Answered step by step

Verified Expert Solution

Question

1 Approved Answer

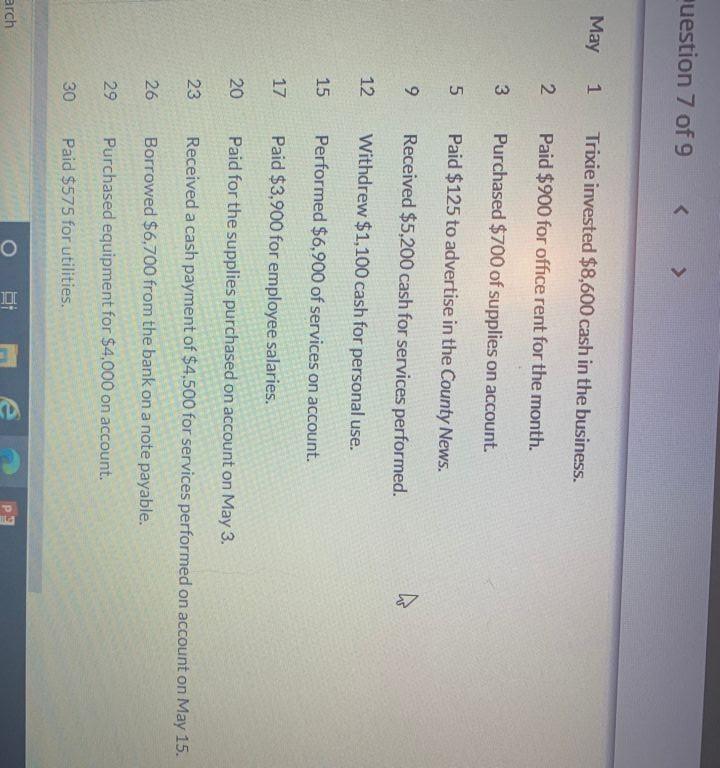

uestion 7 of 9 May 1 Trixie invested $8,600 cash in the business. 2 Paid $900 for office rent for the month. 3 Purchased $700

