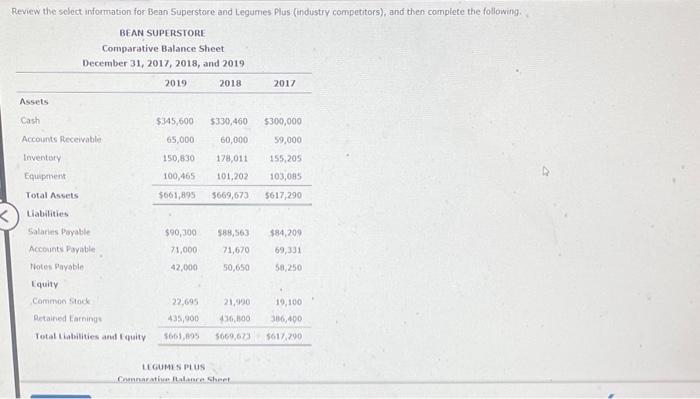

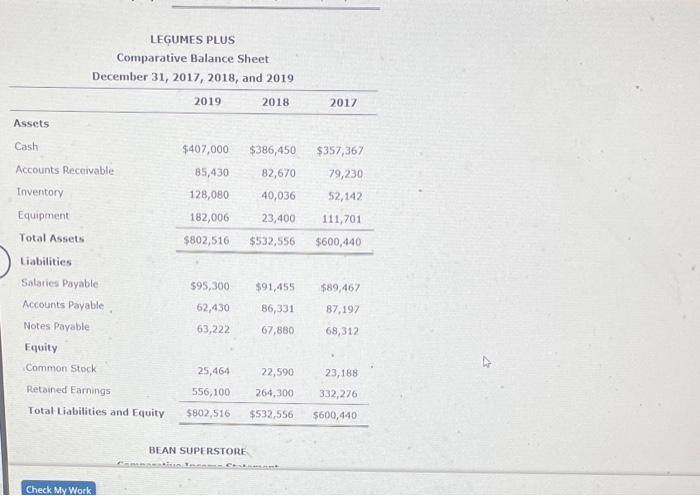

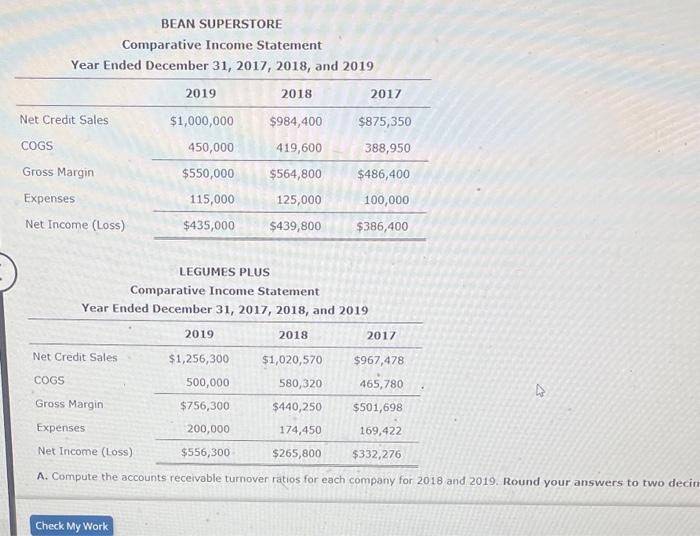

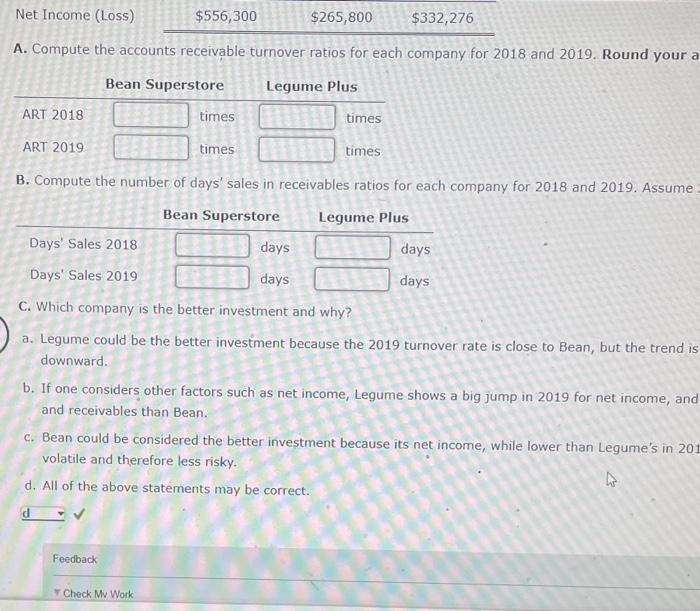

UGUmIN MuS Ceannaratiug Nalare Sheet LEGUMES PLUS Comnarative Ralanro Chot BEAN SUPERSTORE BEAN SUPERSTORE Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 LEGUMES PLUS Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019 . Round your answers to two decin A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019 . Round your a B. Compute the number of days' sales in receivables ratios for each company for 2018 and 2019. Assume C. Which company is the better investment and why? a. Legume could be the better investment because the 2019 turnover rate is close to Bean, but the trend is downward. b. If one considers other factors such as net income, Legume shows a big jump in 2019 for net income, and and receivables than Bean. c. Bean could be considered the better investment because its net income, while lower than Legume's in 201 volatile and therefore less risky. d. All of the above statements may be correct. UGUmIN MuS Ceannaratiug Nalare Sheet LEGUMES PLUS Comnarative Ralanro Chot BEAN SUPERSTORE BEAN SUPERSTORE Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 LEGUMES PLUS Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019 . Round your answers to two decin A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019 . Round your a B. Compute the number of days' sales in receivables ratios for each company for 2018 and 2019. Assume C. Which company is the better investment and why? a. Legume could be the better investment because the 2019 turnover rate is close to Bean, but the trend is downward. b. If one considers other factors such as net income, Legume shows a big jump in 2019 for net income, and and receivables than Bean. c. Bean could be considered the better investment because its net income, while lower than Legume's in 201 volatile and therefore less risky. d. All of the above statements may be correct