Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ullie's Sporting Goods is a retailer of sporting equipment. Last year, Ullie's sales revenues totalled 56,600,000 Total expenses were $2,300,000. Of this amount, approximately 51,320,000

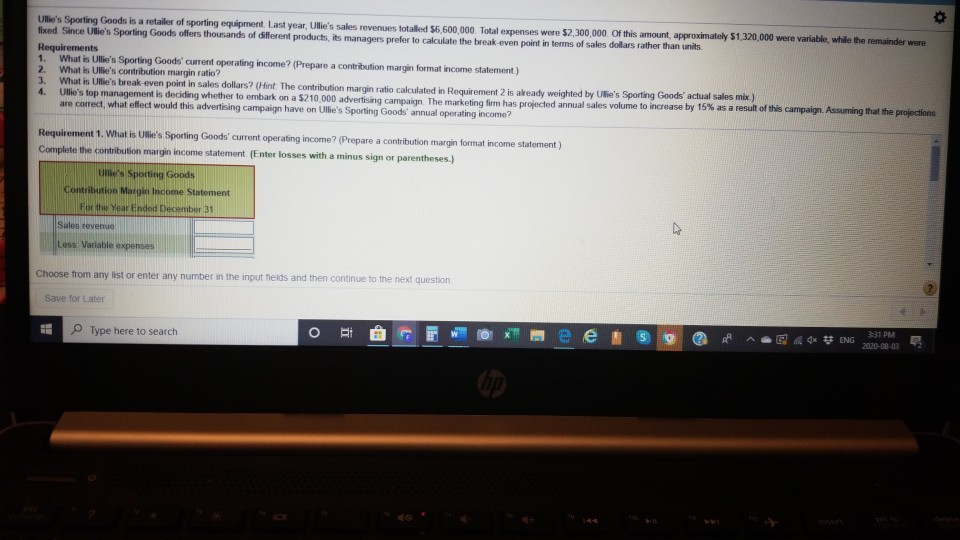

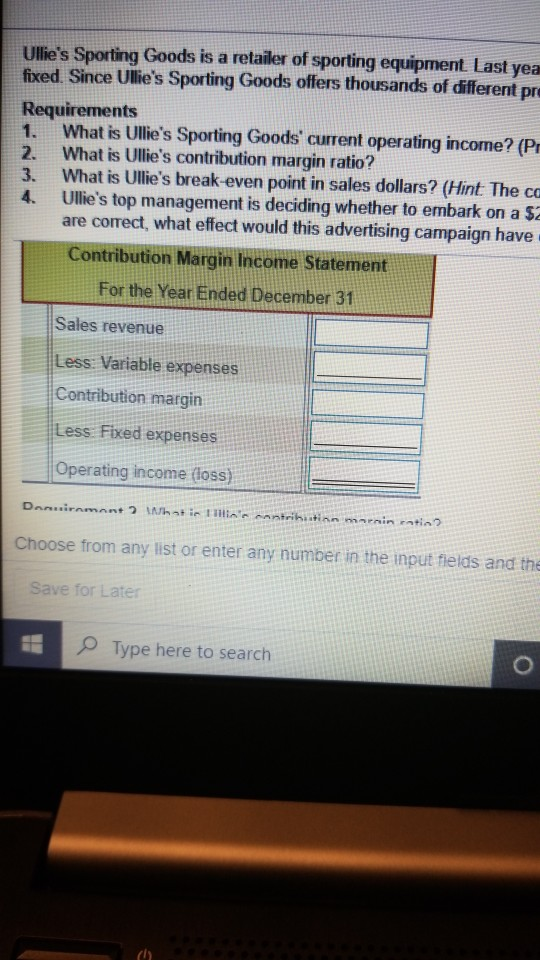

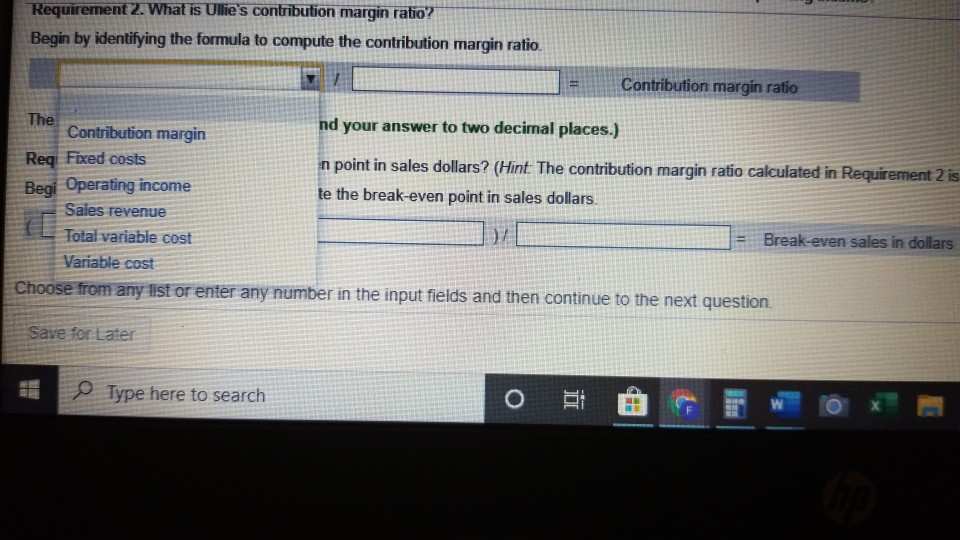

