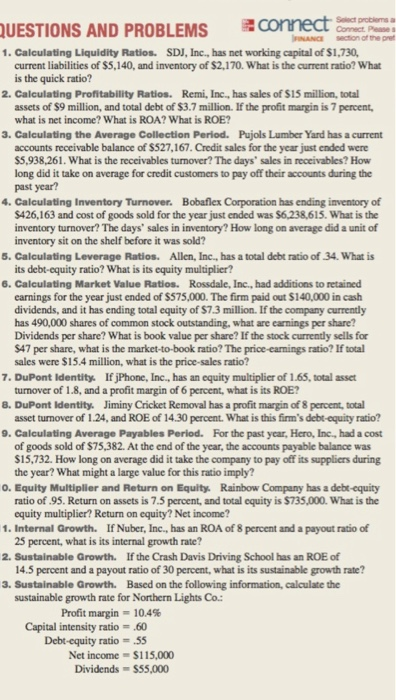

UESTIONS AND PROBLEMS connect 1. Calculating Liquidity Ratios. SDJ, Inc., has net working capital of $1,730, Connect Pease secton of the Det RNANa current liabilities of $5,140, and inventory of $2,170. What is the current ratio? What is the quick ratio? 2. Calculating Profitability Ratios. Remi, Inc, has sales of $15 million, total assets of S9 million, and total debt of $3.7 million. If the profit margin is 7 percent, what is net income? What is ROA? What is ROE? 3. Calculating the Average Collection Period. Pujols Lumber Yard has a current accounts receivable balance of $527,167. Credit sales for the year just ended were $5,938,261. What is the receivables turnover? The days sales in receivables? How long did it take on average for credit customers to pay off their accounts during the past year? 4. Calculating Inventory Turnover. Bobaflex Corporation has ending inventory of $426,163 and cost of goods sold for the year just ended was $6,238,615. What is the inventory turnover? The days' sales in inventory? How long on average did a unit of inventory sit on the shelf before it was sold? 5. Calculating Leverage Ratios. Allen, Inc., has a total debt ratio of .34. What is its debt-equity ratio? What is its equity multiplier? 6. Calculating Market Value Ratios. Rossdale, Inc., had additions to retained earnings for the year just ended of $575,000. The firm paid out $140,000 in cash dividends, and it has ending total equity of $7.3 million. If the company currently has 490,000 shares of common stock outstanding, what are carnings per share? Dividends per share? What is book value per share? If the stock currently sells for $47 per share, what is the market-to-book ratio? The price-earnings ratio? If total sales were $15.4 million, what is the price-sales ratio? 7. DuPont Identity. If jPhone, Inc., has an equity multiplier of 1.65, total asset 8. DuPont Identity. Jiminy Cricket Removal has a profit margin of 8 percent, total .Calculating Average Payables Period. For the past year, Hero, Inc, had a cost turnover of 1.8, and a profit margin of 6 percent, what is its ROE? asset turnover of 1.24, and ROE of 14.30 percent. What is this firm's debt-equity ratio? of goods sold of $75,382. At the end of the year, the accounts payable balance was $15,732. How long on average did it take the company to pay off its suppliers during the year? What might a large value for this ratio imply? o. Equity Multiplier and Return on Equity Rainbow Company has a debt-equity ratio of .95. Return on assets is 7.5 percent, and total equity is $735,000. What is the equity multiplier? Return on equity? Net income? 1. Internal Growth. If Nuber, Inc., has an ROA of 8 percent and a payout ratio of 2. Sustainable Growth. If the Crash Davis Driving School has an ROE of 3. Sustainable Growth. Based on the following information, calculate the 25 percent, what is its internal growth rate? 14.5 percent and a payout ratio of 30 percent, what is its sustainable growth rate? sustainable growth rate for Northern Lights Co. Profit margin = 10.4% Capital intensity ratio-.60 Debt-equity ratio .55 Net income = $115,000 Dividends $55,000