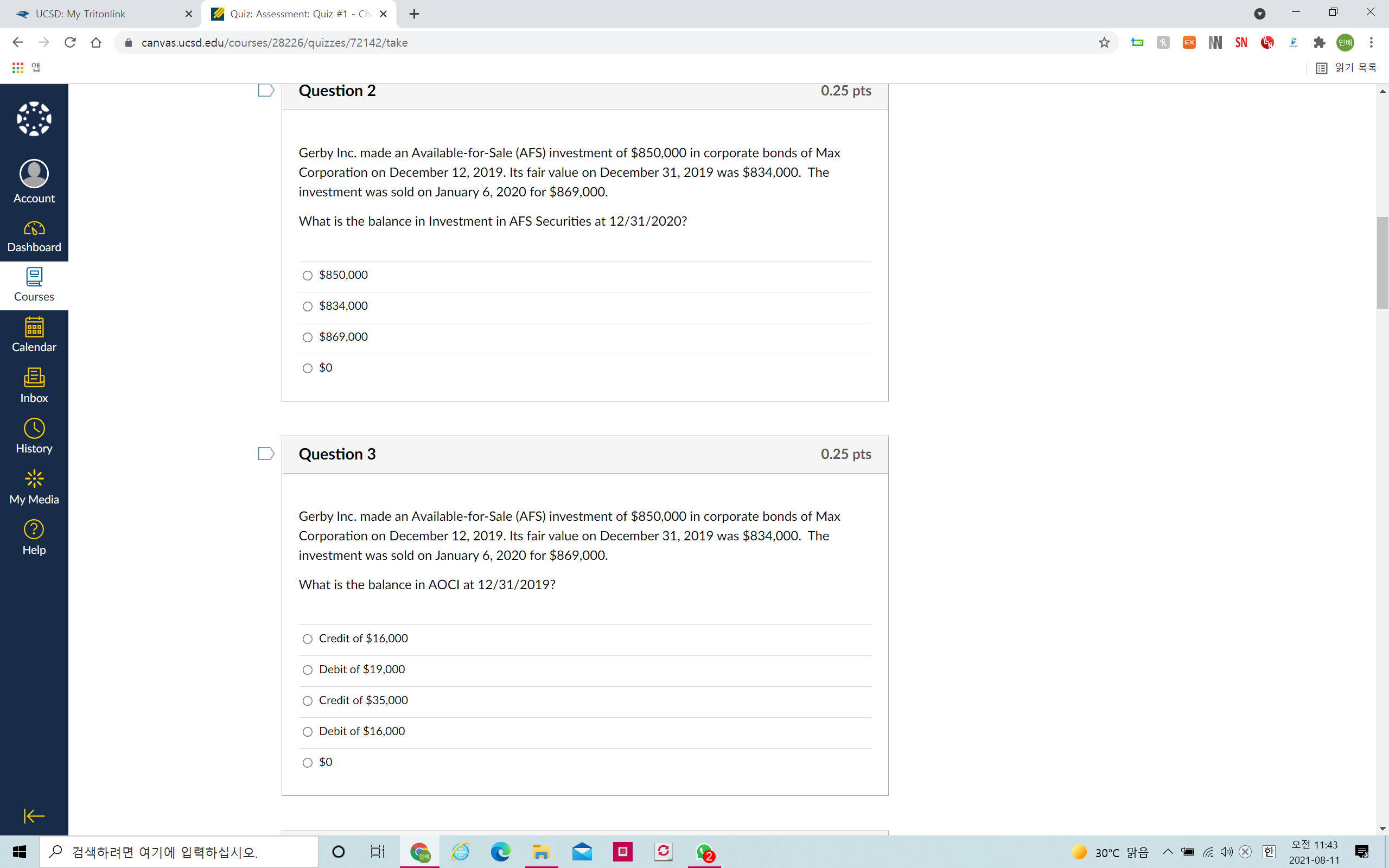

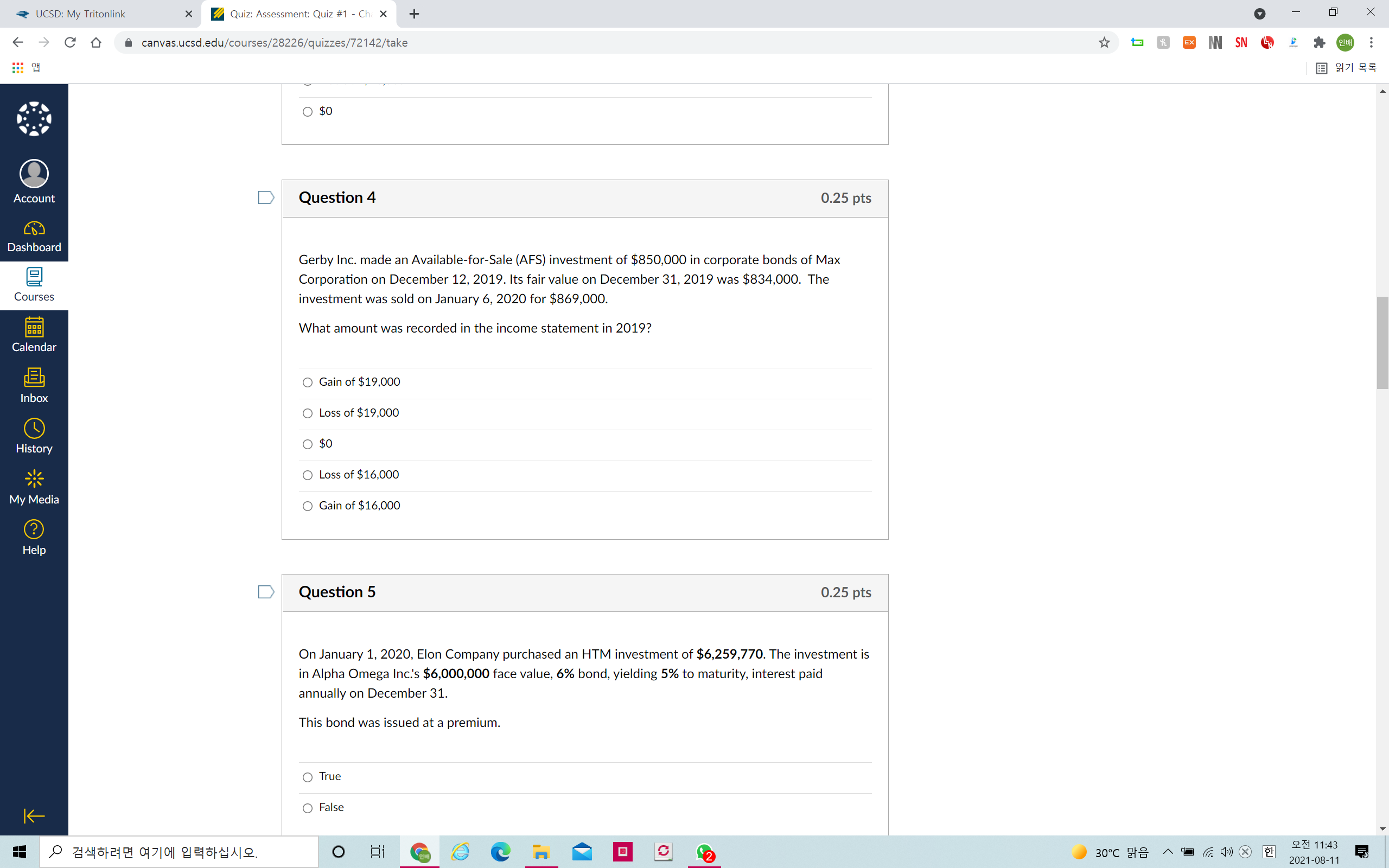

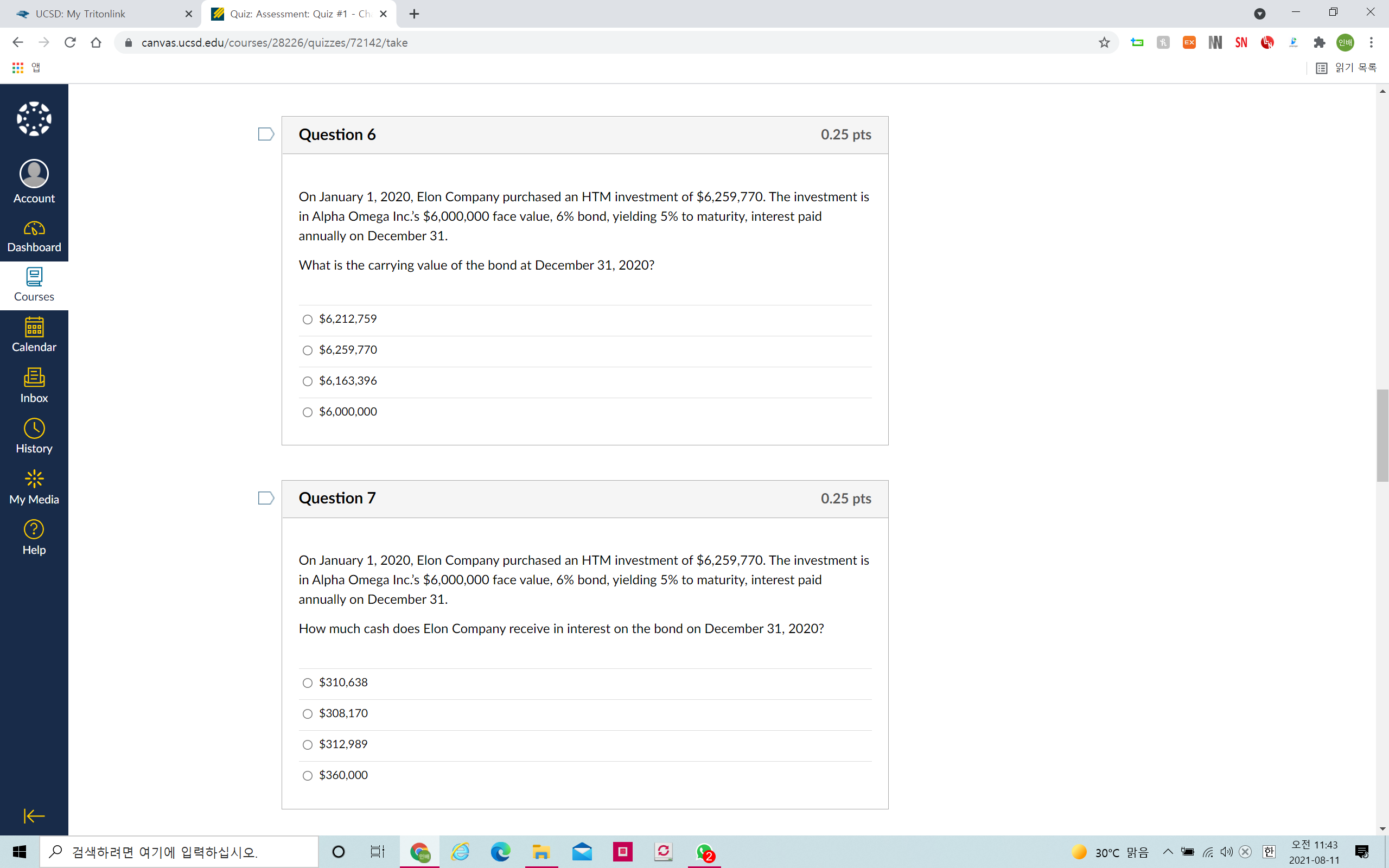

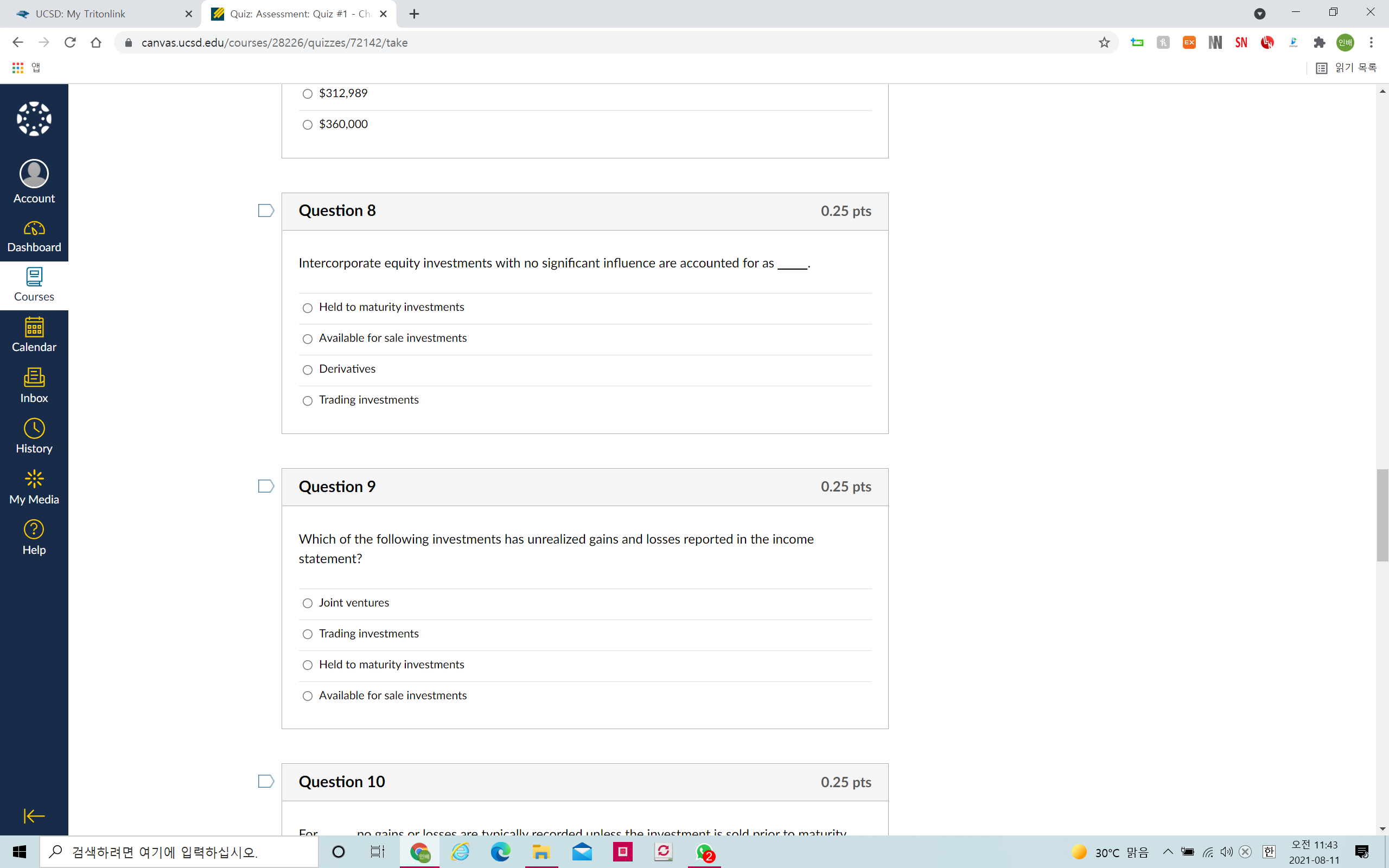

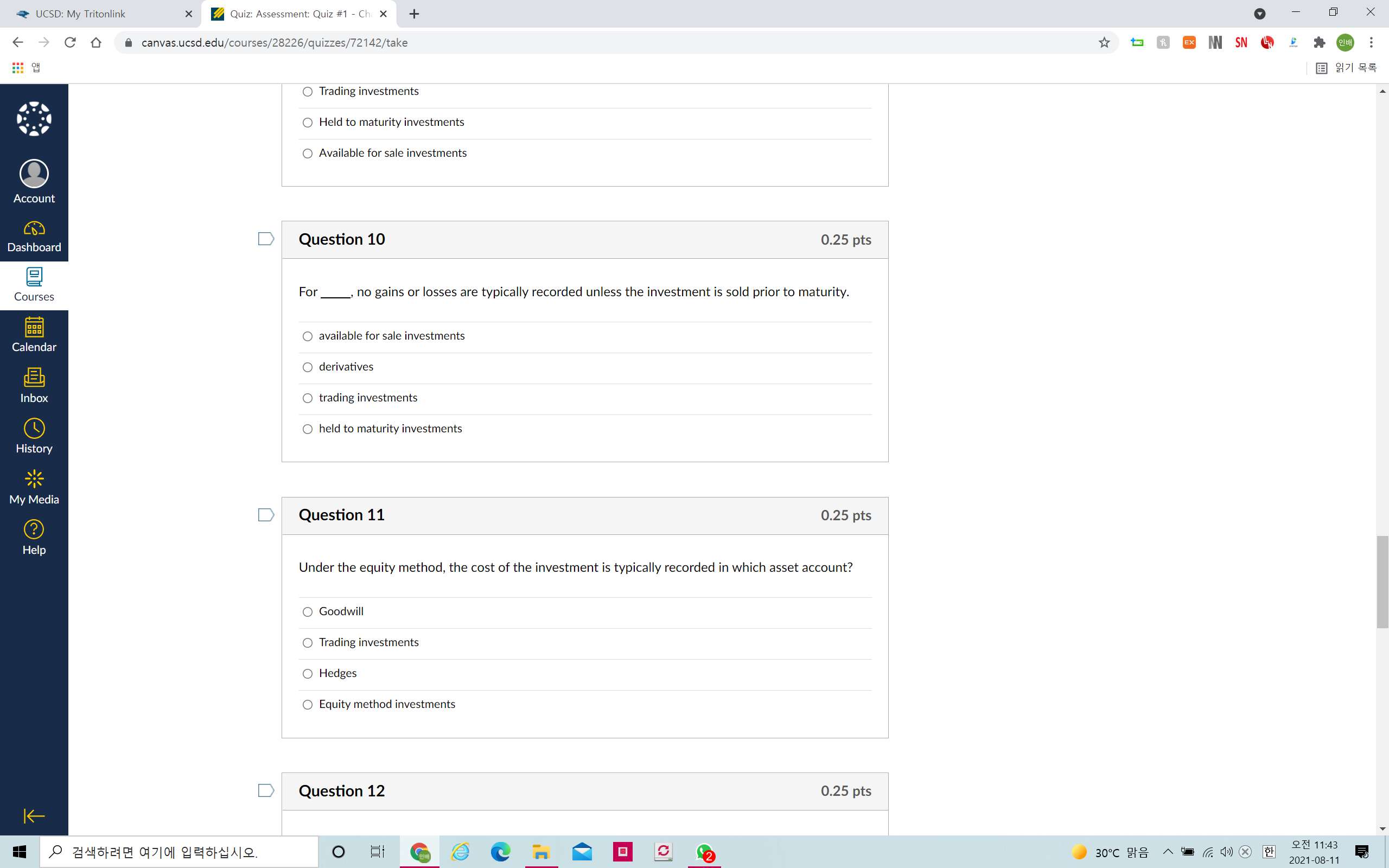

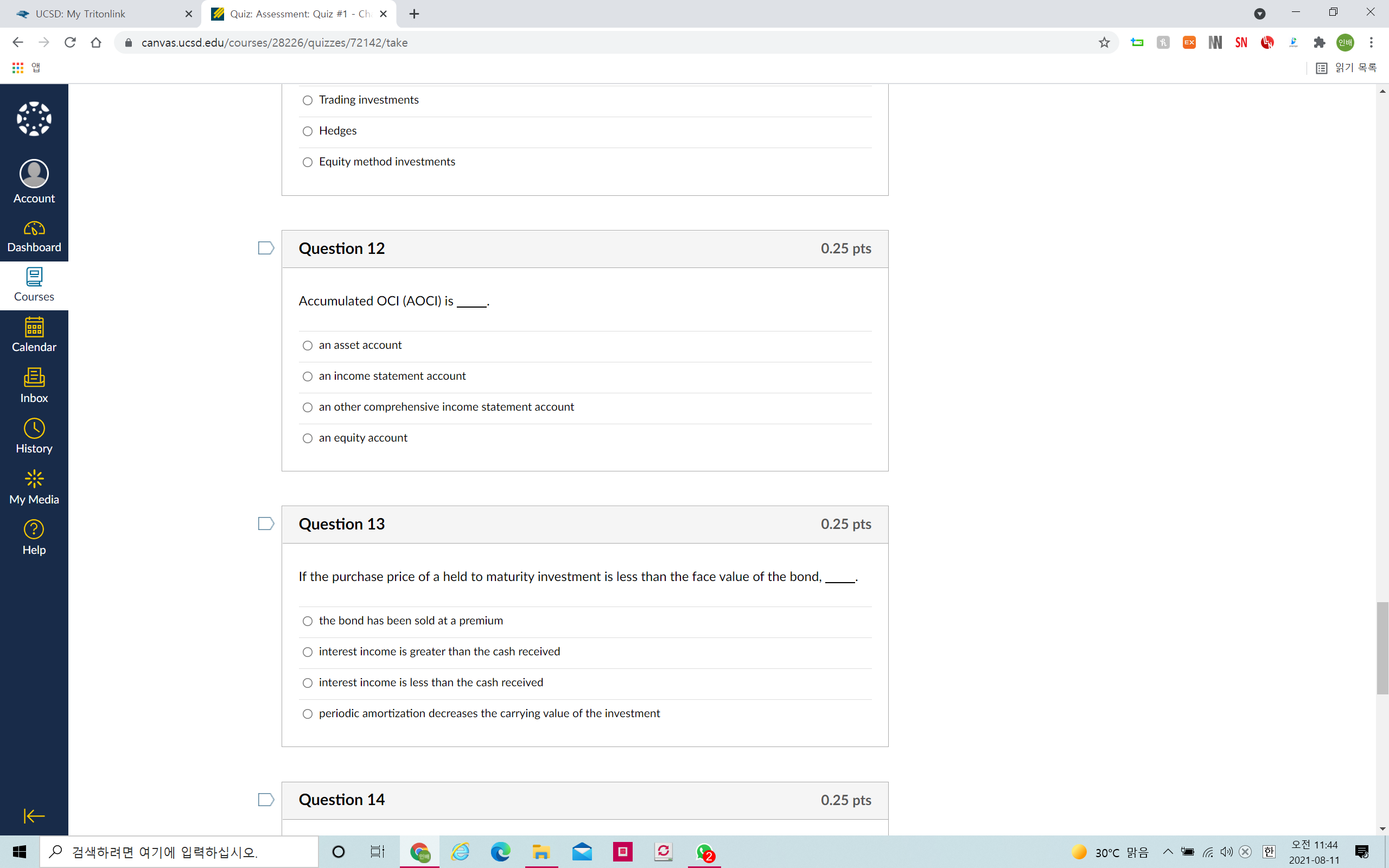

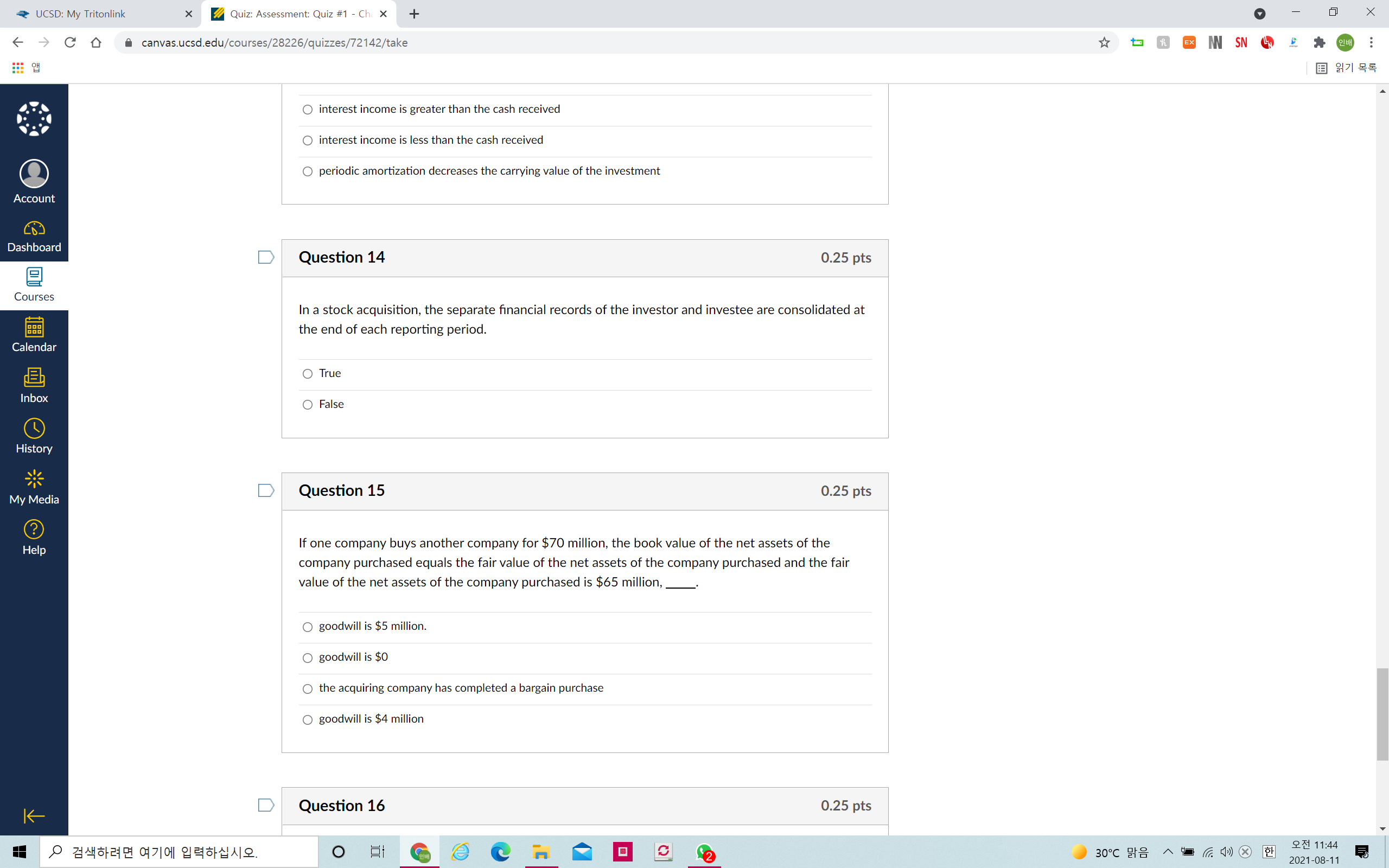

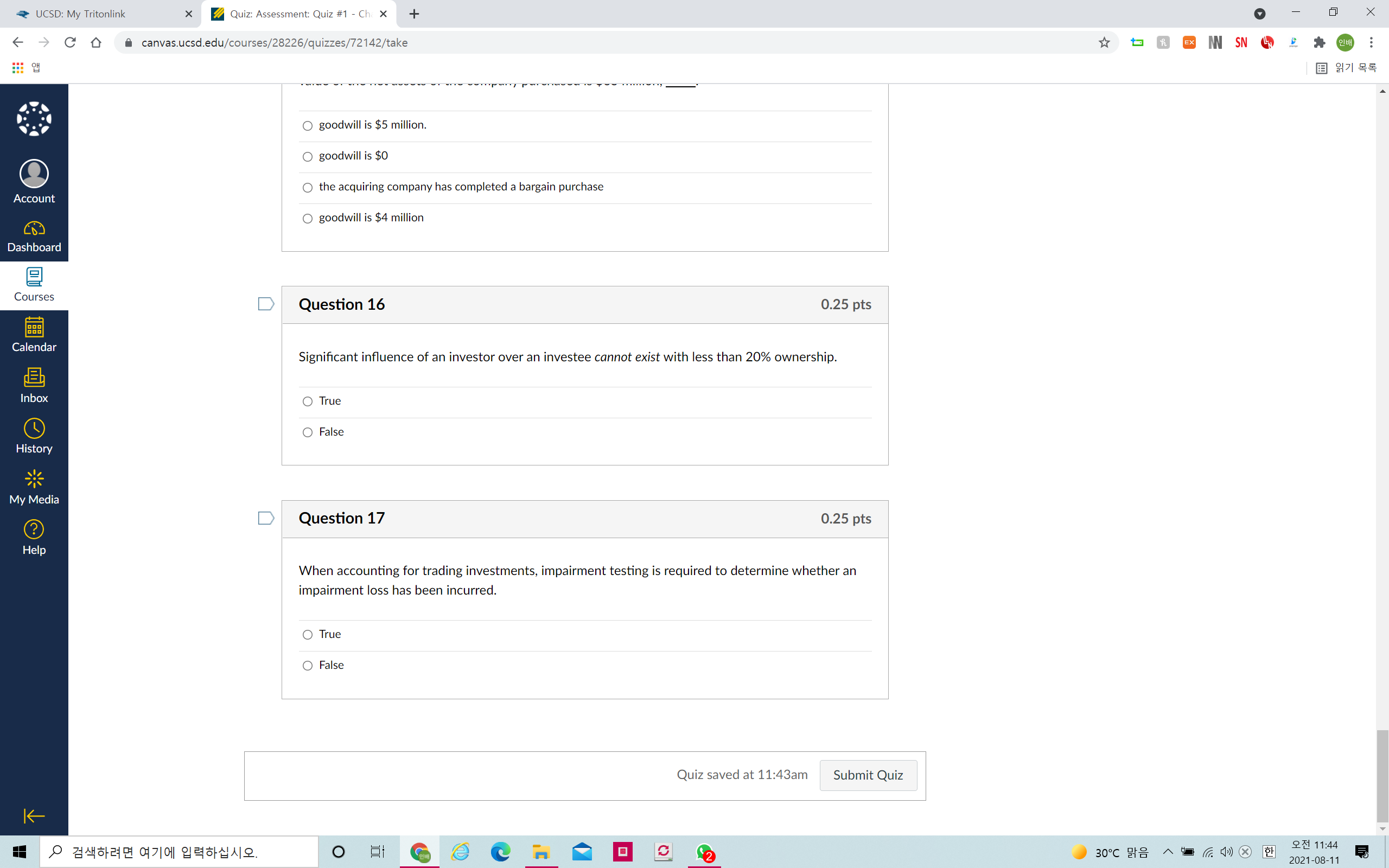

UCSD: My Tritonlink X Quiz: Assessment: Quiz #1 - Ch: X + X canvas.ucsd.edu/courses/28226/quizzes/72142/take 1 971 95 D Question 2 0.25 pts Gerby Inc. made an Available-for-Sale (AFS) investment of $850,000 in corporate bonds of Max Corporation on December 12, 2019. Its fair value on December 31, 2019 was $834,000. The Account investment was