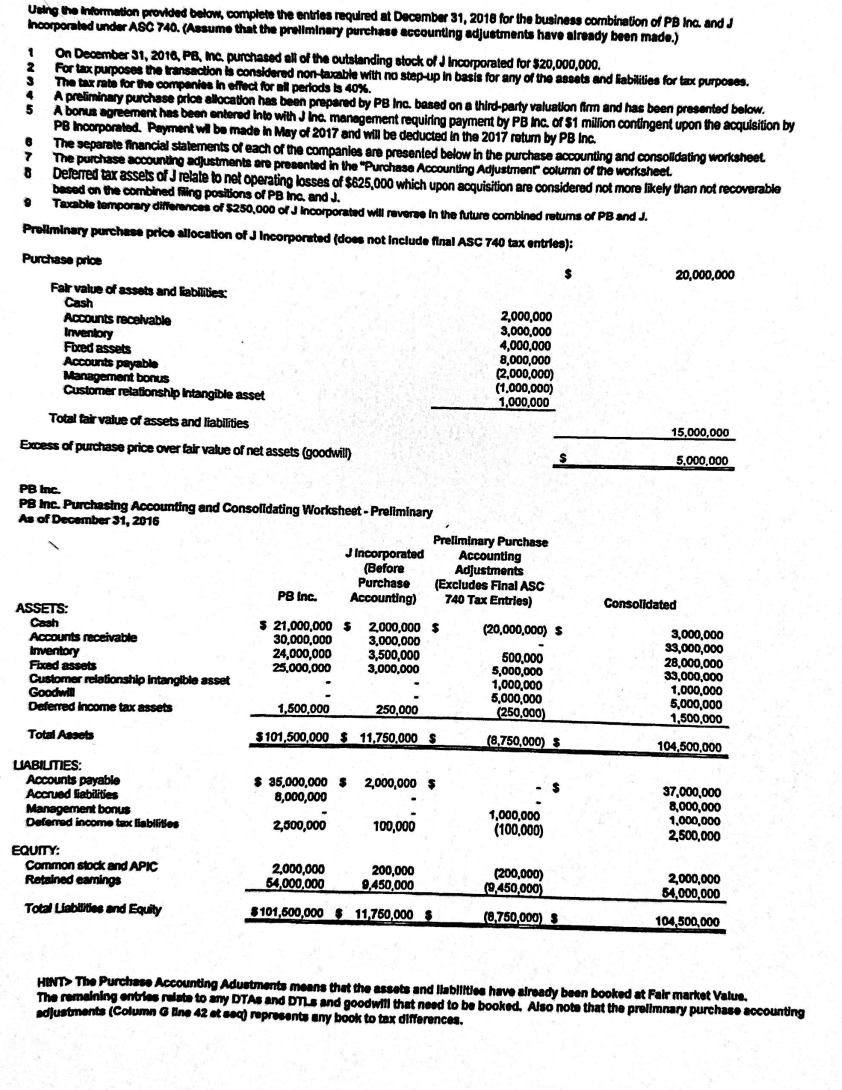

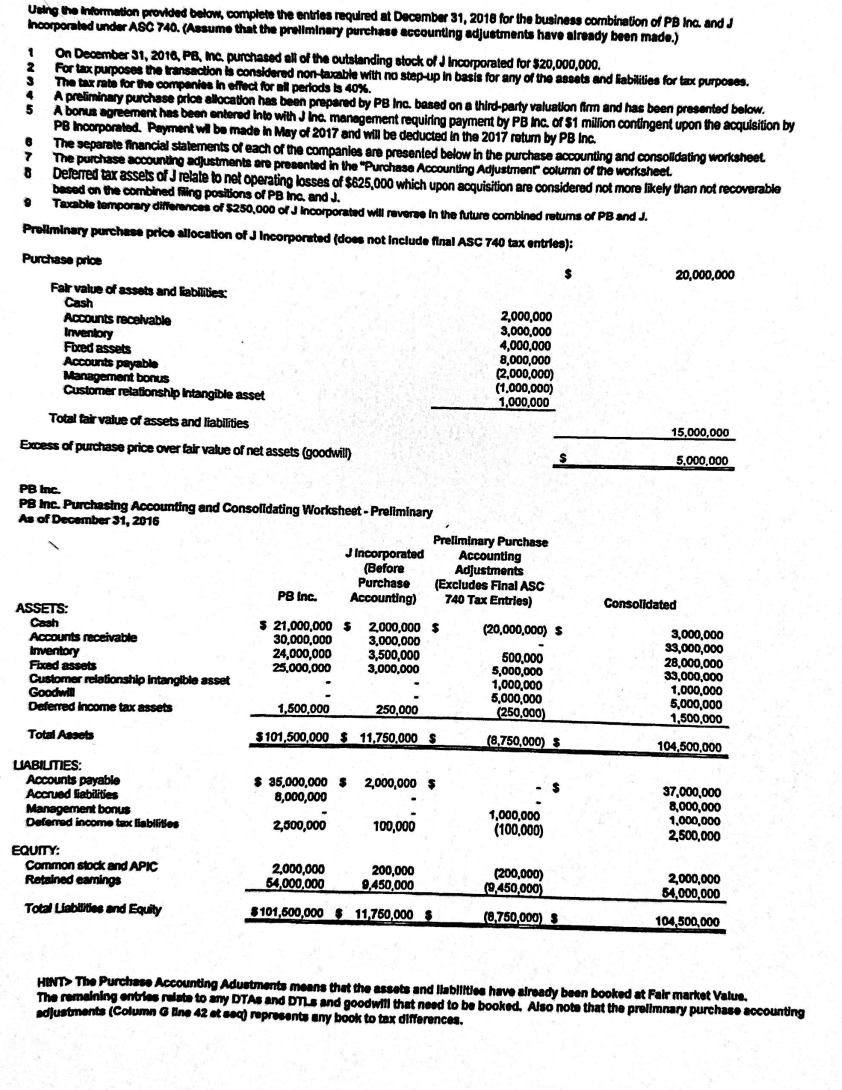

Uaine the intormetion provided belom, compleve the entries requred at December 31, 2018 for the business combination of PB inc, and J Incorperated unde ASC 740. (Acsume that the preilminary purchase aceounting adjubtments have already been made.) 1 On December 31, 2016, PB, ma purchased ell of the outsianding stock of J Incorporated for 320,000,000. For tax purposes the transaction te considered non-axable with no step-up in basis for any of the assets and fiabilities for tex purposes. The tax rate for the compenite in ellect for ell periods is 40%. A prelininary purchase price allocation has been prepared by PB inc. based on a third-party valuation firm and has been presented below. A bons agreement has been entered hito with J ha. manegement requiring payment by PB ha. of 51 million contingent upon the acquisition by PB hncorporaled. Payment wal be made in May of 2017 and wil be deducted in the 2017 retum by PB inc. - The separete inancial statements of each of the companies are presented below in the purchase accounting and consolldating worksheet. 7 The purchase accountho adjustments are presentad in the "Purchase Accounting Adjustment column of the worksheet. - Deferred tar assels of J relate to net operating losses of $625,000 which upon acquisition are considered not more likely than not recoverable - Tased on the combined niling positions of PB ina, and J. - Taceble temporary ditiserences of 5250,000 of J incorporated will reverse in the future combined retums of PB and J. Prellminary purchase price allocation of J Incorporated (does not include final ASC 740 tax entrles): Pu - Ex PB lac. PB Inc Purchasing Accounting and Consolidating Worksheet - Preliminary As of December 31,2816 Hurr The Purchese Accounting Adustments meens that the assets and llablities have already been booked at Fair market Velue. The remaining entiles nelde to any DTAs and DTL and goodwill that need to be booked. Aso note that the prellmnary purchase accounting adlustments (Column G tine 42 et