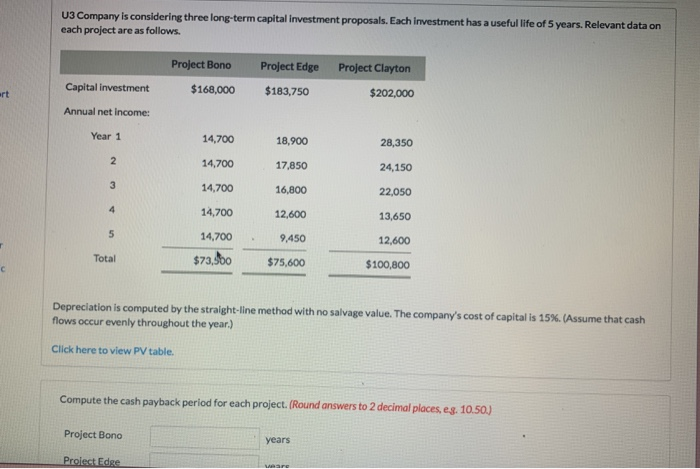

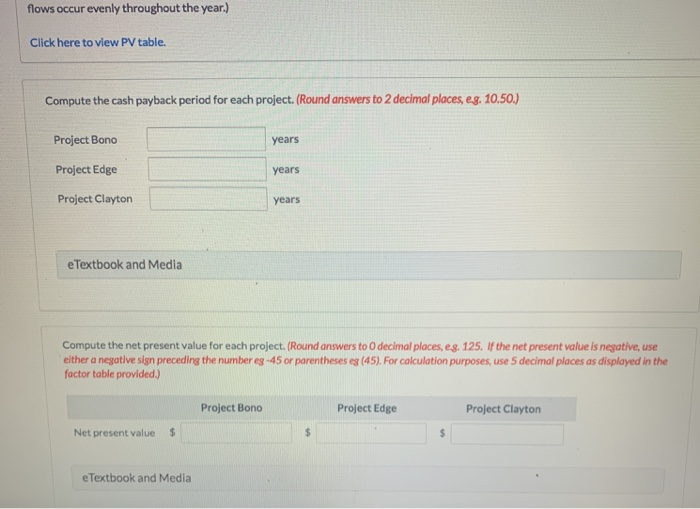

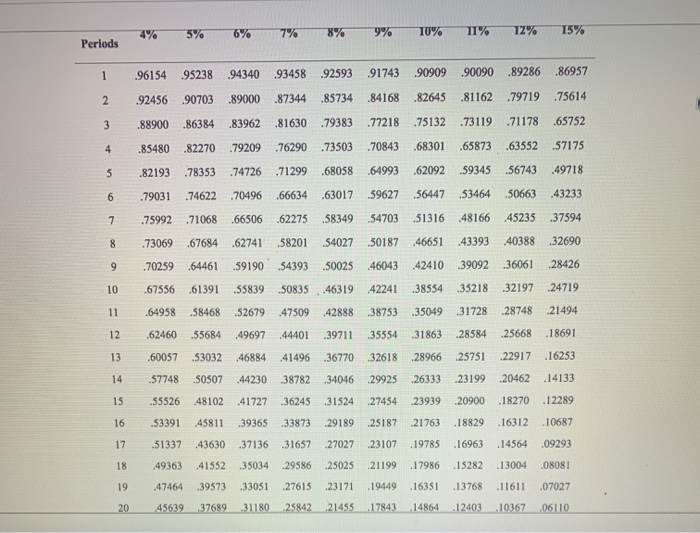

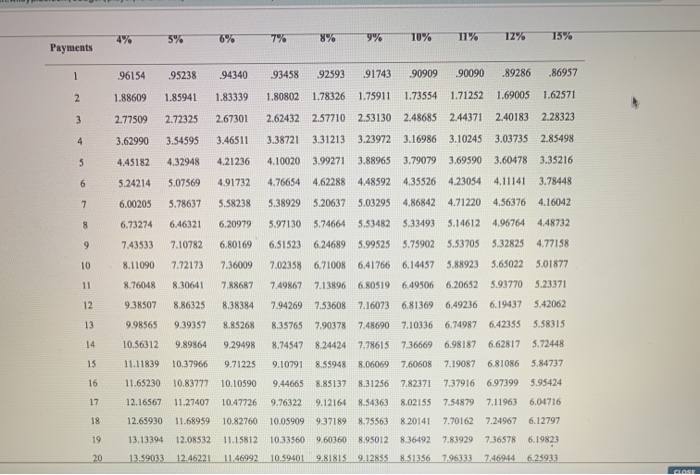

U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment art $168,000 $183,750 $202,000 Annual net income: Year 1 14,700 18,900 28,350 2 14,700 17,850 24,150 3 14,700 16,800 22,050 4 14,700 12,600 13,650 5 9.450 12,600 14,700 $73,500 Total $75,600 $100,800 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50) Project Bono years Proiect Edge flows occur evenly throughout the year.) Click here to view PV table. Compute the cash payback period for each project. (Round answers to 2 decimal places, eg. 10.50.) Project Bono years Project Edge years Project Clayton years e Textbook and Media Compute the net present value for each project. (Round answers to decimal places, eg. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses es (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided) Project Bono Project Edge Project Clayton Net present value $ $ e Textbook and Media 49 5 6 7 8 9 10% 11 12 I Periods 96154 95238 94340 ,93458 92593 91743 90909 ,90090 .89286 86957 2 92456 90703 .89000 .87344 .85734 .84168 .82645 81162 79719 .75614 88900 .86384 .83962 .81 630 .79383 77218 .15132 13119 .71178 65752 4 85480 .82270 79209 76290 73503 .70843 .68301 65873 .63552 .57175 82193 .78353 .744726 ,71299 ,68058 .64993 62092 59345 56743 .49718 6 .79031 .74622 .7096 66634 63017 59627 56447 53464 50663 43233 7 ,75992 .71068 .66506 .62275 .58349 .54703 51316 481 66 45235. .37594 8 .73069 .67684 .62741 58201 54027 50187 .46651 .43393 40388 32690 .70259 ,64461 .59190) 54393 .50025 46043 .424 10 39092 .36061 28426 10 67556 61391 55839 .50835 46319 42241 .38554 .35218 .32197 24719 11 .6958 .58468 52679 47509 42888 .38753 .35049 31728 .28748 21494 12 624 60 ,55684 ,49697 44401 39711 .3555 .31 863 2858 256668 .18691 13 .60057 53032 .46884 41496 .3670 32618 28966 25751 22917 .16253 14 57748 50507 .4-4230 .38782 3406 29925 .26333 2319. 