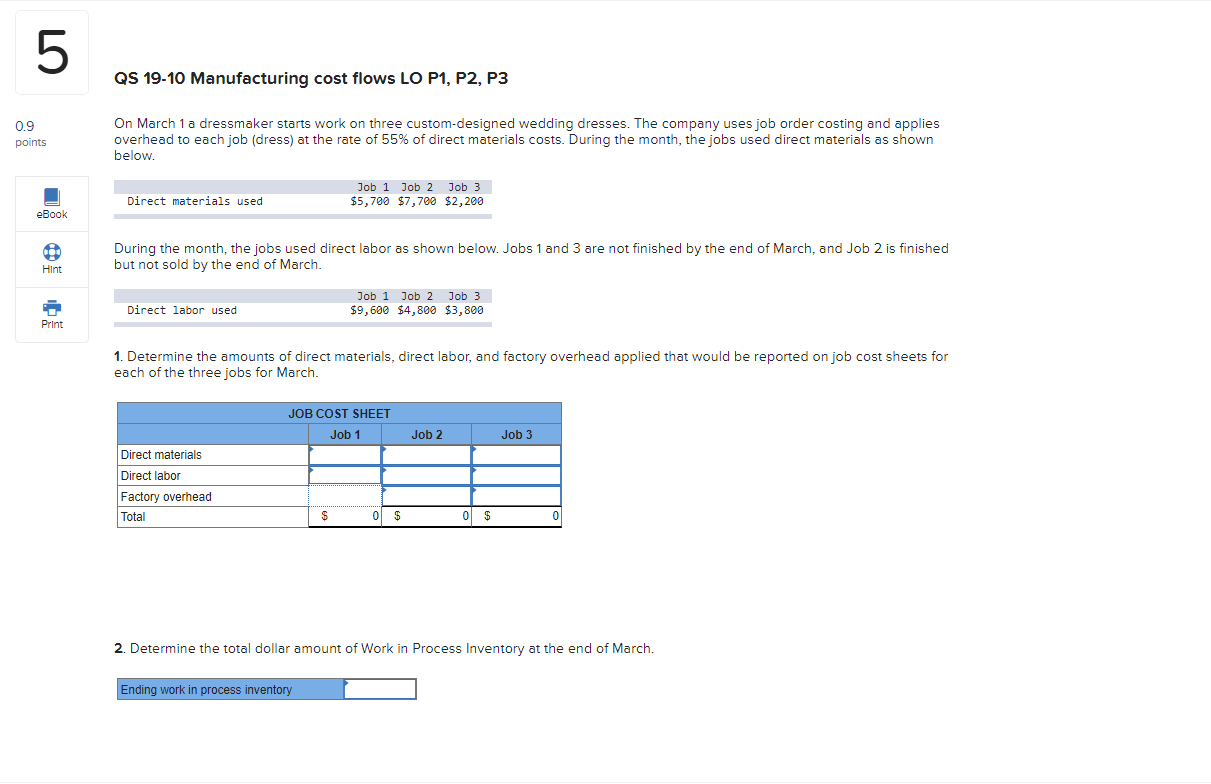

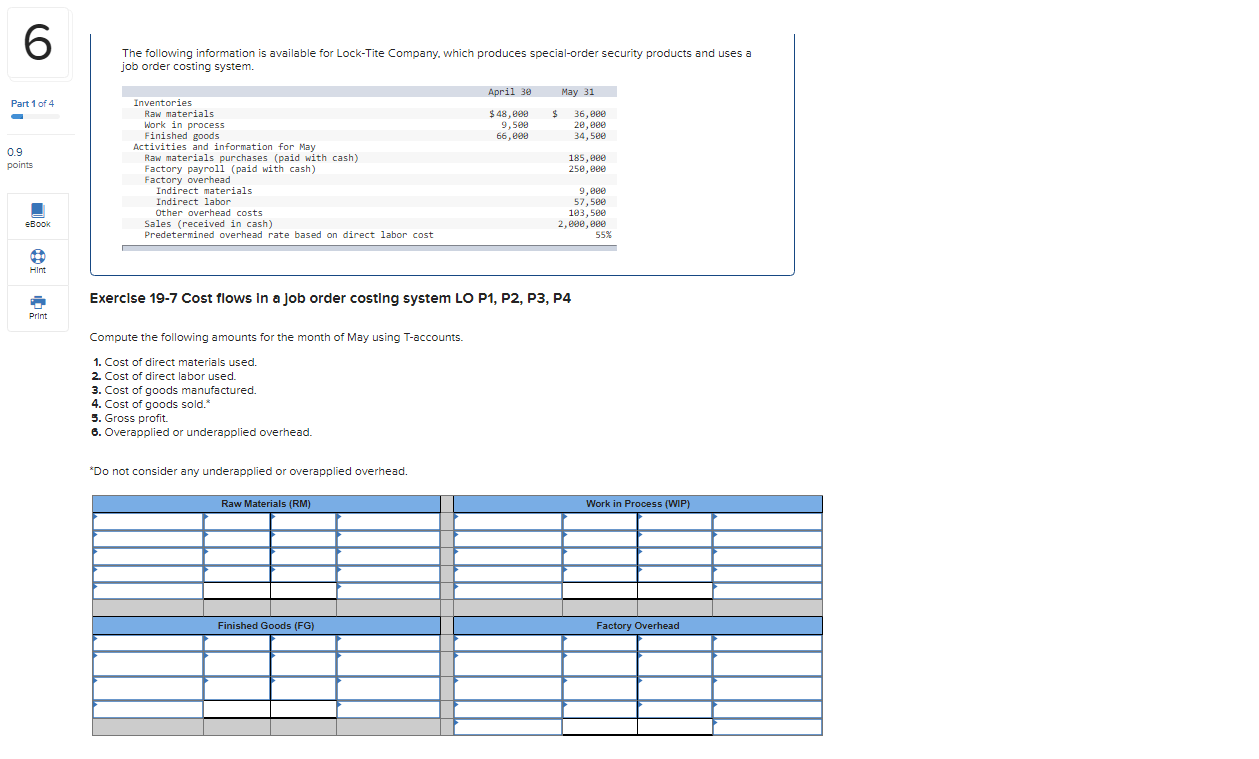

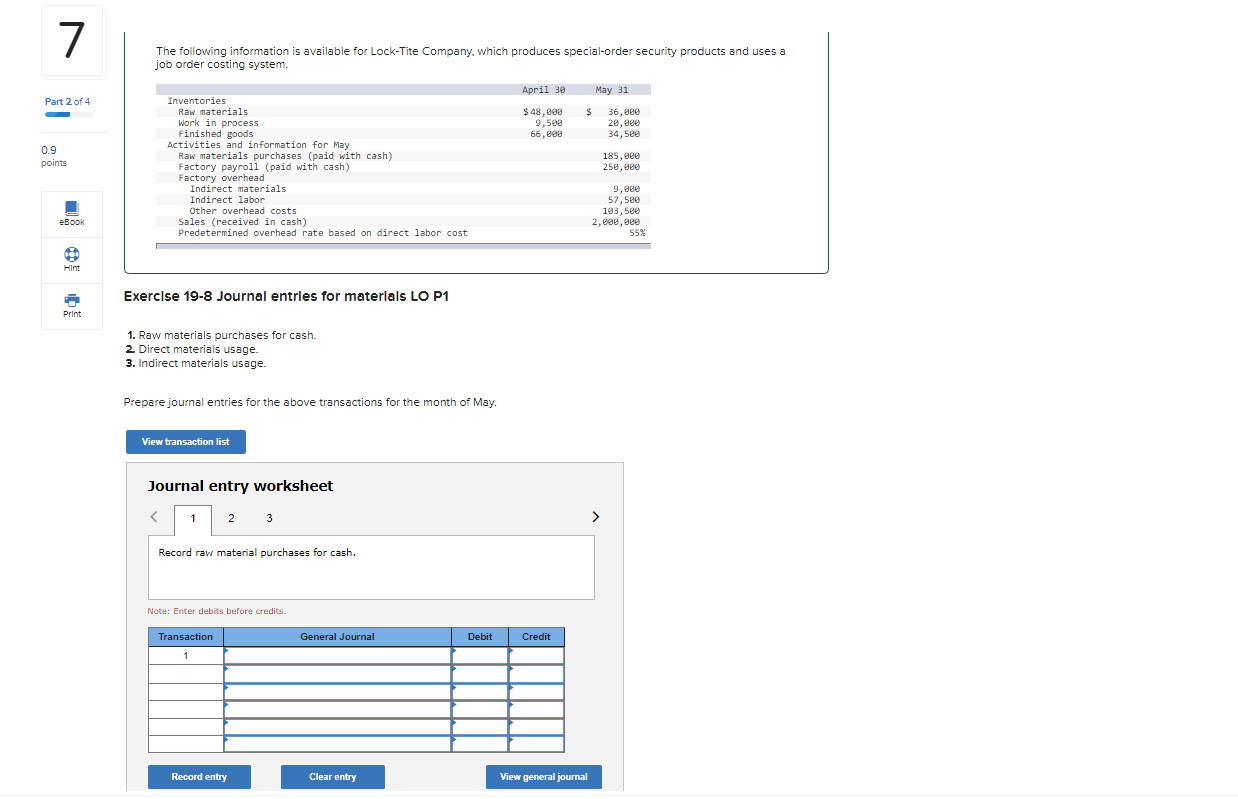

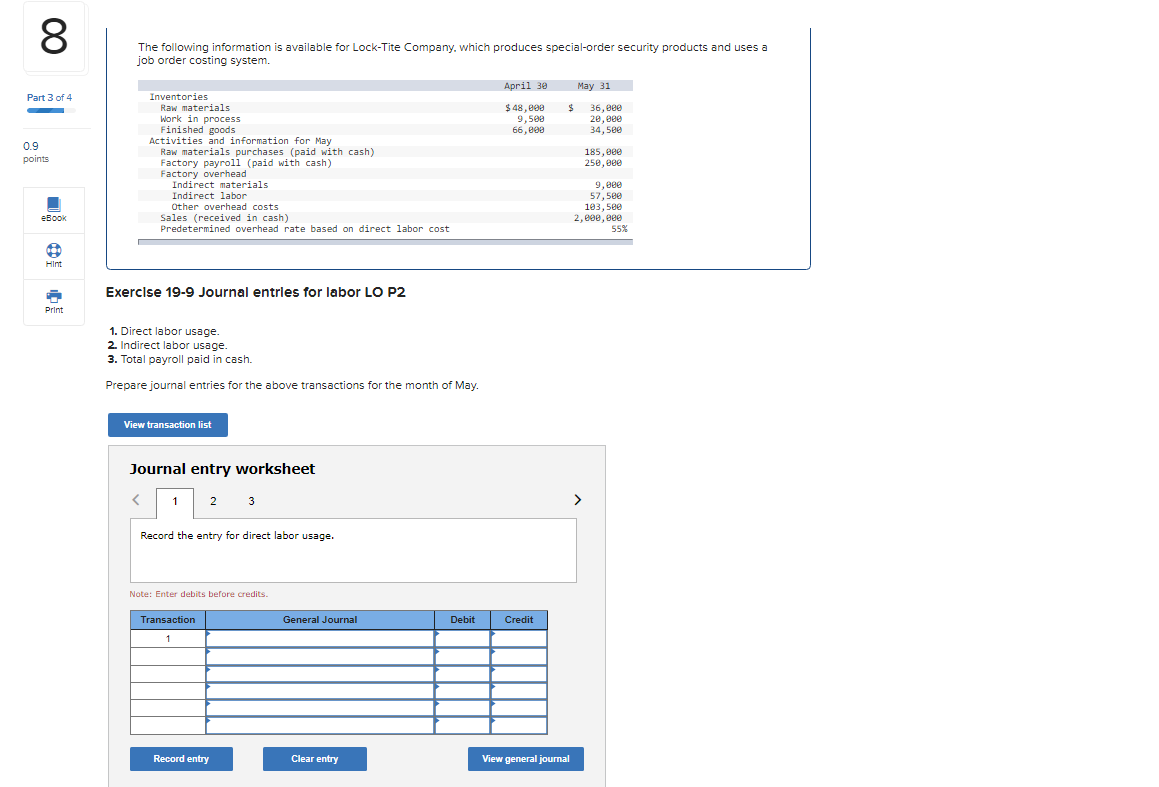

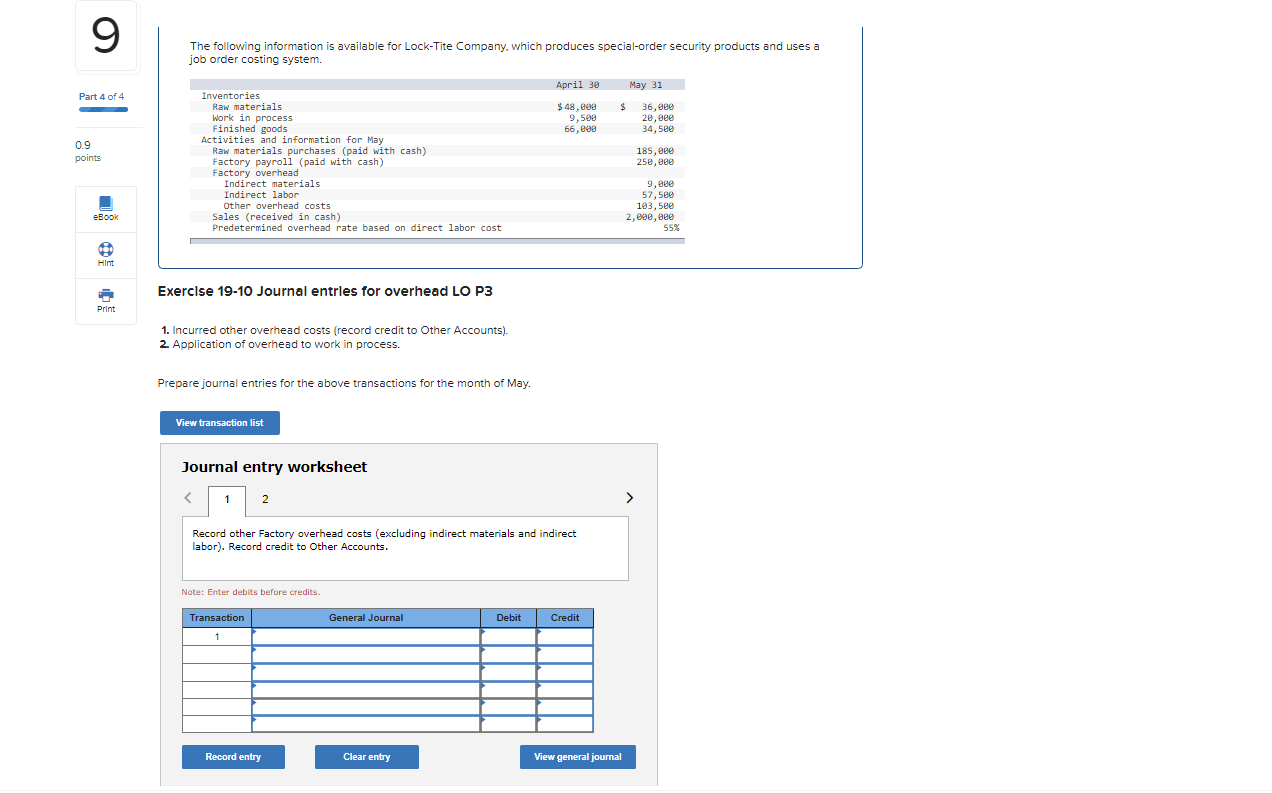

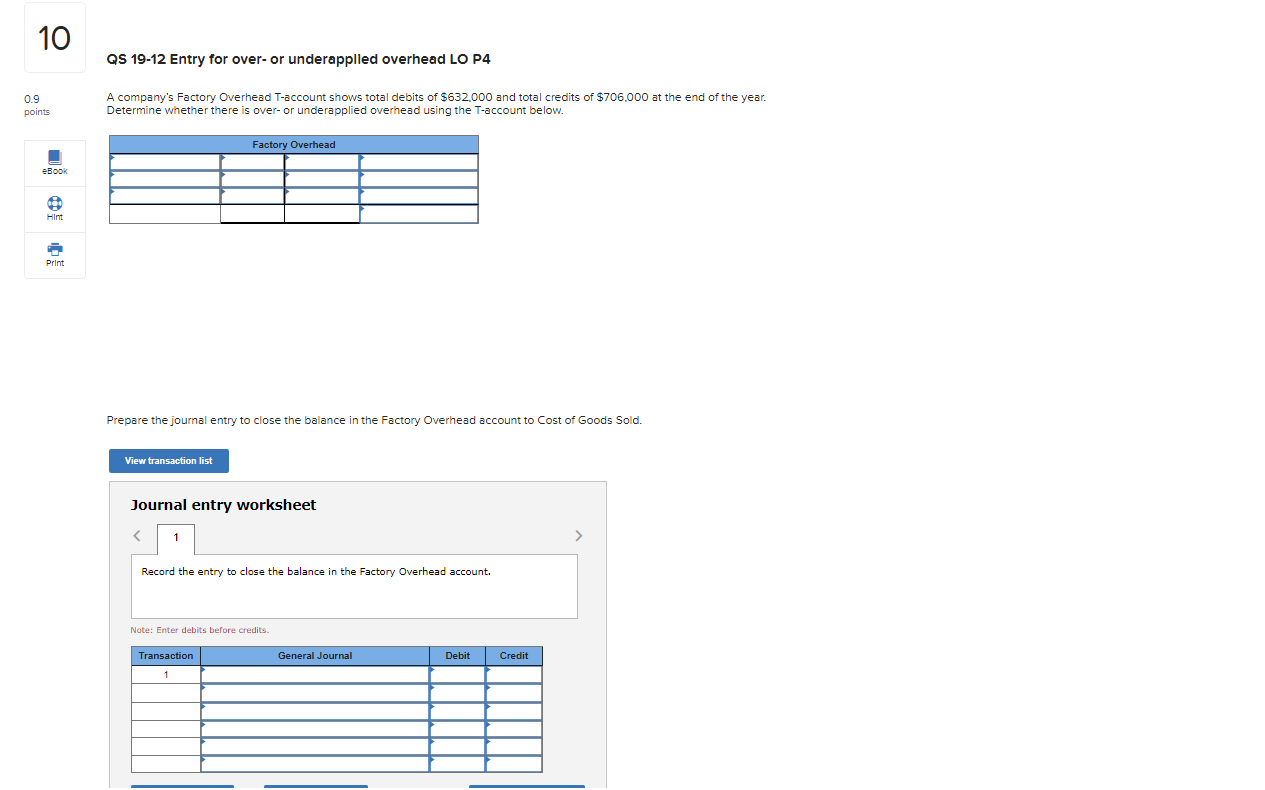

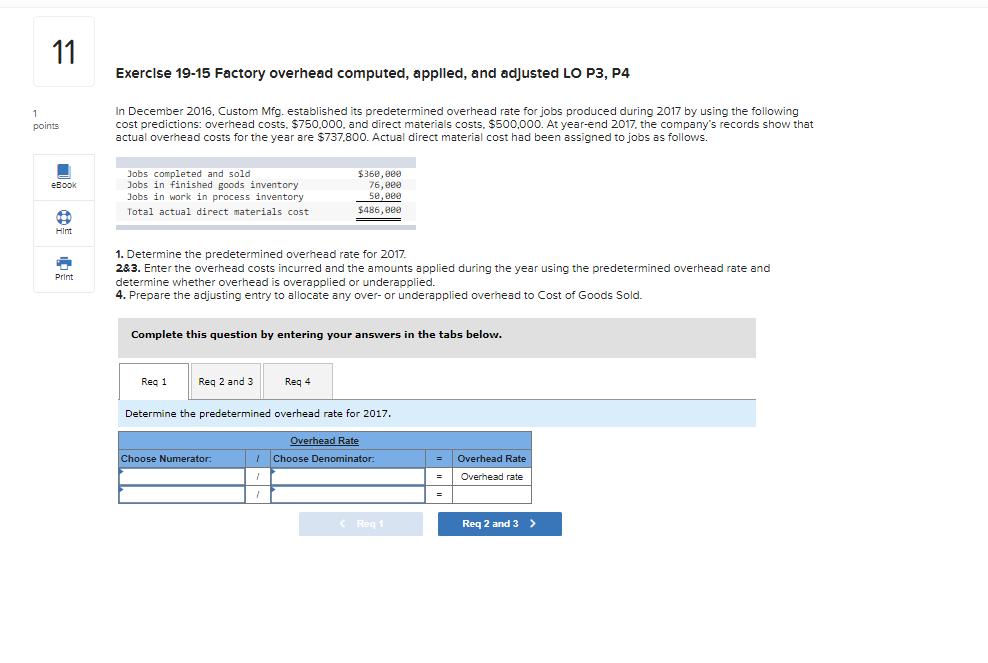

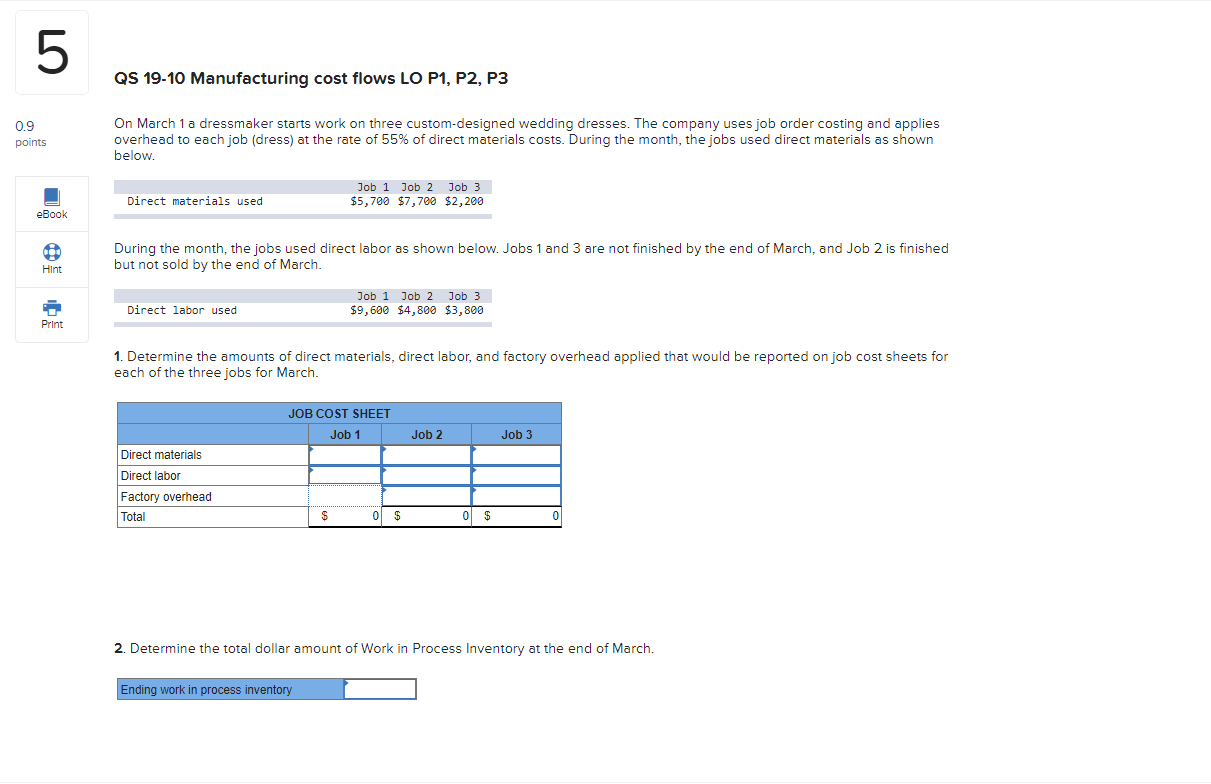

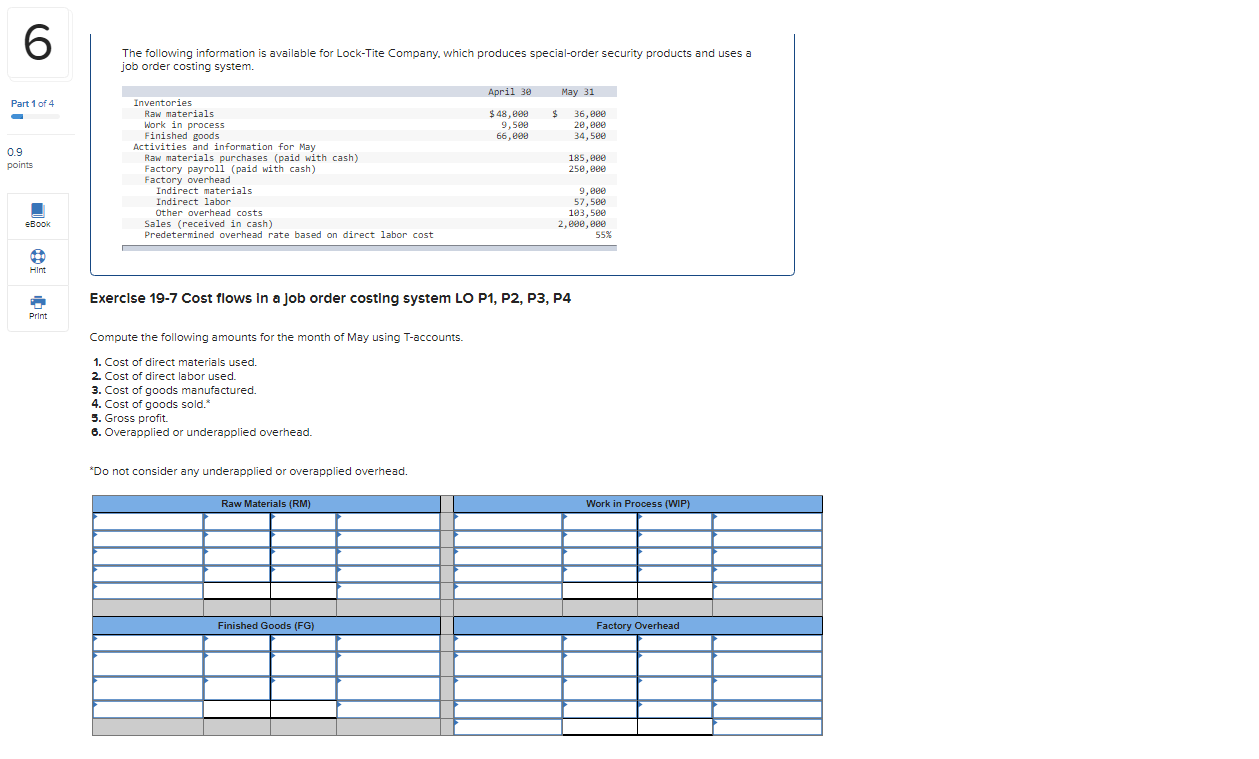

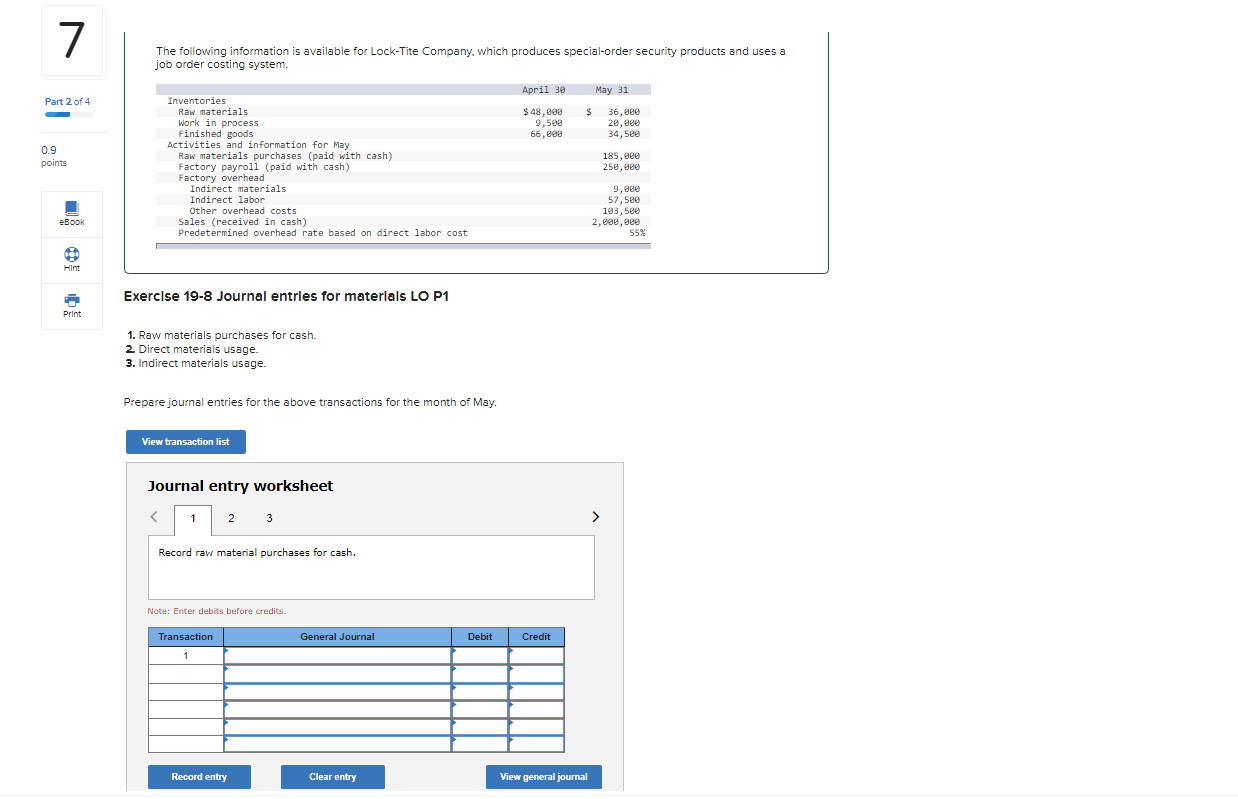

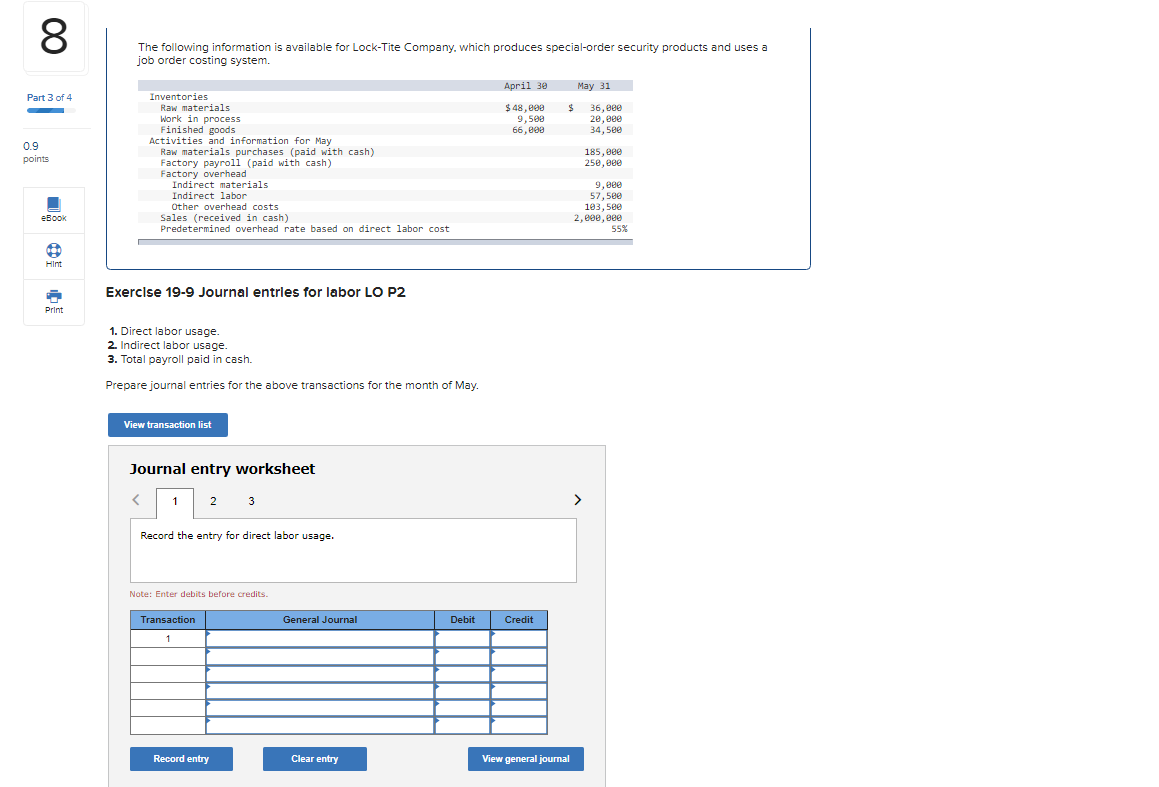

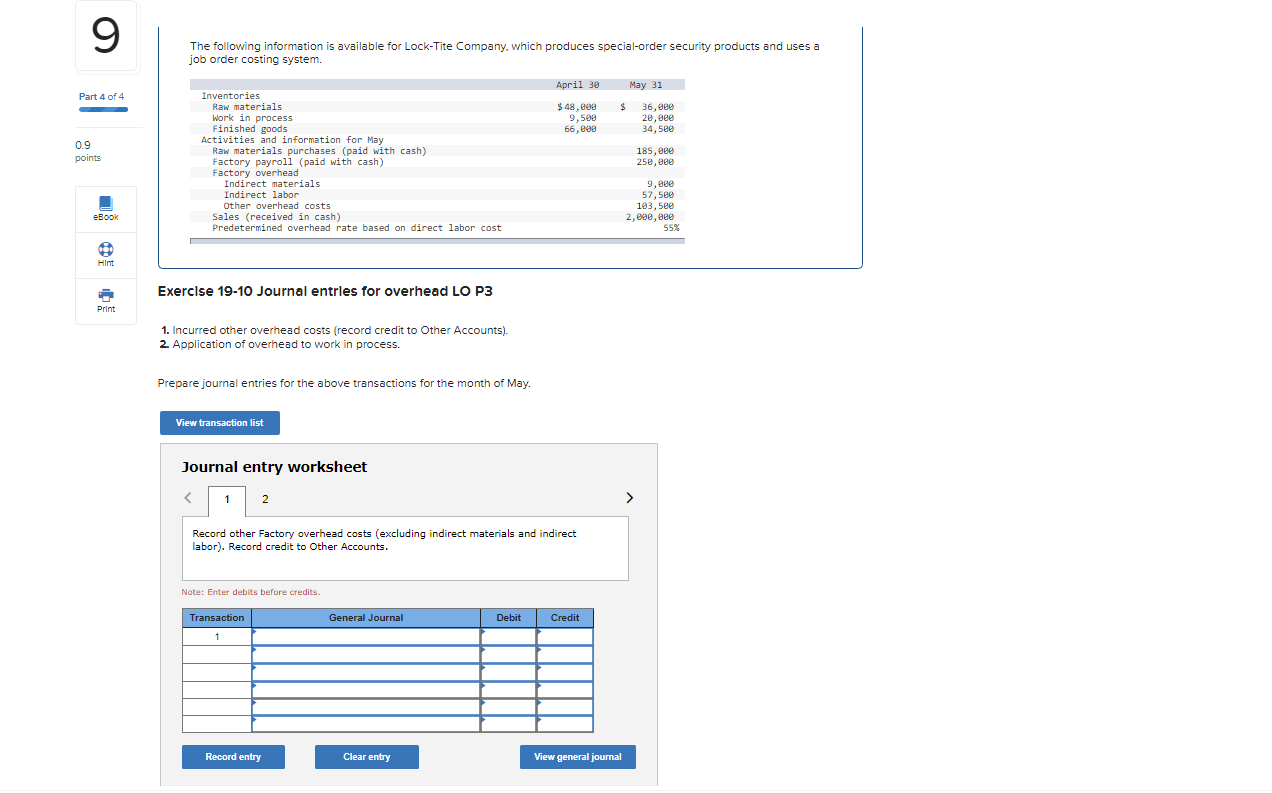

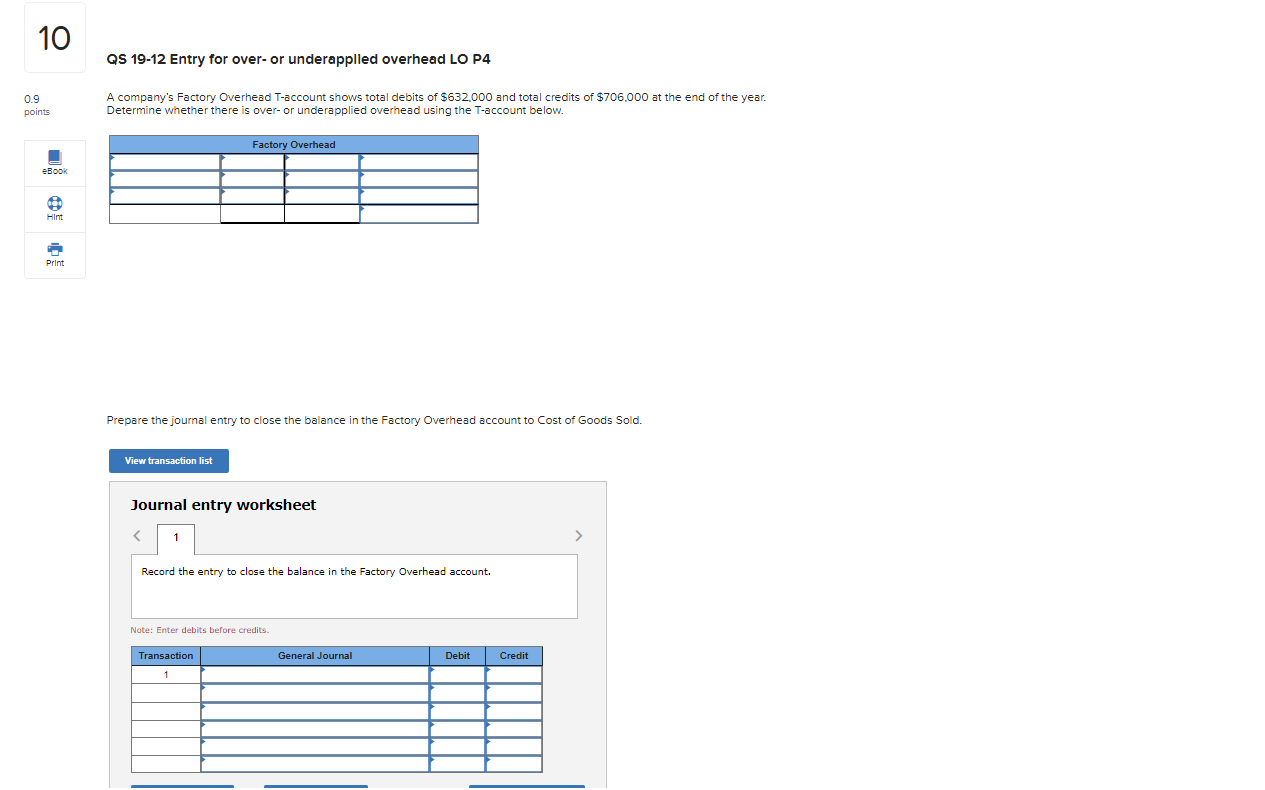

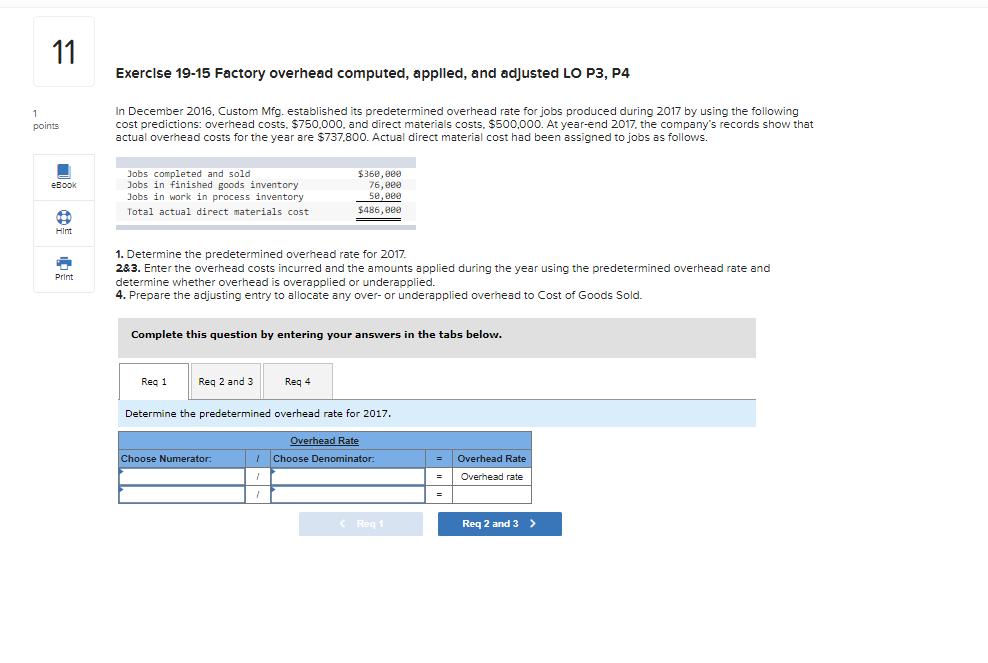

U7 5 QS 19-10 Manufacturing cost flows LO P1, P2, P3 0.9 points On March 1 a dressmaker starts work on three custom-designed wedding dresses. The