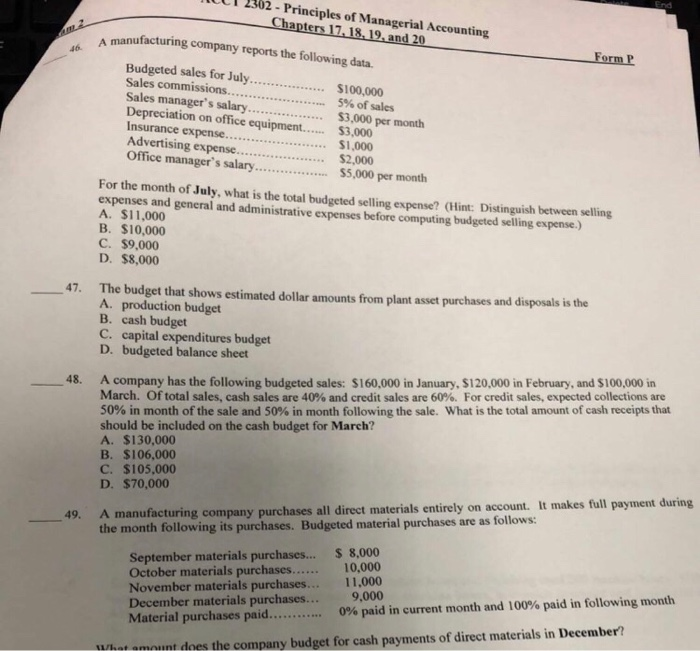

ULI 2302 - Principles of Managerial Accounting Chapters 17, 18, 19, and 20 16. A manuf Form P manufacturing company reports the following data. Budgeted sales for July $100,000 Sales commissions 5% of sales Sales manager's salary. $3,000 per month Depreciation on office equipment..... 53,00 Insurance expense. Advertising expense. Office manager's salary, $5,000 per month $1,000 $2,000 For the month of July, what is the total budgeted selling expense? (Hint: Distinguish between selling expenses and general and administrative expenses before computing budgeted selling expense.) A. $11,000 B. $10,000 C. $9,000 D. $8,000 The budget that shows estimated dollar amounts from plant asset purchases and disposals is the A. production budget B. cash budget C. capital expenditures budget D. budgeted balance sheet 48. A company has the following budgeted sales: $160,000 in January, $120,000 in February, and $100,000 in March. Of total sales, cash sales are 40% and credit sales are 60%. For credit sales, expected collections are 50% in month of the sale and 50% in month following the sale. What is the total amount of cash receipts that should be included on the cash budget for March? A. $130,000 B. $106,000 C. $105.000 D. $70,000 49. A manufacturing company purchases all direct materials entirely on account. It makes full payment during the month following its purchases. Budgeted material purchases are as follows: September materials purchases... October materials purchases...... November materials purchases... December materials purchases... Material purchases paid............ $ 8,000 10,000 11,000 9,000 0% paid in current month and 100% paid in following month What amount does the company budget for cash payments of direct materials in December? ULI 2302 - Principles of Managerial Accounting Chapters 17, 18, 19, and 20 16. A manuf Form P manufacturing company reports the following data. Budgeted sales for July $100,000 Sales commissions 5% of sales Sales manager's salary. $3,000 per month Depreciation on office equipment..... 53,00 Insurance expense. Advertising expense. Office manager's salary, $5,000 per month $1,000 $2,000 For the month of July, what is the total budgeted selling expense? (Hint: Distinguish between selling expenses and general and administrative expenses before computing budgeted selling expense.) A. $11,000 B. $10,000 C. $9,000 D. $8,000 The budget that shows estimated dollar amounts from plant asset purchases and disposals is the A. production budget B. cash budget C. capital expenditures budget D. budgeted balance sheet 48. A company has the following budgeted sales: $160,000 in January, $120,000 in February, and $100,000 in March. Of total sales, cash sales are 40% and credit sales are 60%. For credit sales, expected collections are 50% in month of the sale and 50% in month following the sale. What is the total amount of cash receipts that should be included on the cash budget for March? A. $130,000 B. $106,000 C. $105.000 D. $70,000 49. A manufacturing company purchases all direct materials entirely on account. It makes full payment during the month following its purchases. Budgeted material purchases are as follows: September materials purchases... October materials purchases...... November materials purchases... December materials purchases... Material purchases paid............ $ 8,000 10,000 11,000 9,000 0% paid in current month and 100% paid in following month What amount does the company budget for cash payments of direct materials in December