: Por for at (1+) O tejto +03 Basically, this equation calculates the present value of dividends received during the nonconstant growth period and the present value of the stock's horizon value which is the value at the horizon date of all dividends expected thereafter Quantitative Problem 3: Assume today is December 31, 2013. Imagine Works Inc. just paid a dividend of $1.10 per share at the end of 2013. The dividend is expected to grow at 15% per year for 3 years, after which time it is expected to grow at a constant rate of 5% annually. The company's cost of equity) 9.5% Using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today (December 11, 2013) Round your answer to the nearest cent. Do not round Intermediate calculations $ per share Grade it Now Save & Continue Continue without saving M 113/2002 8 9.4F IC O HI a