Answered step by step

Verified Expert Solution

Question

1 Approved Answer

UB corporation's Export Division exports 100 iPhone XS to Yale country at Yen 100 per machine (Yen10,000 in total: contracted at Yen). UB's C.F.O. asks

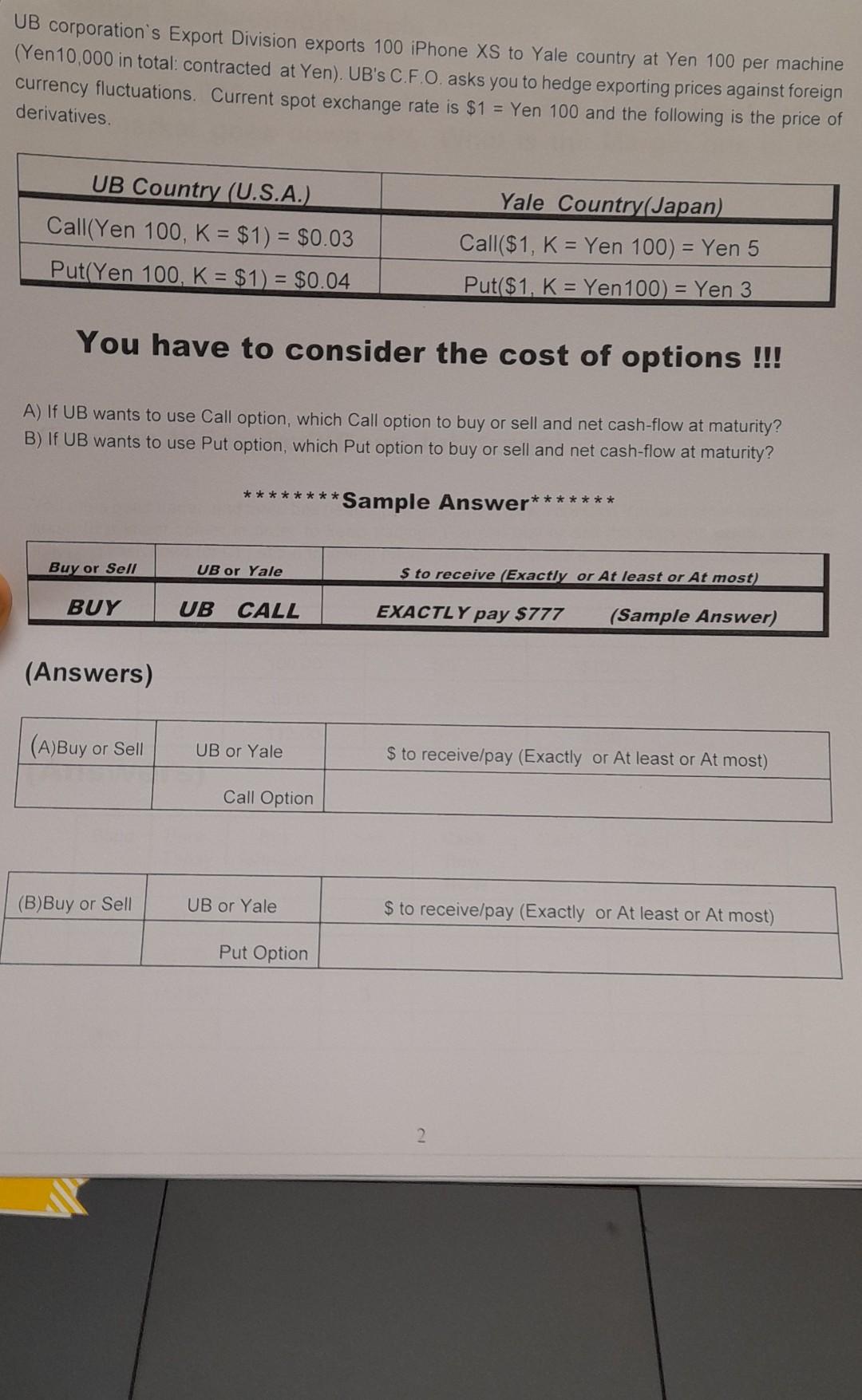

UB corporation's Export Division exports 100 iPhone XS to Yale country at Yen 100 per machine (Yen10,000 in total: contracted at Yen). UB's C.F.O. asks you to hedge exporting prices against foreign currency fluctuations. Current spot exchange rate is $1= Yen 100 and the following is the price of derivatives. You have to consider the cost of options !!! A) If UB wants to use Call option, which Call option to buy or sell and net cash-flow at maturity? B) If UB wants to use Put option, which Put option to buy or sell and net cash-flow at maturity? (Answers)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started