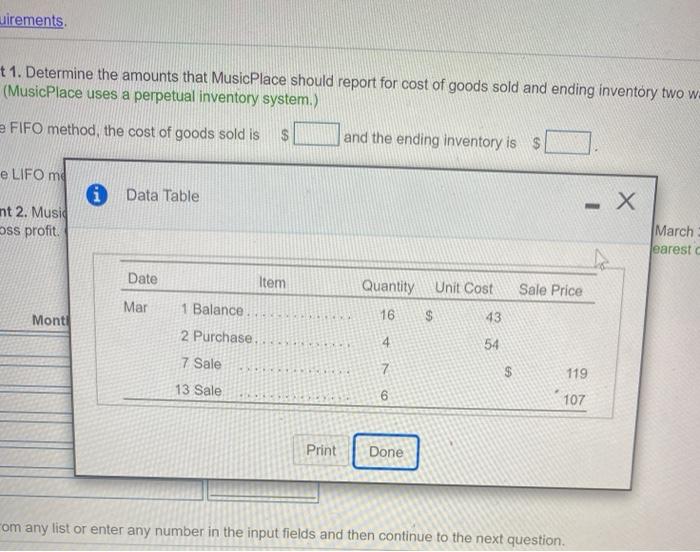

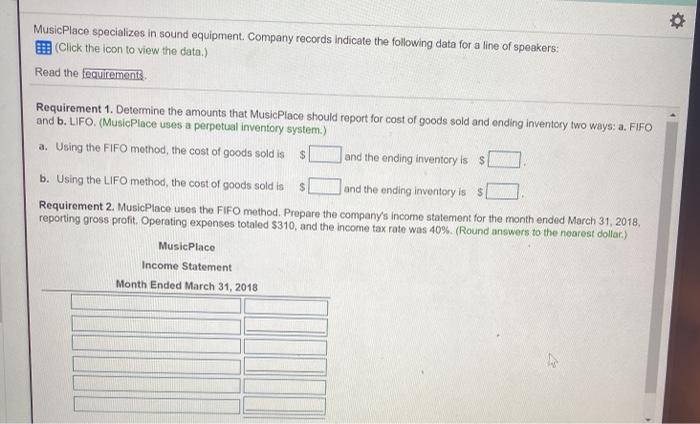

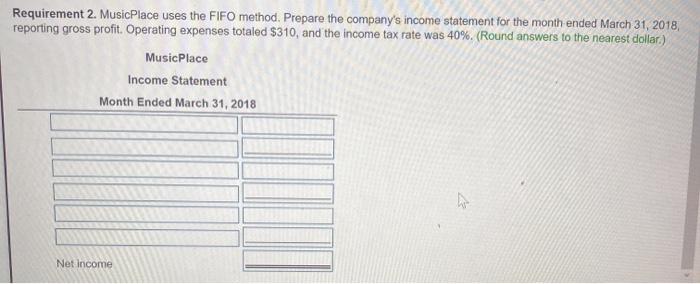

uirements t 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two w (MusicPlace uses a perpetual inventory system.) FIFO method, the cost of goods sold is $ and the ending inventory is $ e LIFO mo i Data Table - nt 2. Musid oss profit March learest Date Item Quantity Unit Cost Sale Price Mar Monti 16 $ 1 Balance 2 Purchase 43 54 7 Sale 7 119 13 Sale 6 107 Print Done com any list or enter any number in the input fields and then continue to the next question equirements. ent 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two 0. (MusicPlace uses a perpetual inventory system.) the FIFO method, the cost of goods sold is $ and the ending inventory is $ the LIFO ma Requirements - X - ment 2. Music gross profit. Mar Leare 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two ways: (MusicPlace uses a perpetual inventory system.) a. FIFO b. LIFO Monti 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2018, reporting gross profit. Operating expenses totaled $310, and the income tax rate was 40%. Print Done o MusicPlace specializes in sound equipment Company records indicate the following data for a line of speakers: (Click the icon to view the data.) Read the fequirements Requirement 1. Determine the amounts that MusicPlace should report for cost of goods sold and ending inventory two ways: a. FIFO and b.LIFO. (MusicPlace uses a perpetual inventory system.) a. Using the FIFO method, the cost of goods sold is s and the ending inventory is S b. Using the LIFO method, the cost of goods sold is and the ending inventory is Requirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2018, reporting gross profit. Operating expenses totaled $310, and the income tax rate was 40% (Round answers to the nearest dollar) Music Place Income Statement Month Ended March 31, 2018 Requirement 2. MusicPlace uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2018, reporting gross profit. Operating expenses totaled $310, and the income tax rate was 40%. (Round answers to the nearest dollar) Music Place Income Statement Month Ended March 31, 2018 Net Income