sold on January 6, 2020 for $869,000. What is the balance in Investment in AFS Securities at 12/31/2020? Dashboard $850,000 Courses O $834,000 O $869,000 Calendar O $0 Inbox History D Question 3 0.25 pts My Media Gerby Inc. made an Available-for-Sale (AFS) investment of $850,000 in corporate bonds of Max (?) Corporation on December 12, 2019. Its fair value on December 31, 2019 was $834,000. The Help investment was sold on January 6, 2020 for $869,000. What is the balance in AOCI at 12/31/2019? O Credit of $16,000 O Debit of $19,000 O Credit of $35,000 O Debit of $16,000 O $0 K O G eCaoDe 2t 11:43 2021-08-11UCSD: My Tritonlink X Quiz: Assessment: Quiz #1 - Chi X + X canvas.ucsd.edu/courses/28226/quizzes/72142/take 1 971 95 O $0 Account D Question 4 0.25 pts Dashboard Gerby Inc. made an Available-for-Sale (AFS) investment of $850,000 in corporate bonds of Max Corporation on December 12, 2019. Its fair value on December 31, 2019 was $834,000. The Courses investment was sold on January 6, 2020 for $869,000. mount was recorded in the income statement in 2019? Calendar O Gain of $19,000 Inbox O Loss of $19,000 History O $0 O Loss of $16,000 My Media O Gain of $16,000 (?) Help D Question 5 0.25 pts On January 1, 2020, Elon Company purchased an HTM investment of $6,259,770. The investment is in Alpha Omega Inc.'s $6,000,000 face value, 6% bond, yielding 