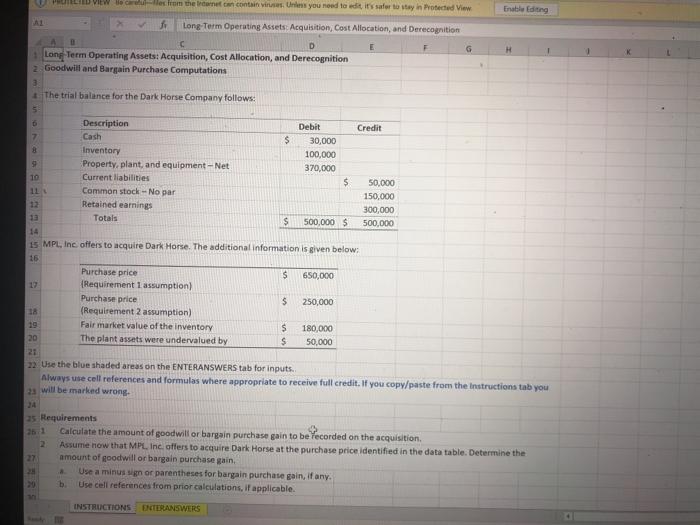

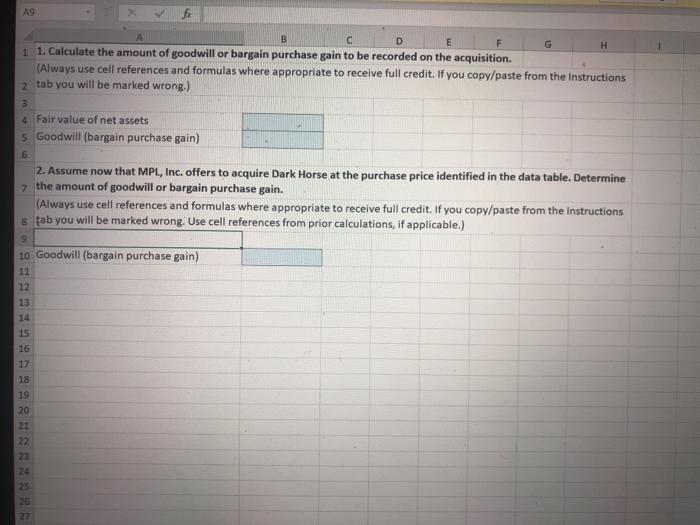

ULID VIEW Becaule from the cornet contain vies: Unins you need to edit it safe to stay in Protected View Enable Editing Long-Term Operating Assets Acquisition, Cost Allocation, and Derecognition D 1 Long Term Operating Assets: Acquisition, Cost Allocation, and Derecognition 2. Goodwill and Bargain Purchase Computations 3 The trial balance for the Dark Horse Company follows: 5 D Description Debit Credit 7. Cash $ 30.000 8 Inventory 100,000 3 Property, plant, and equipment - Net 370,000 TO Current liabilities $ 50.000 11 Common stock - No par 150,000 12 Retained earnings 300,000 Totals $ 500,000 $ 500,000 14 15 MPL Inc offers to acquire Dark Horse. The additional information is given below: 16 Purchase price $ 650,000 (Requirement 1 assumption) Purchase price $ 250,000 18 (Requirement 2 assumption) Fair market value of the inventory $ 180,000 The plant assets were undervalued by S 50,000 0 22 Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you 2 will be marked wrong. 25 Requirements Calculate the amount of goodwill or bargain purchase gain to be Yecorded on the acquisition Assume now that MPL Inc offers to acquire Dark Horse at the purchase price identified in the data table. Determine the amount of goodwill or bargain purchase gain, Use a minus sign or parentheses for bargain purchase gain, if any. b Use cell references from prior calculations, if applicable. INSTRUCTIONS EXTERLANSWERS A9 B H D F G 1 1. Calculate the amount of goodwill or bargain purchase gain to be recorded on the acquisition. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions 2 tab you will be marked wrong.) 3 4 Fair value of net assets 5 Goodwill (bargain purchase gain) 6 2. Assume now that MPL, Inc. offers to acquire Dark Horse at the purchase price identified in the data table. Determine 7 the amount of goodwill or bargain purchase gain. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions 8 tab you will be marked wrong. Use cell references from prior calculations, if applicable.) 10 Goodwill (bargain purchase gain) 12 13 14 15 16 17 18 19 20 21 22 22 24 25 26 27