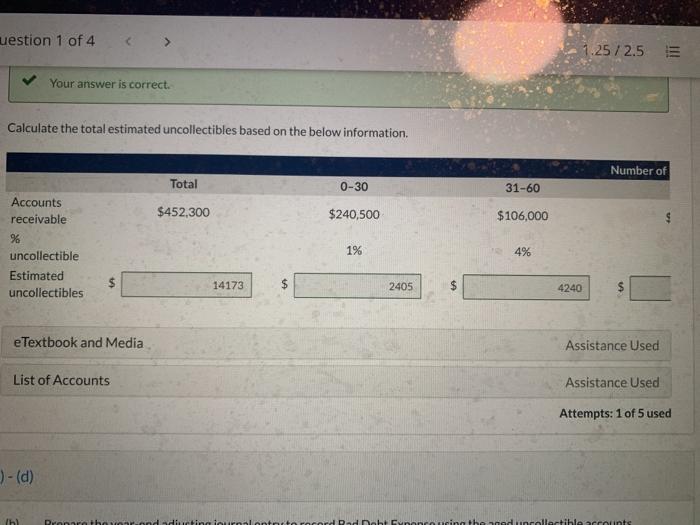

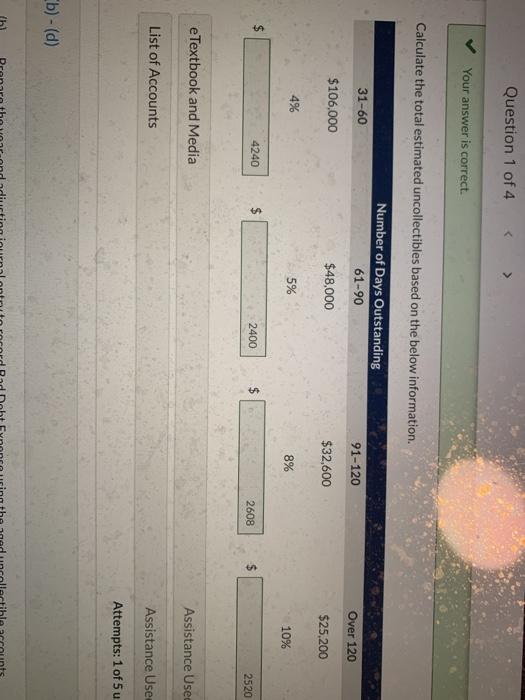

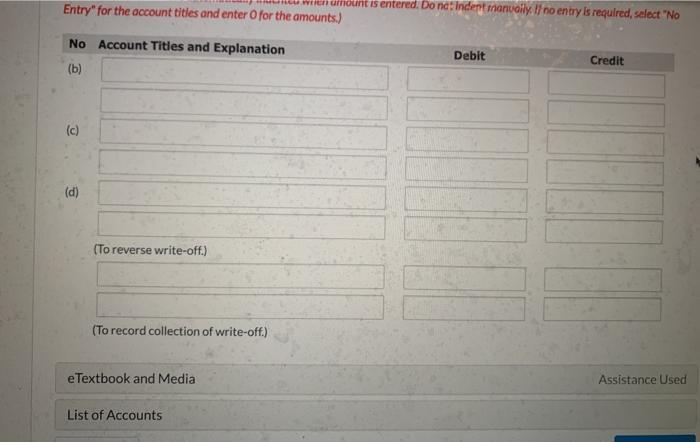

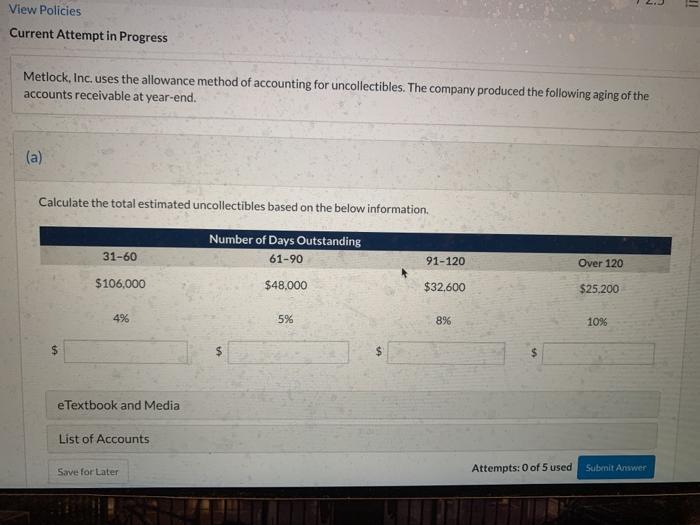

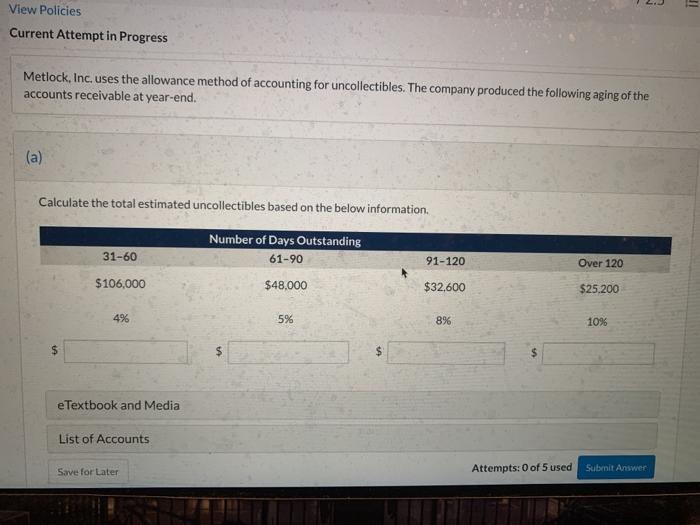

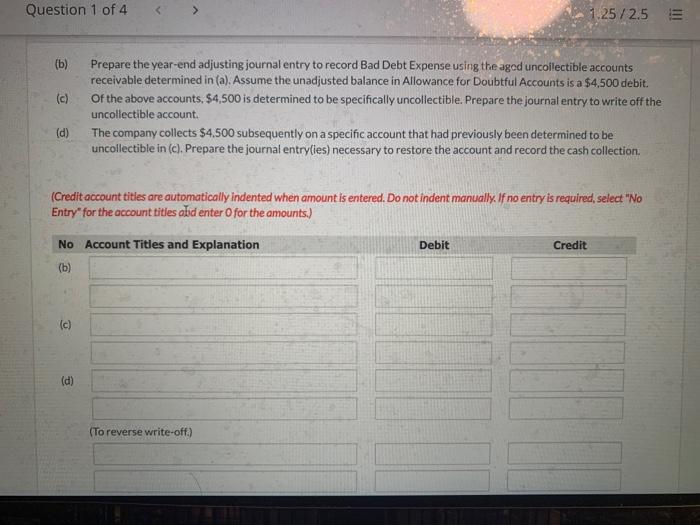

uestion 1 of 4 1.25 / 2.5 Your answer is correct. Calculate the total estimated uncollectibles based on the below information Number of Total 0-30 31-60 $452,300 $240,500 $106,000 Accounts receivable % uncollectible Estimated uncollectibles 1% 4% 14173 $ 2405 $ $ 4240 e Textbook and Media Assistance Used List of Accounts Assistance Used Attempts: 1 of 5 used )-(d) Ihl Danabadditional tartod adnabe Cucing the meduollectible acrointe Question 1 of 4 Your answer is correct. Calculate the total estimated uncollectibles based on the below information Number of Days Outstanding 61-90 31-60 91-120 Over 120 $106.000 $48,000 $32,600 $25,200 4% 5% 8% 10% 4240 2400 $ 2608 2520 e Textbook and Media Assistance Used List of Accounts Assistance Use Attempts: 1 of 5 u -6) (d) IC View Policies Current Attempt in Progress Metlock, Inc. uses the allowance method of accounting for uncollectibles. The company produced the following aging of the accounts receivable at year-end. (a) Calculate the total estimated uncollectibles based on the below information Number of Days Outstanding 61-90 31-60 91-120 Over 120 $106,000 $48.000 $32,600 $25.200 4% 5% 8% 10% $ $ e Textbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer IC View Policies Current Attempt in Progress Metlock, Inc. uses the allowance method of accounting for uncollectibles. The company produced the following aging of the accounts receivable at year-end. (a) Calculate the total estimated uncollectibles based on the below information Number of Days Outstanding 61-90 31-60 91-120 Over 120 $106,000 $48.000 $32,600 $25.200 4% 5% 8% 10% $ $ e Textbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer Question 1 of 4 1.25/2.5 (b) (c) Prepare the year-end adjusting journal entry to record Bad Debt Expense using the aged uncollectible accounts receivable determined in (a). Assume the unadjusted balance in Allowance for Doubtful Accounts is a $4,500 debit. of the above accounts, $4,500 is determined to be specifically uncollectible. Prepare the journal entry to write off the uncollectible account The company collects $4.500 subsequently on a specific account that had previously been determined to be uncollectible in (c). Prepare the journal entrylies) necessary to restore the account and record the cash collection (d) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles ald enter O for the amounts.) Debit Credit No Account Titles and Explanation (b) (c) (d) (To reverse write-off:)