20462 .14133 15 .55526 8102 41727 36245 31524 27454 23939 .209900 .18270 .12289 16 .53391 45811 39365 33873 29189 25187 .21763 18829 16312 10687 17 51337 43630 .37136 .31657 27027 23107 .19785 .16963 1456 09293 18 .49363 .4 1352 .35034 209586 25025 21199 17986 15282 13004 .08O8L 19 ,4746 39573 33051 27615 23171 19449 15351 13768 11611 07027 20 45619 37689 31180 2382 1455 17843 1486- .12403 10367 06110 5% 6% 8% 9% 10% 11% 12% 75% Payments 96154 95238 .94340 93458 .92593 91743 .90909 90090 .89286 .86957 2 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 3 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 4 3.62990 3.54595 3.46511 3.38721 3.31213 3.239723.16986 3.10245 3.03735 2.85498 5 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 6 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 7 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 8 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 9 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.759025.53705 5.32825 4.77158 10 8.11090 7.72173 7.36009 7.02358 6.71008 6,41766 6.14457 5.88923 5.650225.01877 11 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 12 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 13 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 14 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 15 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 16 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 17 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 18 10.82760 10.05909 9.37189 8.75563 8.02155 7.54879 7.11963 6.04716 8.20141 7.701627.24967 6.12797 836492 7.839297.36578 6.19823 8.51356 7.96333 7.46944 6.23933 12.65930 11.68959 13.13394 12.08532 13.59033 12.46221 19 11.15812 10.33560 9.60360 8.95012 11.46992 10.59401 9.81815 9.12855 20 CLOSE