Question

Uli Company has made an analysis of its sales and accounts receivable for the past 5 years. Assume all accounts written off in a year

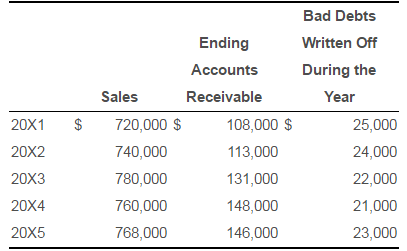

Uli Company has made an analysis of its sales and accounts receivable for the past 5 years. Assume all accounts written off in a year related to sales of the preceding year and were part of the accounts receivable at the end of that year. That? is, no account is written off before the end of the year of the? sale, and all accounts remaining unpaid are written off before the end of the year following the sale. The analysis showed the? following:

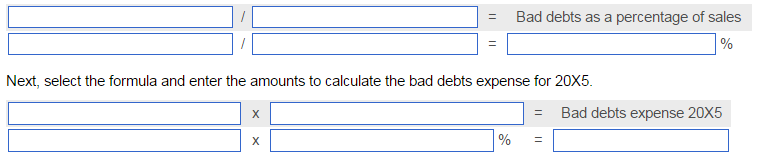

Requirement 1. Determine the bad debts expense for 20X5 and the balance of the Allowance for Uncollectible Accounts for December? 31, 20X5, using the percentage of sales method. ?(A/R = Accounts? Receivable.)

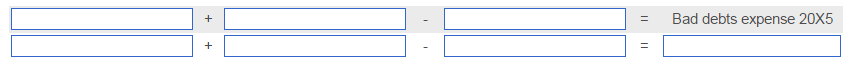

Begin with the bad debts expense for 20X5 and start by determining the formula and entering the amounts to calculate the bad debts expense as a percentage of sales.

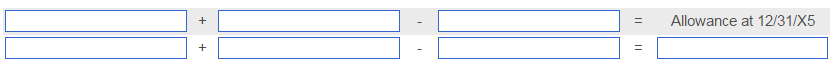

Now determine the balance of the Allowance for Uncollectible Accounts for December? 31, 20X5 using the percentage of sales method.

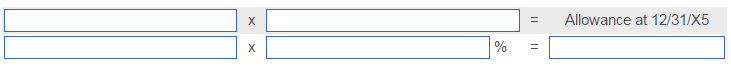

Select the formula and then enter the amounts to calculate the allowance at December? 31, 20X5.

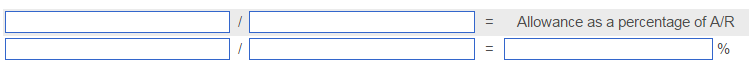

Requirement 2. Repeat requirement 1 using the percentage of ending accounts receivable method. ?(A/R = Accounts? Receivable.)

Start by determine the formula and entering the amounts to calculate the allowance as a percentage of ending accounts receivable using the percentage of ending accounts receivable method.

Next, select the formula and enter the amounts to calculate the balance of the Allowance for Uncollectible accounts at the end of 20X5 using the percentage of ending accounts receivable method.

?Finally, select the formula and then enter the amounts to calculate the bad debts expense for 20X5 under the percentage of ending accounts receivable method.

(* I would really appreciate it if you could follow that exact format)

Sales 20X1 720,000 20X2 740,000 20X3 780,000 20X4 760,000 768,000 20X5 Bad Debts Ending Written Off Accounts During the Receivable Year 25,000 108,000 24,000 113,000 22,000 131,000 21,000 148,000 146,000 23,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started