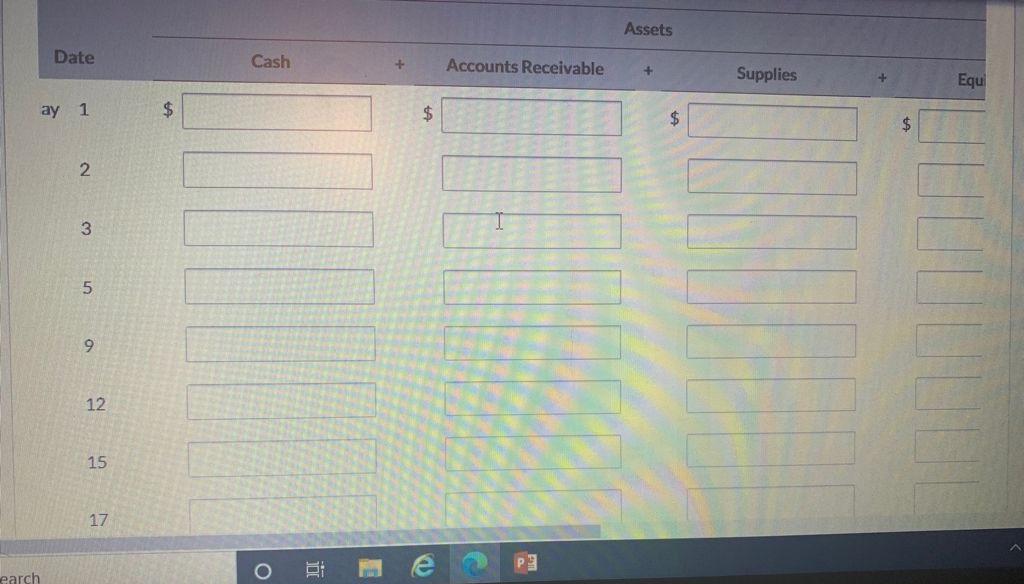

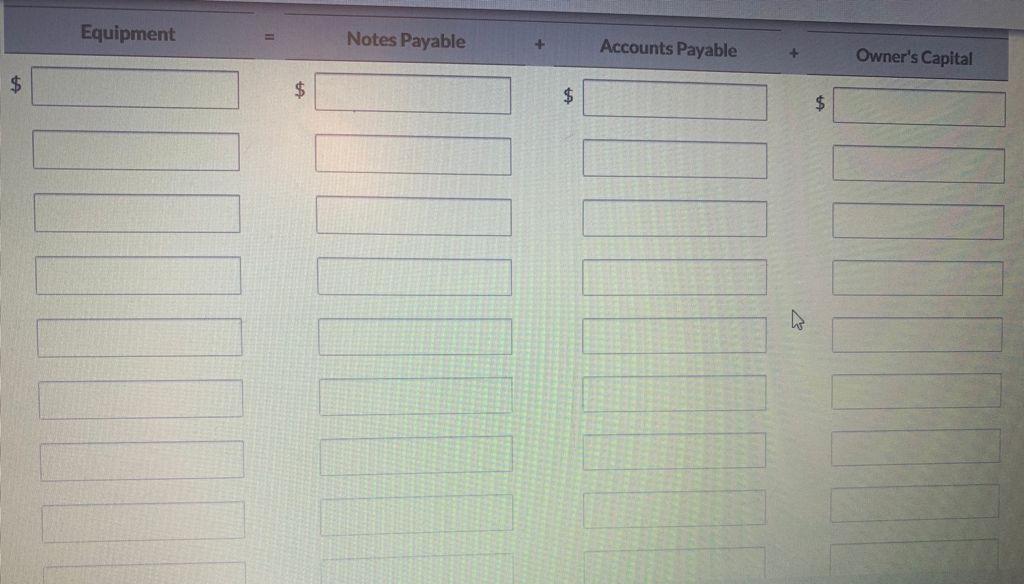

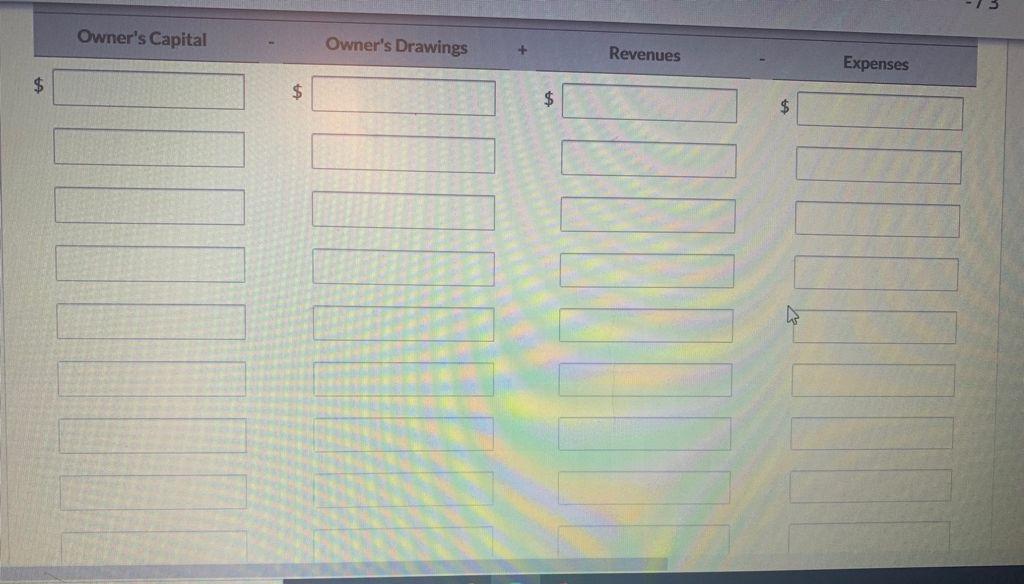

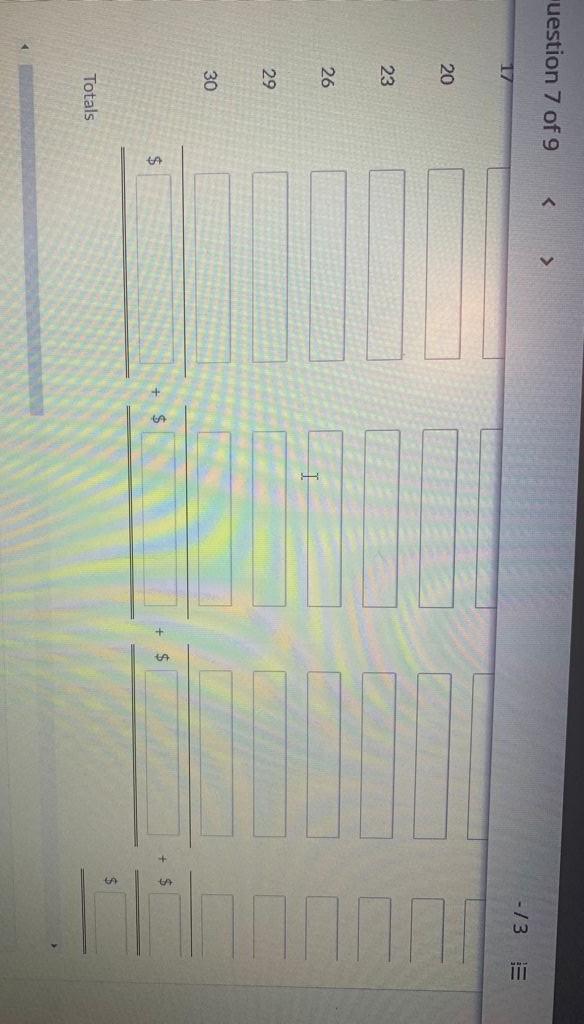

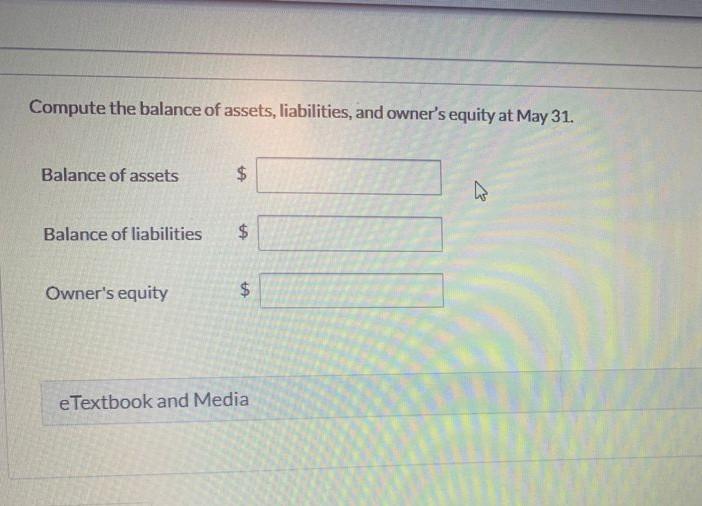

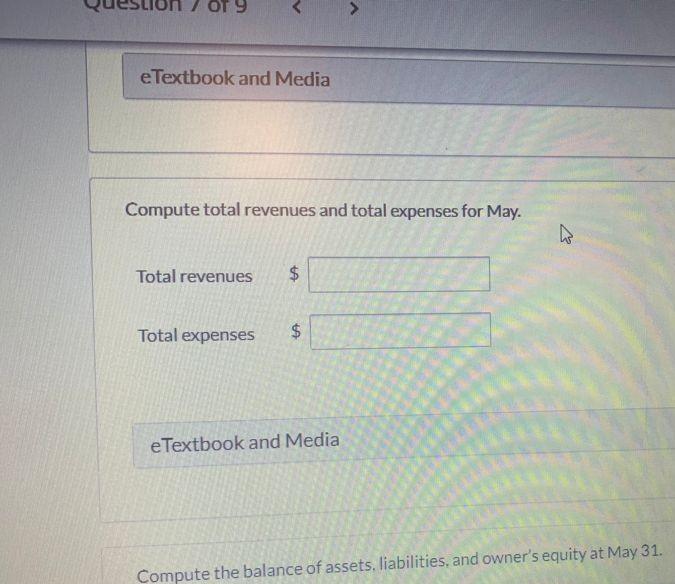

uestion 7 of 9 May 1 Trixie invested $8,600 cash in the business. 2 Paid $900 for office rent for the month. 3 Purchased $700 of supplies on account. 5 Paid $125 to advertise in the County News. 9 Received $5,200 cash for services performed. 12 Withdrew $1,100 cash for personal use. 15 Performed $6,900 of services on account. 17 Paid $3,900 for employee salaries. 20 Paid for the supplies purchased on account on May 3. 23 Received a cash payment of $4.500 for services performed on account on May 15. 26 Borrowed $6,700 from the bank on a note payable. 29 Purchased equipment for $4,000 on account. 30 Paid $575 for utilities. arch Assets Date Cash Accounts Receivable + Supplies Equ ay 1 $ $ $ 2. 3 5 9 12 17 earch Equipment Notes Payable Accounts Payable Owner's Capital $ $ $ $ Owner's Capital Owner's Drawings Revenues Expenses $ $ $ $ uestion 7 of 9 -/3 E 17 20 23 26 I 29 30 $ $ Totals Compute the balance of assets, liabilities, and owner's equity at May 31. Balance of assets $ Balance of liabilities $ Owner's equity ta e Textbook and Media ZOT 9 e Textbook and Media Compute total revenues and total expenses for May. Total revenues $ Total expenses $ e Textbook and Media Compute the balance of assets. liabilities, and owner's equity at May 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started