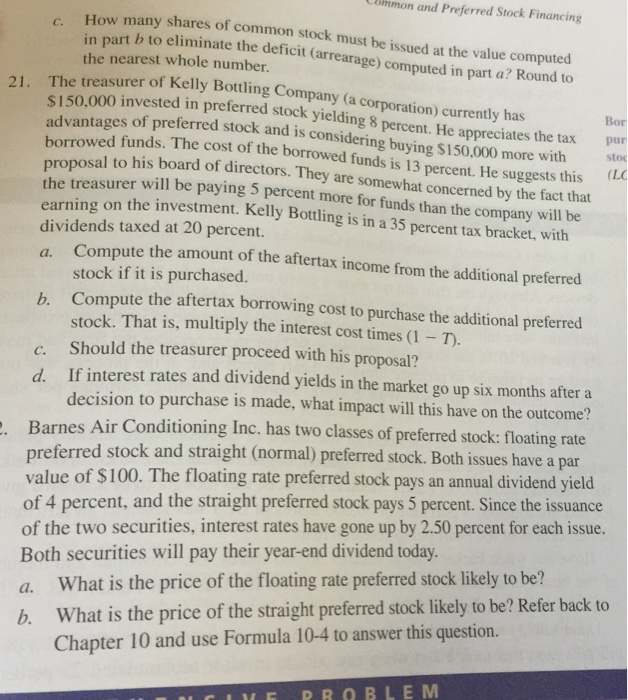

Uimmon and Preferred Stock Financimg How many shares of common stock must be issued at the value computed n part b to eliminate the deficit (arrearage) computed in part a? Round to C. the nearest whole number The treasurer of Kelly Bottling Company (a corporation) currently has 5150,000 invested in preferred stock yielding 8 percent. He appreciates the tax wed funds. The cost of the borrowed funds is 13 percent. He suggests this Bor advantages of stoc (LC rro prop the trea earning dividends taxed at 20 percent. a. Comp osal to his board of directors. They are somewhat concerned by the fact that surer will be paying 5 percent more for funds than the company will be on the investment. Kelly Bottling is in a 35 percent tax bracket, with ute the amount of the aftertax income from the additional preferred stock if it is purchased. b. Compute the aftertax borrowing cost to purchase the additional preferred stock. That is, multiply the interest cost times (1 -T) c. Should the treasurer proceed with his proposal? d. If interest rates and dividend yields in the market go up six months after a decision to purchase is made, what impact will this have on the outcome? Barnes Air Conditioning Inc. has two classes of preferred stock: floating rate referred stock and straight (normal) preferred stock. Both issues have a par value of $100. The floating rate preferred stock pays an annual dividend yield of 4 percent, and the straight preferred stock pays 5 percent. Since the issuance of the two securities, interest rates have gone up by 2.50 percent for each issue. Both securities will pay their year-end dividend today. a. What is the price of the floating rate preferred stock likely to be? b. What is the price of the straight preferred stock likely to be? Refer back to Chapter 10 and use Formula 10-4 to answer this question PROBLEM Uimmon and Preferred Stock Financimg How many shares of common stock must be issued at the value computed n part b to eliminate the deficit (arrearage) computed in part a? Round to C. the nearest whole number The treasurer of Kelly Bottling Company (a corporation) currently has 5150,000 invested in preferred stock yielding 8 percent. He appreciates the tax wed funds. The cost of the borrowed funds is 13 percent. He suggests this Bor advantages of stoc (LC rro prop the trea earning dividends taxed at 20 percent. a. Comp osal to his board of directors. They are somewhat concerned by the fact that surer will be paying 5 percent more for funds than the company will be on the investment. Kelly Bottling is in a 35 percent tax bracket, with ute the amount of the aftertax income from the additional preferred stock if it is purchased. b. Compute the aftertax borrowing cost to purchase the additional preferred stock. That is, multiply the interest cost times (1 -T) c. Should the treasurer proceed with his proposal? d. If interest rates and dividend yields in the market go up six months after a decision to purchase is made, what impact will this have on the outcome? Barnes Air Conditioning Inc. has two classes of preferred stock: floating rate referred stock and straight (normal) preferred stock. Both issues have a par value of $100. The floating rate preferred stock pays an annual dividend yield of 4 percent, and the straight preferred stock pays 5 percent. Since the issuance of the two securities, interest rates have gone up by 2.50 percent for each issue. Both securities will pay their year-end dividend today. a. What is the price of the floating rate preferred stock likely to be? b. What is the price of the straight preferred stock likely to be? Refer back to Chapter 10 and use Formula 10-4 to answer this