company uses job order costing and applies overhead to each job (dress) at the rate of 55% of direct materials costs. During the month, the jobs used direct materials as shown below. Direct materials used Job i Job 2 Job 3 $5,700 $7,700 $2,200 eBook During the month, the jobs used direct labor as shown below. Jobs 1 and 3 are not finished by the end of March, and Job 2 is finished but not sold by the end of March. Hint Direct labor used Job 1 Job 2 Job 3 $9,600 $4,800 $3,800 Print 1. Determine the amounts of direct materials, direct labor, and factory overhead applied that would be reported on job cost sheets for each of the three jobs for March. JOB COST SHEET Job 1 Job 2 Job 3 Direct materials Direct labor Factory overhead Total $ 0 $ 5 2. Determine the total dollar amount of Work in Process Inventory at the end of March. Ending work in process inventory 6 The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. April 30 May 31 Part 1 of 4 $ 48,00 9,500 66,000 $ 36,eee 20, see 34,500 0.9 points Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 185, eee 250,000 9,820 57,500 103,500 2,800, eee 55% eBook Hint Exercise 19-7 Cost flows in a job order costing system LO P1, P2, P3, P4 Print Compute the following amounts for the month of May using T-accounts. 1. Cost of direct materials used. 2. Cost of direct labor used. Cost of goods manufactured. 4. Cost of goods sold." 5. Gross profit. 