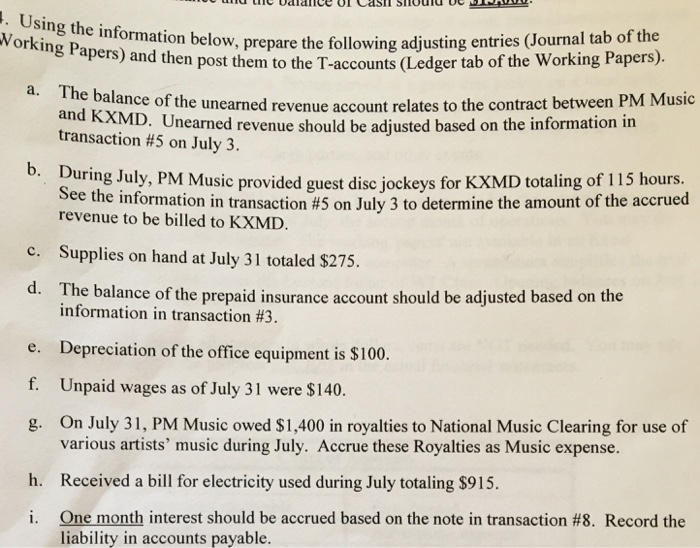

U sing the information below prepare the following adjusting entries Journal tab of the Papers) and then post them to the T-accounts (Ledger tab of the Working Papers). The balance of the unearned revenue account relates to the contract between PM Music and KXMD. Unearned revenue should be adjusted based on the information in transaction #5 on July 3. During July, PM provided guest disc jockeys for of 115 hours During See the information in transaction #5 on July 3 to determine the amount of the accrued revenue billed to KXMD. Supplies on hand at July 31 totaled $275. The balance of the prepaid insurance account should be adjusted based on the information in transaction #3. Depreciation of the office equipment is $100. Unpaid wages as of July 31 were $140. On July 31, PM Music owed $1, 400 in royalties to National Music Clearing for use of various artists' music during July. Accrue these Royalties as Music expense. Received a bill for electricity used during July totaling $915. One month interest should be accrued based on the note in transaction #8. Record the liability in accounts payable. U sing the information below prepare the following adjusting entries Journal tab of the Papers) and then post them to the T-accounts (Ledger tab of the Working Papers). The balance of the unearned revenue account relates to the contract between PM Music and KXMD. Unearned revenue should be adjusted based on the information in transaction #5 on July 3. During July, PM provided guest disc jockeys for of 115 hours During See the information in transaction #5 on July 3 to determine the amount of the accrued revenue billed to KXMD. Supplies on hand at July 31 totaled $275. The balance of the prepaid insurance account should be adjusted based on the information in transaction #3. Depreciation of the office equipment is $100. Unpaid wages as of July 31 were $140. On July 31, PM Music owed $1, 400 in royalties to National Music Clearing for use of various artists' music during July. Accrue these Royalties as Music expense. Received a bill for electricity used during July totaling $915. One month interest should be accrued based on the note in transaction #8. Record the liability in accounts payable