Answered step by step

Verified Expert Solution

Question

1 Approved Answer

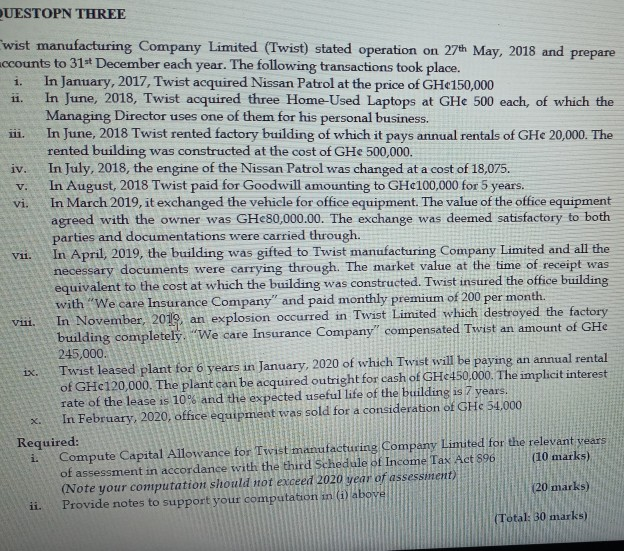

UESTOPN THREE 11. V. vi. Vii. wist manufacturing Company Limited (Twist) stated operation on 27th May, 2018 and accounts to 31st December each year. The

UESTOPN THREE 11. V. vi. Vii. wist manufacturing Company Limited (Twist) stated operation on 27th May, 2018 and accounts to 31st December each year. The following transactions took place. prepare i. In January, 2017, Twist acquired Nissan Patrol at the price of GH150,000 In June, 2018, Twist acquired three Home Used Laptops at GHe 500 each, of which the Managing Director uses one of them for his personal business. In June, 2018 Twist rented factory building of which it pays annual rentals of GHe 20,000. The rented building was constructed at the cost of GHe 500,000. iv. In July, 2018, the engine of the Nissan Patrol was changed at a cost of 18,075. In August, 2018 Twist paid for Goodwill amounting to GHc100,000 for 5 years. In March 2019, it exchanged the vehicle for office equipment. The value of the office equipment agreed with the owner was GHe80,000.00. The exchange was deemed satisfactory to both parties and documentations were carried through. In April, 2019, the building was gifted to Twist manufacturing Company Limited and all the necessary documents were carrying through. The market value at the time of receipt was equivalent to the cost at which the building was constructed. Twist insured the office building with "We care Insurance Company" and paid monthly premium of 200 per month. Viti. In November, 2019, an explosion occurred in Twist Limited which destroyed the factory building completely. "We care Insurance Company" compensated Twist an amount of GHe 245,000. Twist leased plant for 6 years in January, 2020 of which Twist will be paying an annual rental of GHc120,000. The plant can be acquired outright for cash of GH450,000. The implicit interest rate of the lease is 10% and the expected useful life of the building is 7 years. In February, 2020, office equipment was sold for a consideration of GHS 54,000 Required: Compute Capital Allowance for Twist manufacturing Company Limited for the relevant vears (10 marks) of assessment in accordance with the third Schedule of Income Tax Act 896 (Note your computation should not exceed 2020 year of assessment) (20 marks) Provide notes to support your computation in (i) above (Total: 30 marks) 1x X. 1. UESTOPN THREE 11. V. vi. Vii. wist manufacturing Company Limited (Twist) stated operation on 27th May, 2018 and accounts to 31st December each year. The following transactions took place. prepare i. In January, 2017, Twist acquired Nissan Patrol at the price of GH150,000 In June, 2018, Twist acquired three Home Used Laptops at GHe 500 each, of which the Managing Director uses one of them for his personal business. In June, 2018 Twist rented factory building of which it pays annual rentals of GHe 20,000. The rented building was constructed at the cost of GHe 500,000. iv. In July, 2018, the engine of the Nissan Patrol was changed at a cost of 18,075. In August, 2018 Twist paid for Goodwill amounting to GHc100,000 for 5 years. In March 2019, it exchanged the vehicle for office equipment. The value of the office equipment agreed with the owner was GHe80,000.00. The exchange was deemed satisfactory to both parties and documentations were carried through. In April, 2019, the building was gifted to Twist manufacturing Company Limited and all the necessary documents were carrying through. The market value at the time of receipt was equivalent to the cost at which the building was constructed. Twist insured the office building with "We care Insurance Company" and paid monthly premium of 200 per month. Viti. In November, 2019, an explosion occurred in Twist Limited which destroyed the factory building completely. "We care Insurance Company" compensated Twist an amount of GHe 245,000. Twist leased plant for 6 years in January, 2020 of which Twist will be paying an annual rental of GHc120,000. The plant can be acquired outright for cash of GH450,000. The implicit interest rate of the lease is 10% and the expected useful life of the building is 7 years. In February, 2020, office equipment was sold for a consideration of GHS 54,000 Required: Compute Capital Allowance for Twist manufacturing Company Limited for the relevant vears (10 marks) of assessment in accordance with the third Schedule of Income Tax Act 896 (Note your computation should not exceed 2020 year of assessment) (20 marks) Provide notes to support your computation in (i) above (Total: 30 marks) 1x X. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started