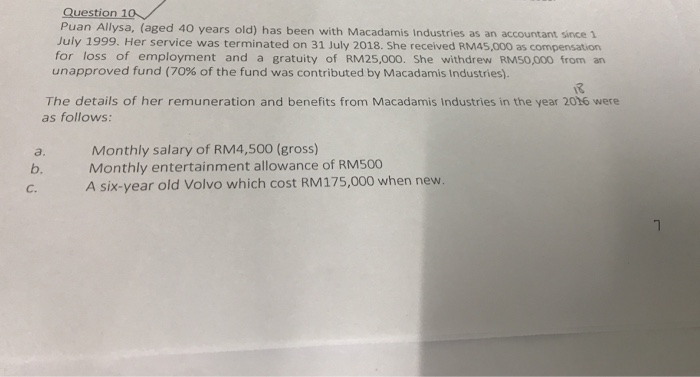

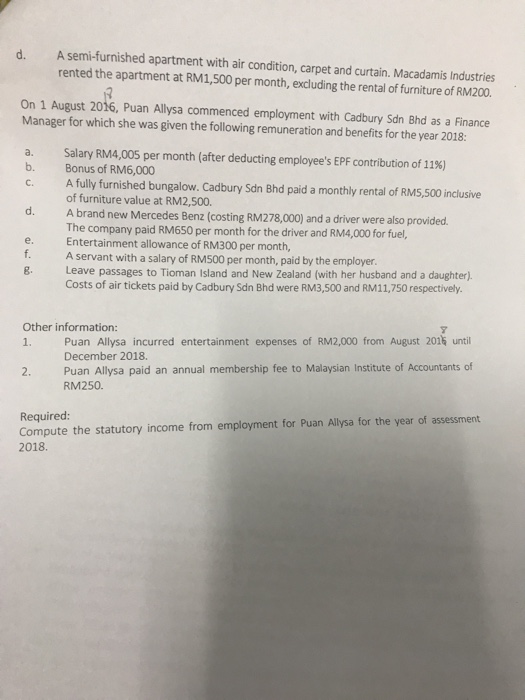

ues Puan Allysa, (aged 4o years old) has been with Macadamis Industries as an accountant since 1 July 1999. Her service was terminated on 31 July 2018. She received RM45,000 as compensation for loss of employment and a gratuity of RM25,000. She withdrew RM50,000 from an unapproved fund (70% of the fund was contributed by Macadamis Industries. The details of her remuneration and benefits from Macadamis Industries in the year 2016 were as follows: b. C. Monthly salary of RM4,500 (gross) Monthly entertainment allowance of RM500 A six-year old Volvo which cost RM175,000 when new A semi-furnished apartment with air condition, carpet and curtain. Macadamis Industries rented the apartment at RM1,500 per month, excluding the rental of furniture of RM200. d. On 1 August 2016, Puan Allysa commenced employment with Cadbury Sdn Bhd as a Finance Manager for which she was given the following remuneration and benefits for the year 2018: a. Salary RM4,005 per month (after deducting employee's EPF contribution of 11%) b. Bonus of RM6,000 c. A fully furnished bungalow. Cadbury Sdn Bhd paid a monthly rental of RM5,500 inclusive of furniture value at RM2,500. d. A brand new Mercedes Benz (costing RM278,000) and a driver were also provided. The company paid RM650 per month for the driver and RM4,000 for fuel, e. Entertainment allowance of RM300 per month, f. A servant with a salary of RM500 per month, paid by the employer 8. Leave passages to Tioman Island and New Zealand (with her husband and a daughter). Costs of air tickets paid by Cadbury Sdn Bhd were RM3,500 and RM11,750 respectively. Other information: 1. Puan Allysa incurred entertainment expenses of RM2,000 from August 201% until December 2018. 2. Puan Allysa paid an annual membership fee to Malaysian Institute of Accountants of RM250. Required: Compute the statutory income from employment for Puan Allysa for the year of assessment 2018. ues Puan Allysa, (aged 4o years old) has been with Macadamis Industries as an accountant since 1 July 1999. Her service was terminated on 31 July 2018. She received RM45,000 as compensation for loss of employment and a gratuity of RM25,000. She withdrew RM50,000 from an unapproved fund (70% of the fund was contributed by Macadamis Industries. The details of her remuneration and benefits from Macadamis Industries in the year 2016 were as follows: b. C. Monthly salary of RM4,500 (gross) Monthly entertainment allowance of RM500 A six-year old Volvo which cost RM175,000 when new A semi-furnished apartment with air condition, carpet and curtain. Macadamis Industries rented the apartment at RM1,500 per month, excluding the rental of furniture of RM200. d. On 1 August 2016, Puan Allysa commenced employment with Cadbury Sdn Bhd as a Finance Manager for which she was given the following remuneration and benefits for the year 2018: a. Salary RM4,005 per month (after deducting employee's EPF contribution of 11%) b. Bonus of RM6,000 c. A fully furnished bungalow. Cadbury Sdn Bhd paid a monthly rental of RM5,500 inclusive of furniture value at RM2,500. d. A brand new Mercedes Benz (costing RM278,000) and a driver were also provided. The company paid RM650 per month for the driver and RM4,000 for fuel, e. Entertainment allowance of RM300 per month, f. A servant with a salary of RM500 per month, paid by the employer 8. Leave passages to Tioman Island and New Zealand (with her husband and a daughter). Costs of air tickets paid by Cadbury Sdn Bhd were RM3,500 and RM11,750 respectively. Other information: 1. Puan Allysa incurred entertainment expenses of RM2,000 from August 201% until December 2018. 2. Puan Allysa paid an annual membership fee to Malaysian Institute of Accountants of RM250. Required: Compute the statutory income from employment for Puan Allysa for the year of assessment 2018