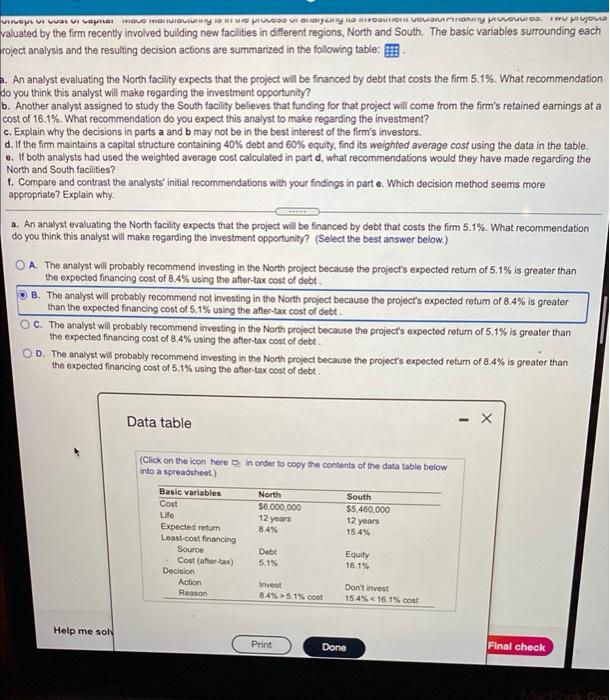

UITUGUE UOLUILAR OVO MOVIUNTY PRODUTO OU VOUOMIPOHY POUCO. W piyou valuated by the firm recently involved building new facilities in different regions, North and South. The basic variables surrounding each roject analysis and the resulting decision actions are summarized in the following table: An analyst evaluating the North facility expects that the project will be financed by debt that costs the firm 5.1%. What recommendation do you think this analyst will make regarding the investment opportunity? b. Another analyst assigned to study the South facility believes that funding for that project will come from the firm's retained earnings at a cost of 16.1%. What recommendation do you expect this analyst to make regarding the investment? c. Explain why the decisions in parts a and b may not be in the best interest of the firm's investors. d. If the fim maintains a capital structure containing 40% debt and 60% equity, find its weighted average cost using the data in the table. e. If both analysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? 1. Compare and contrast the analysts' initial recommendations with your findings in parte. Which decision method seems more appropriate? Explain why a. An analyst evaluating the North facility expects that the project will be financed by debt that costs the firm 5.1%. What recommendation do you think this analyst will make regarding the investment opportunity? (Select the best answer below.) OA. The analyst will probably recommend investing in the North project because the project's expected return of 5.1% is greater than the expected financing cost of 8.4% using the after-tax cost of debt . B. The analyst will probably recommend not investing in the North project because the project's expected retum of 8.4% is greater than the expected financing cost of 5.1% using the after-tax cost of debt OC. The analyst will probably recommend investing in the North project because the project's expected return of 5.1% is greater than the expected financing cost of 8.4% using the after-tax cost of debt OD. The analyst will probably recommend investing in the North project because the project's expected return of 8.4% is greater than the expected financing cost of 5.1% using the after-tax cost of debt Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Basic variables North South Cost $6.000.000 $5,460,000 Life 12 years 12 years Expected retum 8.4% 154% Least-cost financing Source Debt Equity Coster-tax 5.1% 16.1% Decision Action Invest Don't invest Reason 8.4%> 5.1% cost 15.4%