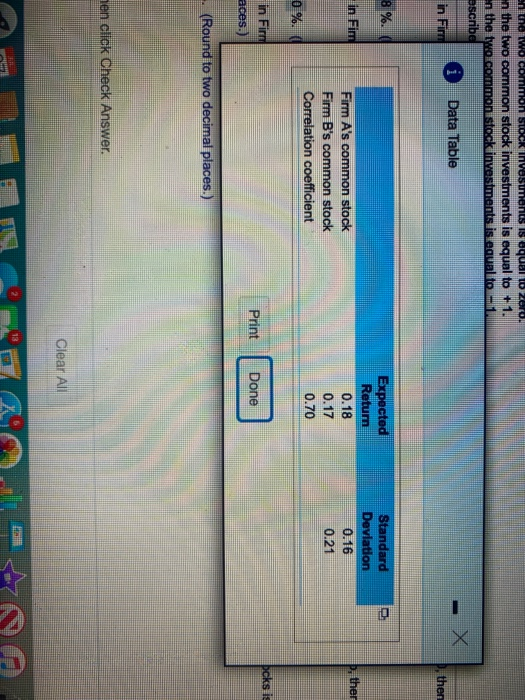

UI PL 2 completa HW Score: 66.67%, 5.33 of 8 pts P8-3 (similar to) Question Help (Computing the standard deviation for a portfolio of two risky Investments Mary Gulott rently graduated from Nichols State University and is ardous to begin investing her meager savings as a way of applying what she has leamed in business school. Specifically, she is evaluating an investment in a portfolio comprised of two ma common lock. She has collected the following information about the common stock of Firm A and Firm B: alf Mary invests hall her money in each of the two common stocks, what is the portfollo's expected rate of return and standard deviation in portfolio retur? b. Answer part a where the correlation between the two common stock investments is equal to zero. C. Answer part a where the correlation between the two common stock investments is equal to +1. d. Answer part a where the correlation between the two common stock investments is equal to - 1 o. Using your responses to questions, describe the relationship between the correlation and the risk and return of the portfolio a. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's common stock and the correlation between the two locks is 0.70, then the expected rate of retum in the portfolio is 17.5%. (Round to two decimal places) The standard deviation in the portfolio is 1705% (Round to two decimal places.) b. f Mary decides to invest 50% of her money in Fim A's common stock and 50% in Fim B's common stock and the correlation between the two slocks is zero, then the expected rate of retum in the portation 17.5% (Round to two decimal places) The standard deviation in the portfolio is 13 20 %. (Round to two decimal places.) c. 1 Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm's common stock and the correlation coeficient between the two stocks is +1, then the expected rate of retum in the portfolio is 17.5% (Round to two decimal places) The standard deviation in the portfolio is 0% (Round to two decimal places.) en me two common Stock Invesundnes is oqulo Zoro n the two common stock investments is equal to +1. in the two common stock investments is equalto escribe Data Table in Firm - X then e in Fim Expected Retum 0.18 0.17 0.70 Standard Deviation 0.16 0.21 Firm A's common stock Firm B's common stock Correlation coefficient B.ther 0 % bcks ig in Firm aces.) Print Done (Round to two decimal places.) hen click Check Answer. Clear All