Answered step by step

Verified Expert Solution

Question

1 Approved Answer

U200 1,200 Selling expense Taxes Vehicles ed in the balance a fleet of delivery trucks in a large metropolitan area, and has just completed his

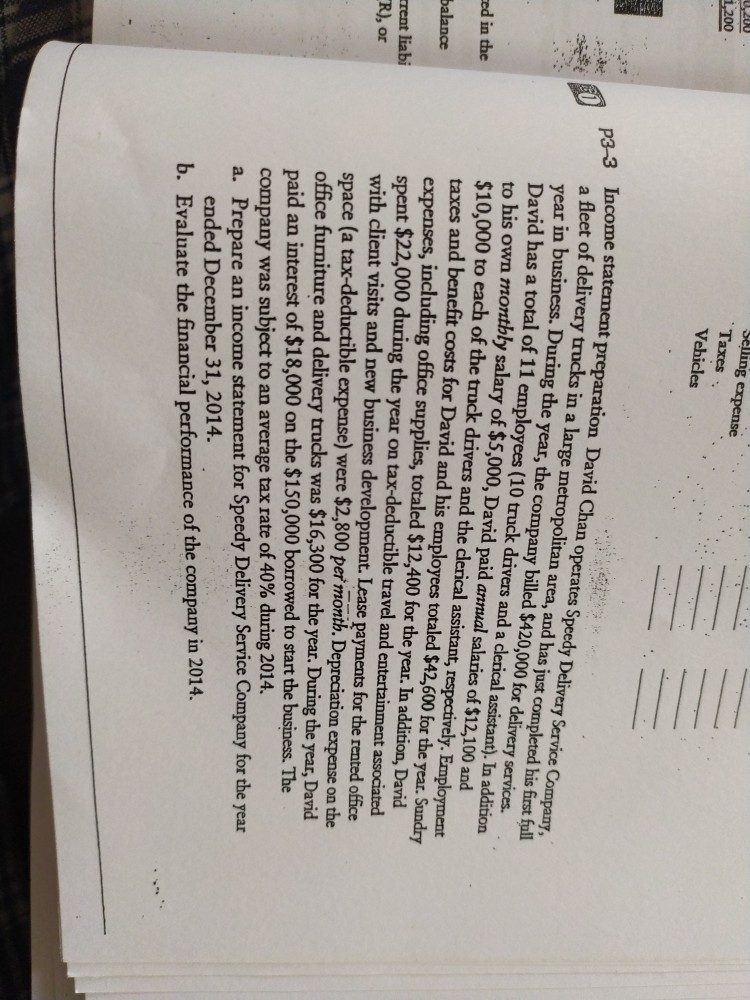

U200 1,200 Selling expense Taxes Vehicles ed in the balance a fleet of delivery trucks in a large metropolitan area, and has just completed his first full year in business. During the year, the company billed $420,000 for delivery services. David has a total of 11 employees (10 truck drivers and a clerical assistant). In addition to his own monthly salary of $5,000, David paid annual salaries of $12,100 and $10,000 to each of the truck drivers and the clerical assistant, respectively. Eroployment taxes and benefit costs for David and his employees totaled $42,600 for the year. Sundry expenses, including office supplies, totaled $12,400 for the year. In addition, David spent $22,000 during the year on tax-deductible travel and entertainment associated with client visits and new business development. Lease payments for the rented office space (a tax-deductible expense) were $2,800 per month. Depreciation expense on the office furniture and delivery trucks was $16,300 for the year. During the year, David paid an interest of $18,000 on the $150,000 borrowed to start the business. The trent liabi _R), or company was subject to an average tax rate of 40% during 2014. a. Prepare an income statement for Speedy Delivery Service Company for the year ended December 31, 2014. b. Evaluate the financial performance of the company in 2014. P3-3 Income statement preparation David Chan operates Speedy Delivery Service Company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started