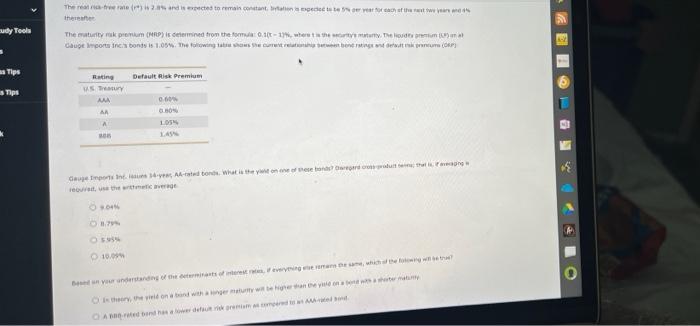

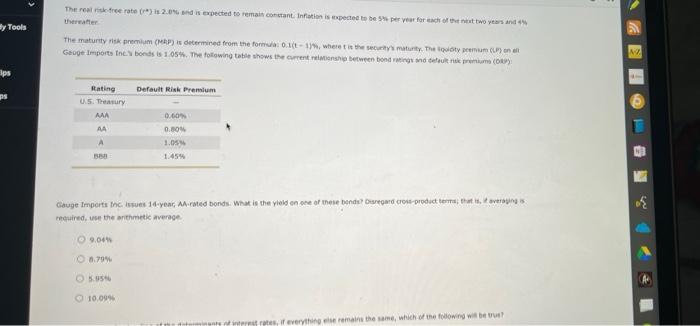

udy Tools 3 Tips Tips The reat ress-free rate (r) is 2.3% and is expected to remain constant, btation is expected to be 5% per year for each of the next we years and thereafter The maturity rak premium (MRP) is determined from the formula: 0.10-13%, where is the security's matuty. The liquides premium (58) ma Gauge Imports Inc.'s bonds is 1.05%. The following table shows the current relationship between bond ratings and default (OP) Default Risk Premium Rating US Treasury AMA 0.60% AA 0.80% 1054 of these bonds? Derepard cross product in that is veran Geuge Imports Inf. saus 14-year AA-rated bonds. What required, use the arithmetic average 2.04% 1.79% - 595% 10.09 Besed on your understanding of the determinants of interest rates, everything we remans the same, which of the flowing will be th On then, the yield on a band with a singer maturty will be higher than the yield on a better ABB-rated and has a lower defaut risk gremiam as compered to an 4 0 By Tools lps The real risk-free rate (r) is 2.0% and is expected to remain constant. Inflation is expected to be 5% per year for each of the next two years and 4% thereafter The maturity risk premium (MAP) is determined from the formula: 0.1(t-13%, where t is the security's maturity. The liquidity premium (LP) on all Gauge Imports Inc.% bonds is 1.05%. The following table shows the current relationship between bond ratings and default risk premium (DP) Default Risk Premium Rating U.S. Treasury AAA 0.60% AA 0.80% A 1.05% 888 1.45% Gauge Imports Inc. issues 14-year AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average 9.04% 8.79% 5.95% 10,09% ty of interest rates, if everything else remains the same, which of the following will be true? NO 1 4 Gauge Imports Inc. issues 14-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 9.04% 8.79% 5.95% 10.09% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? O In theory, the yield on a bond with a longer maturity will be higher than the yield on a bond with a shorter maturity. OA BBB-rated bond has a lower default risk premium as compared to an AAA-rated bond. Grade It Now Save & Continue Continue without saving