Answered step by step

Verified Expert Solution

Question

1 Approved Answer

UK Tax Dingo died on 15 September 2019 leaving the following assets at its market value on the date of death: Main Residence worth 250,000

UK Tax

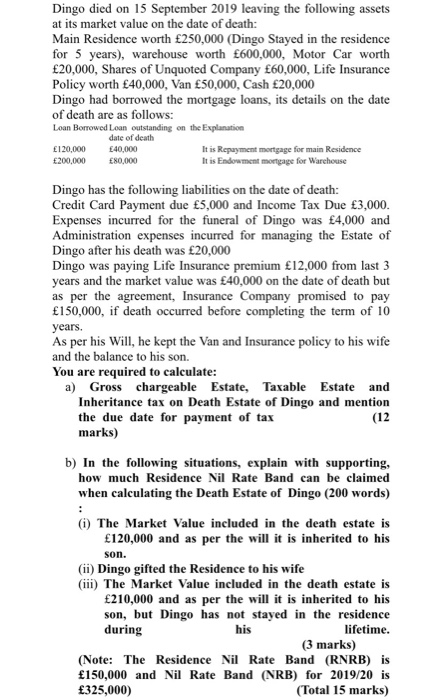

Dingo died on 15 September 2019 leaving the following assets at its market value on the date of death: Main Residence worth 250,000 (Dingo Stayed in the residence for 5 years), warehouse worth 600,000, Motor Car worth 20,000, Shares of Unquoted Company 60,000, Life Insurance Policy worth 40,000, Van 50,000, Cash 20,000 Dingo had borrowed the mortgage loans, its details on the date of death are as follows: Loan Borrowed Loan outstanding on the Explanation date of death 120,000 40,000 It is Repayment mortgage for main Residence 200,000 80,000 It is Endowment mortgage for Warehouse Dingo has the following liabilities on the date of death: Credit Card Payment due 5,000 and Income Tax Due 3,000. Expenses incurred for the funeral of Dingo was 4,000 and Administration expenses incurred for managing the Estate of Dingo after his death was 20,000 Dingo was paying Life Insurance premium 12,000 from last 3 years and the market value was 40,000 on the date of death but as per the agreement, Insurance Company promised to pay 150,000, if death occurred before completing the term of 10 years. As per his Will, he kept the Van and Insurance policy to his wife and the balance to his son. You are required to calculate: a) Gross chargeable Estate, Taxable Estate and Inheritance tax on Death Estate of Dingo and mention the due date for payment of tax (12 marks) b) In the following situations, explain with supporting, how much Residence Nil Rate Band can be claimed when calculating the Death Estate of Dingo (200 words) (1) The Market Value included in the death estate is 120,000 and as per the will it is inherited to his son. (ii) Dingo gifted the Residence to his wife (iii) The Market Value included in the death estate is 210,000 and as per the will it is inherited to his son, but Dingo has not stayed in the residence during his lifetime. (3 marks) (Note: The Residence Nil Rate Band (RNRB) is 150,000 and Nil Rate Band (NRB) for 2019/20 is 325,000) (Total 15 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started