6. Overapplied or underapplied overhead. *Do not consider any underapplied or overapplied overhead. Raw Materials (RM) Work in Process (WIP) Finished Goods (FG) Factory Overhead 7 The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. April 30 May 31 Part 2 of 4 $ $48.000 9,500 66.800 36, eee 20, eee 34,5ee 0.9 points Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 185, eee 25e,eee 9, eee 57,5ee 103,500 2,800,000 55% eBook det Hint Exercise 19-8 Journal entries for materials LO P1 Print 1. Raw materials purchases for cash. . 2. Direct materials usage. 3. Indirect materials usage. Prepare journal entries for the above transactions for the month of May. View transaction list Journal entry worksheet Record raw material purchases for cash. . Note: Enter debits before credits Transaction General Journal Debit Credit 1 1 Record entry Clear entry View general journal 00 8 The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. April 30 May 31 Part 3 of 4 $ $ $ 48,99 9,529 66,099 36, eee 20, eee 34,500 0.9 points Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 185,888 250, eee 9, eee 57,5ee 103,500 2. eee, see 55% eBook Hint Exercise 19-9 Journal entries for labor LO P2 Print 1. Direct labor usage. 2. Indirect labor usage. 3. Total payroll paid in cash. Prepare journal entries for the above transactions for the month of May. View transaction list Journal entry worksheet Record the entry for direct labor usage. