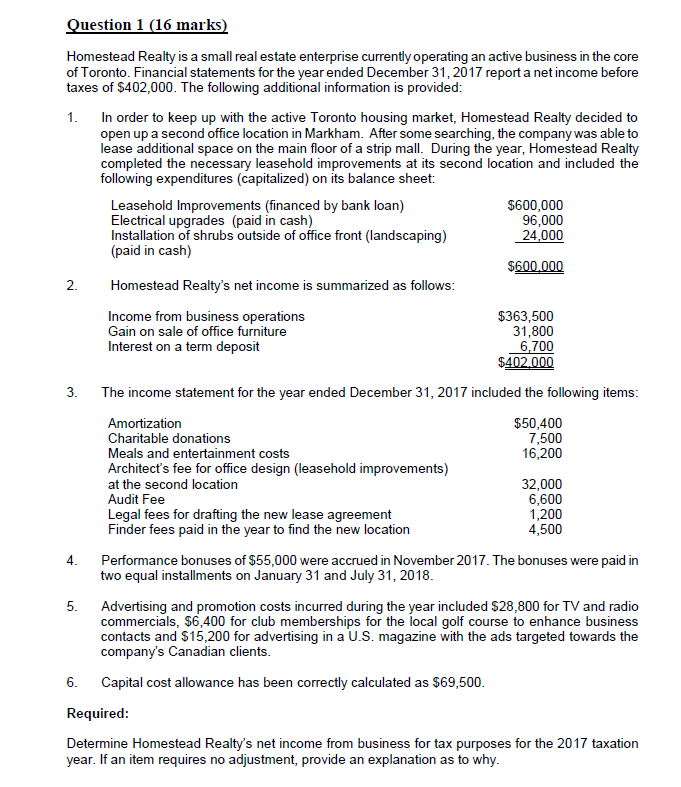

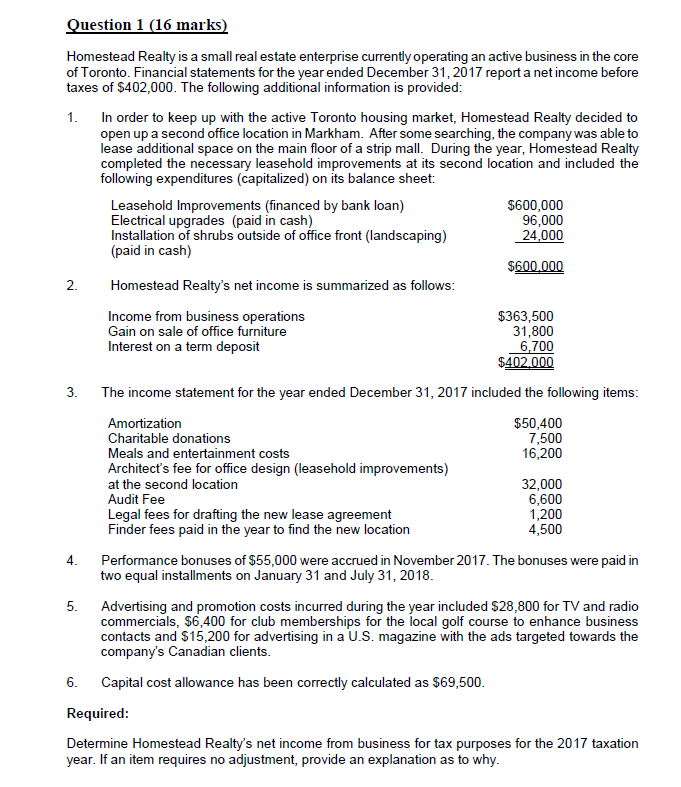

uestion 1 (16 marks Homestead Realty is a small real estate enterprise currently operating an active business in the core of Toronto. Financial statements for the yearended December 31, 2017 report a net income before taxes of $402,000. The following additional information is provided 1. In order to keep up with the active Toronto housing market, Homestead Realty decided to open up a second office location in Markham. After some searching, the company was able to lease additional space on the main floor of a strip mall. During the year, Homestead Realty completed the necessary leasehold improvements at its second location and included the following expenditures (capitalized) on its balance sheet: Leasehold Improvements (financed by bank loan) Electrical upgrades (paid in cash) Installation of shrubs outside of office front (landscaping) (paid in cash) $600,000 96,000 24.000 $600.000 2. Homestead Realty's net income is summarized as follows $363,500 31,800 6,700 $402000 Income from business operations Gain on sale of office furniture Interest on a term deposit 3. The income statement for the year ended December 31, 2017 included the following items Amortization Charitable donations Meals and entertainment costs Architect's fee for office design at the second location Audit Fee Legal fees for drafting the new lease agreement Finder fees paid in the year to find the new location $50,400 7,500 16,200 (leasehold improvements) 32,000 6,600 1,200 4,500 4. Performance bonuses of $55,000 were accrued in November 2017. The bonuses were paid in two equal installments on January 31 and July 31, 2018 5. Advertising and promotion costs incurred during the year included $28,800 for TV and radio commercials, $6,400 for club memberships for the local golf course to enhance business contacts and $15,200 for advertising in a U.S. magazine with the ads targeted towards the company's Canadian clients 6. Capital cost allowance has been correctly calculated as $69,500 Required: Determine Homestead Realty's net income from business for tax purposes for the 2017 taxation year. If an item requires no adjustment, provide an explanation as to why uestion 1 (16 marks Homestead Realty is a small real estate enterprise currently operating an active business in the core of Toronto. Financial statements for the yearended December 31, 2017 report a net income before taxes of $402,000. The following additional information is provided 1. In order to keep up with the active Toronto housing market, Homestead Realty decided to open up a second office location in Markham. After some searching, the company was able to lease additional space on the main floor of a strip mall. During the year, Homestead Realty completed the necessary leasehold improvements at its second location and included the following expenditures (capitalized) on its balance sheet: Leasehold Improvements (financed by bank loan) Electrical upgrades (paid in cash) Installation of shrubs outside of office front (landscaping) (paid in cash) $600,000 96,000 24.000 $600.000 2. Homestead Realty's net income is summarized as follows $363,500 31,800 6,700 $402000 Income from business operations Gain on sale of office furniture Interest on a term deposit 3. The income statement for the year ended December 31, 2017 included the following items Amortization Charitable donations Meals and entertainment costs Architect's fee for office design at the second location Audit Fee Legal fees for drafting the new lease agreement Finder fees paid in the year to find the new location $50,400 7,500 16,200 (leasehold improvements) 32,000 6,600 1,200 4,500 4. Performance bonuses of $55,000 were accrued in November 2017. The bonuses were paid in two equal installments on January 31 and July 31, 2018 5. Advertising and promotion costs incurred during the year included $28,800 for TV and radio commercials, $6,400 for club memberships for the local golf course to enhance business contacts and $15,200 for advertising in a U.S. magazine with the ads targeted towards the company's Canadian clients 6. Capital cost allowance has been correctly calculated as $69,500 Required: Determine Homestead Realty's net income from business for tax purposes for the 2017 taxation year. If an item requires no adjustment, provide an explanation as to why