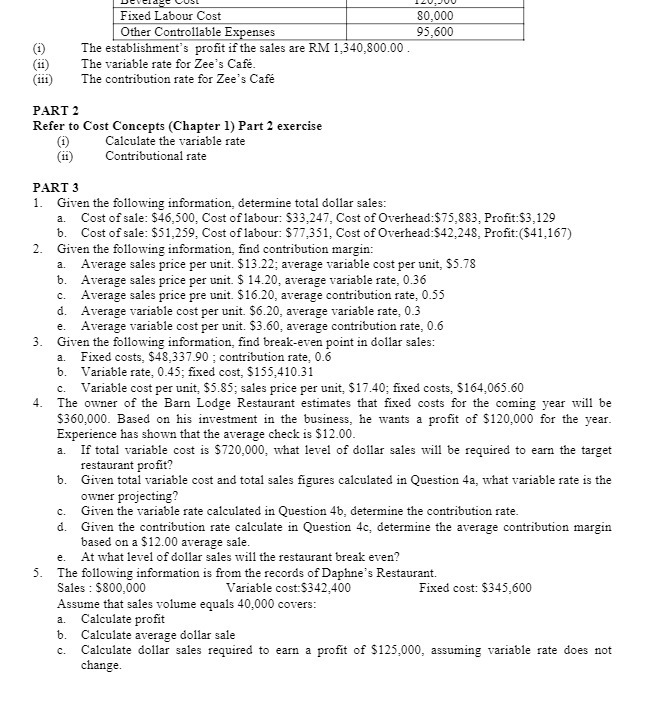

UGI'Ell-'E uual. LLU1JUU .Fised Labour Cost 30,000 Other Controllable 'u enses 95,600 (i) The establishment's prot ii'the sales are m 1,340,300.00 . {ii} The variable rate for Eee's Cafe. {iii} The contribution rate for Eee's Cafe PART 2 Refer to Cost Concepts [Chapter 1] Part 1 elercise {i} Calculate the variable rate {ii} Contributional rate PART 3 1. Given the following information, determine total dollar sales: a. Cost ofsale: $415,500, Cost oflabour: 533,247, Cost of Overhead:$?5,333, Prot:$3,12ilI b. Cost ofsale: $51,259, Cost oflabour: $31,351, Cost ovaerhead-j-'l, Prot:{$41._ 165'} 2. Given the following information, nd contribution margin: a. Average sales price per unit. $13 .32; average variable cost per unit, $533 b. Average sales price per unit. '35 14.20, average variable rate, 0.30 c. Average sales price pre unit. $15.20, average contribution rate, 0.55 d. Average variable cost per unit. $6.20, average variable rate, 0.3 e. Average variable cost per unit. $3.50, average contribution rate, 0.0 3. Given the following information, find breakeven point in dollar sales: a. Fixed costs, $43,333.90 ; contribution rate, 0.6 b. Variable rate, 0.45; xed cost, $155,410.31 c. Variable cost per unit; $5.35; sales price per unit; $1140; xed costs, $154,005.60 4. The owner of the Barn Lodge Restaurant estimates that fused costs for the coming year will be $300,000. Based on his investment in the business, he wants a profit of $120,000 for the year. Experienoe has shown that the average check is $12.00. a. If total variable cost is $330,000, what level of dollar sales will be required to earn the target restaurant prot? b. Given total variable cost and total sales gures calculated in Question 4a, what variable rate is the owner projecting? c. Given the variable rate calculated in IQuestion 4b, determine the contribution rate. d. Given the contribution rate calculate in JQuestion 4c, determine the average contribution margin based on a $12.00 average sale. e. At what level of'dollar sales will the restaurant break even'E' 5. The following information is from the records of Daphne's Restaurant. Sales : $800,000 Variable cost:S3-t-2._400 Fixed cost: $345,600 Assume that sales volume equals 40,000 covers: a. Calculate profit b. Calculate average dollar sale c. Calculate dollar sales required to earn a profit of $125,000, assuming variable rate does not change