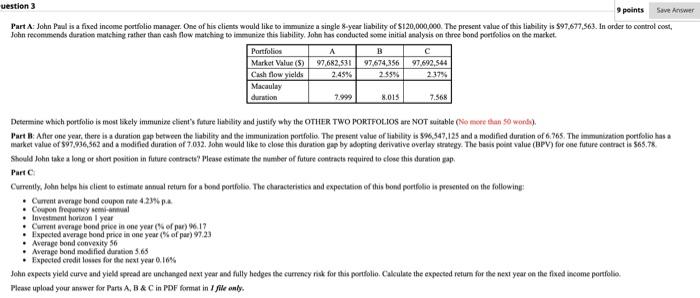

uestion 3 9 points Save Aywer Part A: John Poal is a fixed income portfolio manager. One of his clients would like to immanize a single 8-year liability of S120,000,000. The present value of this liability is $97,677,563. In order to control cost, John recommends duration matching rather than cash flow matching to immunize this liability, John has conducted some initial analysis on three bond portfolios on the market. Portfolios A B Market Value (5) 97,682,531 97.674,356 97.692,544 Cash flow yields 2.45% 2.55% 2.37% Macaulay duration 7.999 8.015 7.568 Determine which portfolio is most likely immunire client's future liability and justify why the OTHER TWO PORTFOLIOS are NOT suitable (No more than 5 words). Part B After one year, there is a duration gap between the liability and the immunication portfolio. The present value of liability is 596,547,125 and a modified duration of 6.765. The immunication portfolio has a market value of $97.936,362 and a modified duration of 7.032. John would like to close this duration gap by adopting derivative overlay trategy. The basis point value (BPV) for one future contract is 565.78 Should John take a long or short position in future contracts? Please estimate the number of future contracts required to close this duration gap Part Currently, John helps bio client to entitate antroul retum for a bond portfolio. The characteristics and expectation of this bond portfolio in prevented on the following: . Current average bond coupon we 4.2% pa Coupon fregney semi- Investment horizon 1 year Current everage bond price in one year of pur) 96.17 Expected average bond price in one year (% of par) 9.23 Average bond convexity 56 Average bond modified duration 365 Expected credit losses for the next year 0.10% John expects yield curve and yield spread are unchanged next year and fully hedges the currency risk for this portfolio Calculate the expected retum for the next year on the fixed income portfolio Please upload your answer for Parts A, B&C in PDF format in 1 file only uestion 3 9 points Save Aywer Part A: John Poal is a fixed income portfolio manager. One of his clients would like to immanize a single 8-year liability of S120,000,000. The present value of this liability is $97,677,563. In order to control cost, John recommends duration matching rather than cash flow matching to immunize this liability, John has conducted some initial analysis on three bond portfolios on the market. Portfolios A B Market Value (5) 97,682,531 97.674,356 97.692,544 Cash flow yields 2.45% 2.55% 2.37% Macaulay duration 7.999 8.015 7.568 Determine which portfolio is most likely immunire client's future liability and justify why the OTHER TWO PORTFOLIOS are NOT suitable (No more than 5 words). Part B After one year, there is a duration gap between the liability and the immunication portfolio. The present value of liability is 596,547,125 and a modified duration of 6.765. The immunication portfolio has a market value of $97.936,362 and a modified duration of 7.032. John would like to close this duration gap by adopting derivative overlay trategy. The basis point value (BPV) for one future contract is 565.78 Should John take a long or short position in future contracts? Please estimate the number of future contracts required to close this duration gap Part Currently, John helps bio client to entitate antroul retum for a bond portfolio. The characteristics and expectation of this bond portfolio in prevented on the following: . Current average bond coupon we 4.2% pa Coupon fregney semi- Investment horizon 1 year Current everage bond price in one year of pur) 96.17 Expected average bond price in one year (% of par) 9.23 Average bond convexity 56 Average bond modified duration 365 Expected credit losses for the next year 0.10% John expects yield curve and yield spread are unchanged next year and fully hedges the currency risk for this portfolio Calculate the expected retum for the next year on the fixed income portfolio Please upload your answer for Parts A, B&C in PDF format in 1 file only