eeq) mopreents any book to tox difiterences. Uaine the intormetion provided belom, compleve the entries requred at December 31, 2018 for the business combination of PB inc, and J Incorperated unde ASC 740. (Acsume that the preilminary purchase aceounting adjubtments have already been made.) 1 On December 31, 2016, PB, ma purchased ell of the outsianding stock of J Incorporated for 320,000,000. For tax purposes the transaction te considered non-axable with no step-up in basis for any of the assets and fiabilities for tex purposes. The tax rate for the compenite in ellect for ell periods is 40%. A prelininary purchase price allocation has been prepared by PB inc. based on a third-party valuation firm and has been presented below. A bons agreement has been entered hito with J ha. manegement requiring payment by PB ha. of 51 million contingent upon the acquisition by PB hncorporaled. Payment wal be made in May of 2017 and wil be deducted in the 2017 retum by PB inc. - The separete inancial statements of each of the companies are presented below in the purchase accounting and consolldating worksheet. 7 The purchase accountho adjustments are presentad in the "Purchase Accounting Adjustment column of the worksheet. - Deferred tar assels of J relate to net operating losses of $625,000 which upon acquisition are considered not more likely than not recoverable - Tased on the combined niling positions of PB ina, and J. - Taceble temporary ditiserences of 5250,000 of J incorporated will reverse in the future combined retums of PB and J. Prellminary purchase price allocation of J Incorporated (does not include final ASC 740 tax entrles): Pu - Ex PB lac. PB Inc Purchasing Accounting and Consolidating Worksheet - Preliminary As of December 31,2816 Hurr The Purchese Accounting Adustments meens that the assets and llablities have already been booked at Fair market Velue. The remaining entiles nelde to any DTAs and DTL and goodwill that need to be booked. Aso note that the prellmnary purchase accounting adlustments (Column G tine 42 et eeq) mopreents any book to tox difiterences