Question

UGO has the following summary transactions for its fiscal year ended December 31, 2021. Using the information provided below, enter the correct amounts for the

UGO has the following summary transactions for its fiscal year ended December 31, 2021. Using the information provided below, enter the correct amounts for the correct accounts in the Excel template. Because these are summary transactions (i.e., each transaction reflects the annual effect of a particular type of activity), all effective dates are presumed to be December 31, 2021. Although this simplification does not allow you to see all of the detail associated with the timing of individual transactions throughout the year, the resulting end-of-the-year trial balance and financial statements will be complete.

In the Excel Template boxes are sometimes though not always highlighted to indicate that a value needs to be entered in that box. For Transactions 1 through 4 all boxes that need to be filled in have a pale yellow highlight. Starting with Transaction 5 boxes are only sometimes highlighted as a prompt on more challenging transactions.

Important Note: Restriction codes need to be entered for all Revenues and Program codes need to be entered for all expenses.

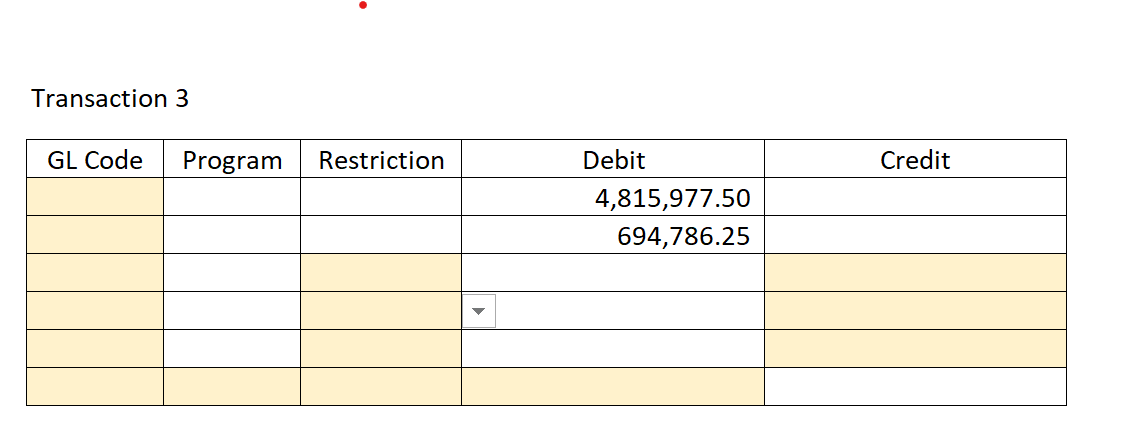

Transaction 3:

UGO receives various cash contributions, pledges, and in-kind contributions. The following table presents these contributions:

| Contribution Type: | Without donor restrictions | With donor restrictions |

| Cash | $4,165,977.50 | $650,000.00 |

| Pledges receivable | 0.00 | 694,786.25 |

| In-kind contributions | 122,641.25 | 0.00 |

| Total | $4,983,405.00 | $1,344.786.25 |

The in-kind contributions represent donations of services by licensed professionals. These services would have otherwise been purchased and should therefore result in an expense for professional services related to Management and General activities of the organization.

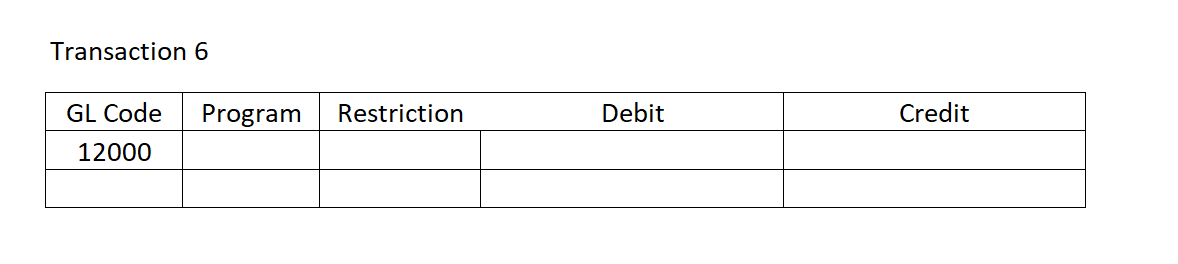

Transaction 6:

UGO has an unrealized gain of $866,673.75 on its main operating investment account, not the one associated with an endowment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started