Answered step by step

Verified Expert Solution

Question

1 Approved Answer

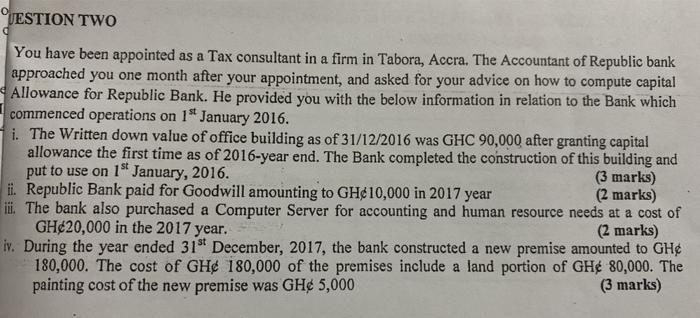

VESTION TWO You have been appointed as a Tax consultant in a firm in Tabora, Accra. The Accountant of Republic bank approached you one

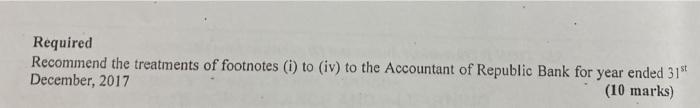

VESTION TWO You have been appointed as a Tax consultant in a firm in Tabora, Accra. The Accountant of Republic bank approached you one month after your appointment, and asked for your advice on how to compute capital Allowance for Republic Bank. He provided you with the below information in relation to the Bank which commenced operations on 1st January 2016. i. The Written down value of office building as of 31/12/2016 was GHC 90,000 after granting capital allowance the first time as of 2016-year end. The Bank completed the construction of this building and put to use on 1st January, 2016. G (3 marks) (2 marks) ii. Republic Bank paid for Goodwill amounting to GH10,000 in 2017 year iii. The bank also purchased a Computer Server for accounting and human resource needs at a cost of GH 20,000 in the 2017 year. marks) iv. During the year ended 31st December, 2017, the bank constructed a new premise amounted to GH 180,000. The cost of GHe 180,000 of the premises include a land portion of GH 80,000. The painting cost of the new premise was GH 5,000 (3 marks) Required Recommend the treatments of footnotes (i) to (iv) to the Accountant of Republic Bank for year ended 31st December, 2017 (10 marks)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer i Capital Allowance for Office Building The Written down value of office building ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started