5% to maturity, interest paid annually on December 31 This bond was issued at a premium. O True K O False O G e CANOE 2 2t 11:43 2021-08-11UCSD: My Tritonlink X Quiz: Assessment: Quiz #1 - Ch X + X canvas.ucsd.edu/courses/28226/quizzes/72142/take 13 EX N SN BALEH 1 971 95 D Question 6 0.25 pts Account On January 1, 2020, Elon Company purchased an HTM investment of $6,259,770. The investment is in Alpha Omega Inc.'s $6,000,000 face value, 6% bond, yielding 5% to maturity, interest paid annually on December 31. Dashboard What is the carrying value of the bond at December 31, 2020? Courses O $6,212,759 Calendar O $6,259,770 O $6,163,396 Inbox O $6,000,000 History My Media D Question 7 0.25 pts (?) Help On January 1, 2020, Elon Company purchased an HTM investment of $6,259,770. The investment is in Alpha Omega Inc.'s $6,000,000 face value, 6% bond, yielding 5% to maturity, interest paid annually on December 31. How much cash does Elon Company receive in interest on the bond on December 31, 2020? O $310,638 O $308,170 O $312,989 O $360,000 K O Became 2 2t 11:43 2021-08-11UCSD: My Tritonlink X Quiz: Assessment: Quiz #1 - Ch: x + X canvas.ucsd.edu/courses/28226/quizzes/72142/take 1 971 95 $312,989 O $360,000 Account D Question 8 0.25 pts Dashboard Intercorporate equity investments with no significant influence are accounted for as _ Courses