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal 9 The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. April 30 May 31 Part 4 of 4 $ $ 48,899 9,500 66,898 36, eee 2e, see 34,5ee 0.9 points Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 185, eee 25e,eee 9,88e 57,5ee 103,5ee 2,eee, eee 55% eBook Hint Exercise 19-10 Journal entries for overhead LO P3 Print 1. Incurred other overhead costs (record credit to Other Accounts). 2. Application of overhead to work in process. Prepare journal entries for the above transactions for the month of May. View transaction list Journal entry worksheet Record other factory overhead costs (excluding indirect materials and indirect labor). Record credit to Other Accounts. Note: Enter debits before credits Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal 10 QS 19-12 Entry for over- or underapplied overhead LO P4 0.9 points A company's Factory Overhead T-account shows total debits of $632.000 and total credits of $706.000 at the end of the year. Determine whether there is over- or underapplied overhead using the T-account below. Factory Overhead eBook Hint Print Prepare the journal entry to close the balance in the Factory Overhead account to Cost of Goods Sold. View transaction list Journal entry worksheet 1 > Record the entry to close the balance in the Factory Overhead account. Note: Enter debits before credits Transaction General Journal Debit Credit 1 11 Exercise 19-15 Factory overhead computed, applied, and adjusted LO P3, P4 1 points In December 2016. Custom Mfg. established its predetermined overhead rate for jobs produced during 2017 by using the following cost predictions: overhead costs. $750.000, and direct materials costs. $500,000. At year-end 2017, the company's records show that actual overhead costs for the year are $737,800. Actual direct material cost had been assigned to jobs as follows. eBook Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory Total actual direct materials cost $360, see 76,eee 5e, see $486,000 Hint Print 1. Determine the predetermined overhead rate for 2017. 2&3. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Reg 4 Determine the predetermined overhead rate for 2017. Overhead Rate 1 Choose Denominator: Choose Numerator Overhead Rate Overhead rate = = Reg 1 Reg 2 and 3 >