Answered step by step

Verified Expert Solution

Question

1 Approved Answer

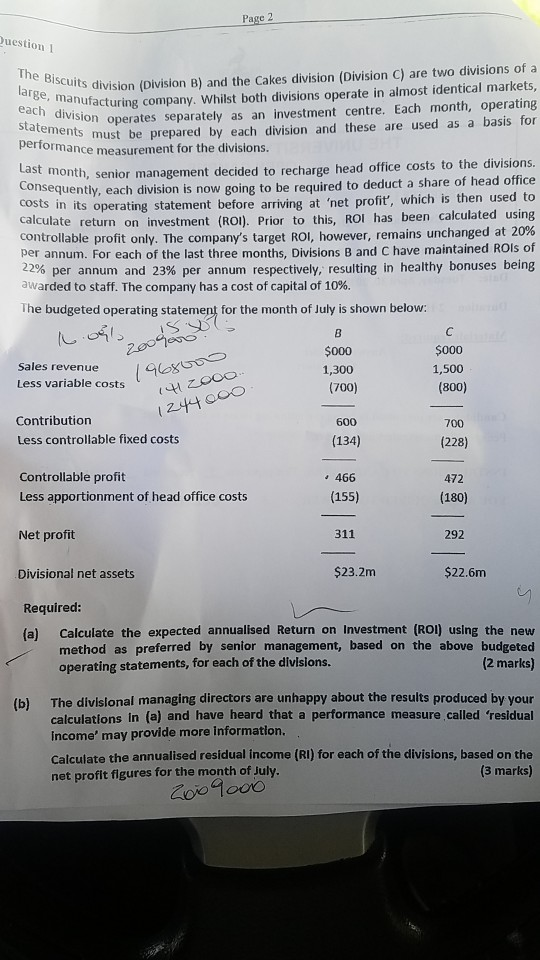

uestion1 edivision (Division B) and the Cakes division (Division C) are two divisions of a anufacturing company. Whilst both divisions operate in almost identical markets,

uestion1 edivision (Division B) and the Cakes division (Division C) are two divisions of a anufacturing company. Whilst both divisions operate in almost identical markets, n operates separately as an investment centre. Each month, operating Th each division statements must be prepare d by each division and these are used as a basis for mance measurement for the divisions. Last month, senior management decided to recharge head office costs to the divisions. Conse iently, each division is now going to be required to deduct a share of head office costs in its operating statement before arriving at 'net profit', which is then used calculate return on investment (ROI). Prior to this, ROI has been calculated using controllable profit only. The company's target ROl, however per annum. For each of the last three months, Divisions B and C have maintained ROIs of 22% per annum and 23% per annum respectively, resulting in healthy bonuses being awarded to staff. The company has a cost of capital of 10%. , remains unchanged at 20% The budgeted operating statement for the month of July is shown below: Sales revenue Less variable costst Contribution Less controllable fixed costs 1,500 (800) 1,300 (700) 1244 600 700 134 (228) 466 (155) Controllable profit 472 Less apportionment of head office costs Net profit Divisional net assets Required: 180 311 292 $22.6m $23.2m 1 Calculate the expected annualised Return on Investment (ROI) using the new method as preferred by senior management, based on the above budgeted (2 marks) (a) operating statements, for each of the divisions. The divislonal managing directors are unhappy about the results produced by your calculations in (a) and have heard that a performance measure called 'residual (b) income' may provide more informatlon. Calculate the annualised residual income (RI) for each of the divisions, based on the (3 marks) net profit flgures for the month of July. uestion1 edivision (Division B) and the Cakes division (Division C) are two divisions of a anufacturing company. Whilst both divisions operate in almost identical markets, n operates separately as an investment centre. Each month, operating Th each division statements must be prepare d by each division and these are used as a basis for mance measurement for the divisions. Last month, senior management decided to recharge head office costs to the divisions. Conse iently, each division is now going to be required to deduct a share of head office costs in its operating statement before arriving at 'net profit', which is then used calculate return on investment (ROI). Prior to this, ROI has been calculated using controllable profit only. The company's target ROl, however per annum. For each of the last three months, Divisions B and C have maintained ROIs of 22% per annum and 23% per annum respectively, resulting in healthy bonuses being awarded to staff. The company has a cost of capital of 10%. , remains unchanged at 20% The budgeted operating statement for the month of July is shown below: Sales revenue Less variable costst Contribution Less controllable fixed costs 1,500 (800) 1,300 (700) 1244 600 700 134 (228) 466 (155) Controllable profit 472 Less apportionment of head office costs Net profit Divisional net assets Required: 180 311 292 $22.6m $23.2m 1 Calculate the expected annualised Return on Investment (ROI) using the new method as preferred by senior management, based on the above budgeted (2 marks) (a) operating statements, for each of the divisions. The divislonal managing directors are unhappy about the results produced by your calculations in (a) and have heard that a performance measure called 'residual (b) income' may provide more informatlon. Calculate the annualised residual income (RI) for each of the divisions, based on the (3 marks) net profit flgures for the month of July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started