O Held to maturity investments O Available for sale investments Calendar Derivatives Inbox O Trading investments History D Question 9 0.25 pts My Media (?) Which of the following investments has unrealized gains and losses reported in the income Help statement? O Joint ventures O Trading investments O Held to maturity investments O Available for sale investments D Question 10 0.25 pts K For no maine or Inccec are tunically recorded unless the investment ic cold nine to maturity O 2t 11:43 2021-08-11UCSD: My Tritonlink X Quiz: Assessment: Quiz #1 - Chi X + X canvas.ucsd.edu/courses/28226/quizzes/72142/take 1 971 95 O Trading investments O Held to maturity investments O Available for sale investments Account D 0.25 pts Dashboard Question 10 Courses For _, no gains or losses are typically recorded unless the investment is sold prior to maturity. available for sale investments Calendar O derivatives Inbox O trading investments O held to maturity investments History My Media D Question 11 0.25 pts (?) Help Under the equity method, the cost of the investment is typically recorded in which asset account? O Goodwill Trading investments O Hedges O Equity method investments D Question 12 0.25 pts K O 2 2t 11:43 2021-08-11UCSD: My Tritonlink X Quiz: Assessment: Quiz #1 - Ch: X + X canvas.ucsd.edu/courses/28226/quizzes/72142/take 1 971 95 O Trading investments O Hedges O Equity method investments Account Dashboard D Question 12 0.25 pts Courses Accumulated OCI (AOCI) is Calendar an asset account O an income statement account Inbox O an other comprehensive income statement account O an equity account History My Media (?) D Question 13 0.25 pts Help If the purchase price of a held to maturity investment is less than the face value of the bond, O the bond has been sold at a premium interest income is greater than the cash received O interest income is less than the cash received O periodic amortization decreases the carrying value of the investment D Question 14 0.25 pts K O 2 2t1 11:44 2021-08-11Q ucso: My Tritonlink >