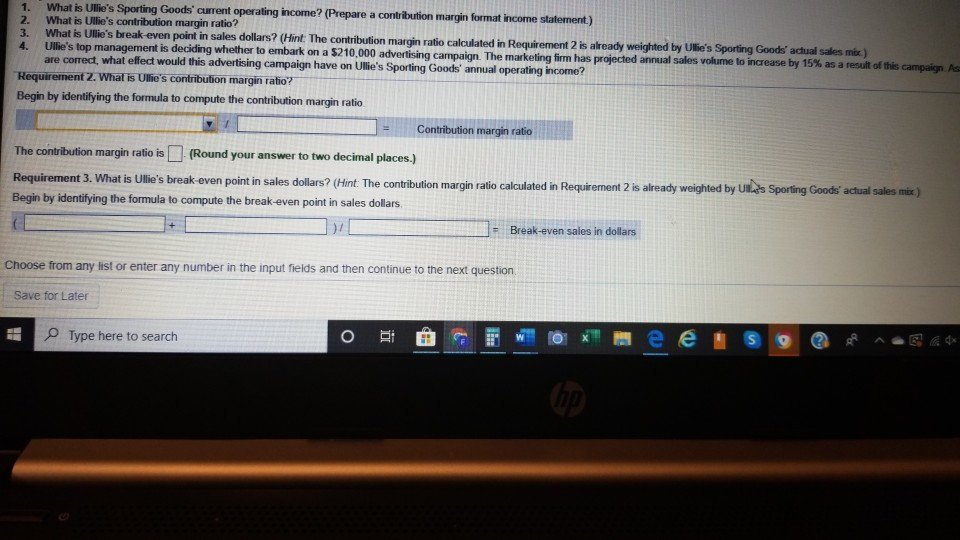

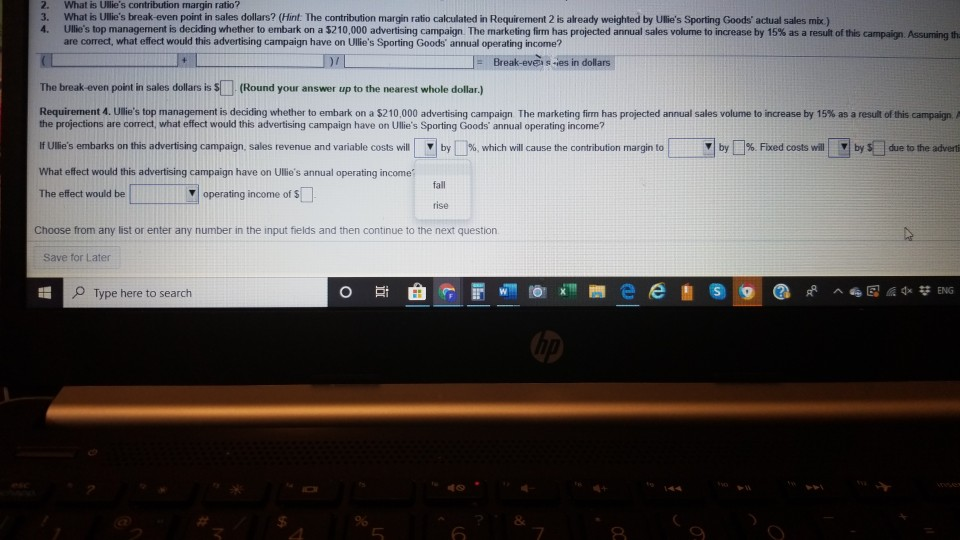

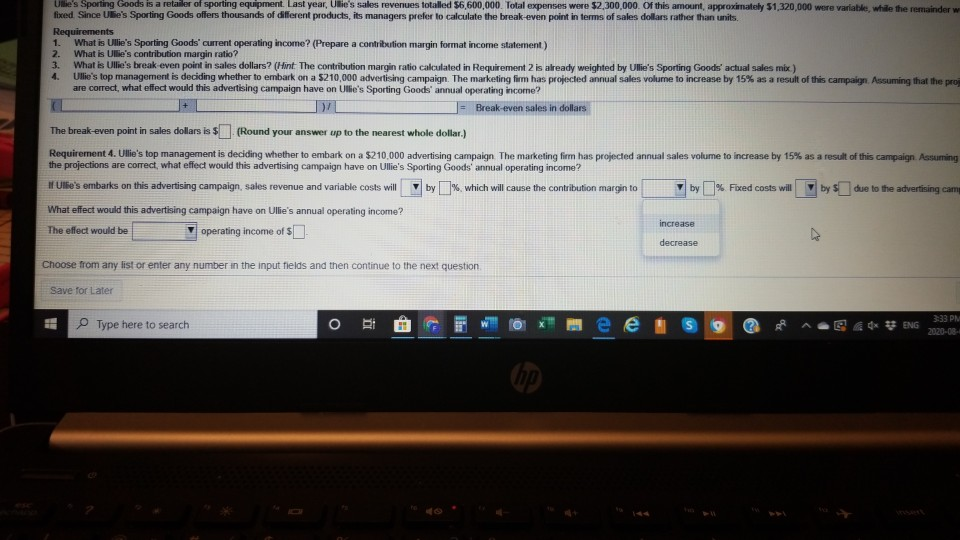

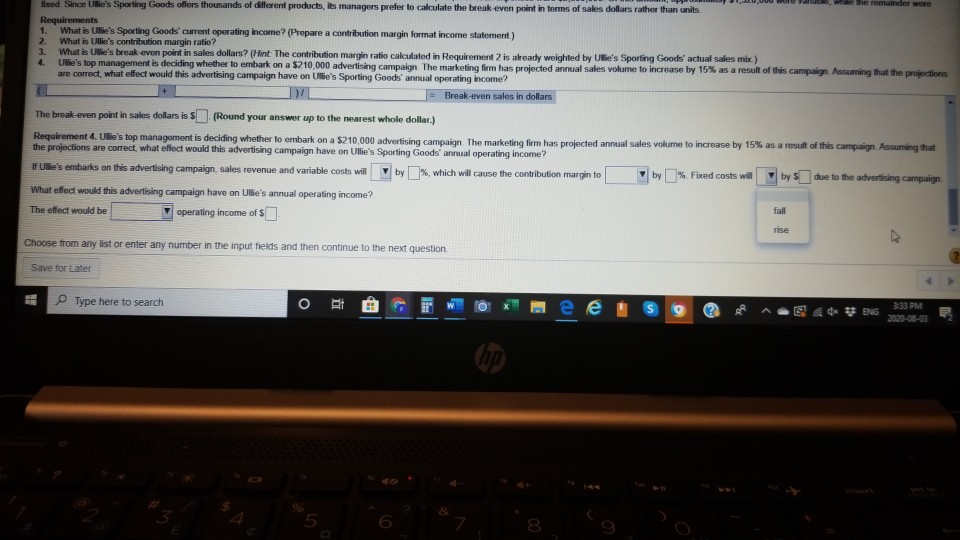

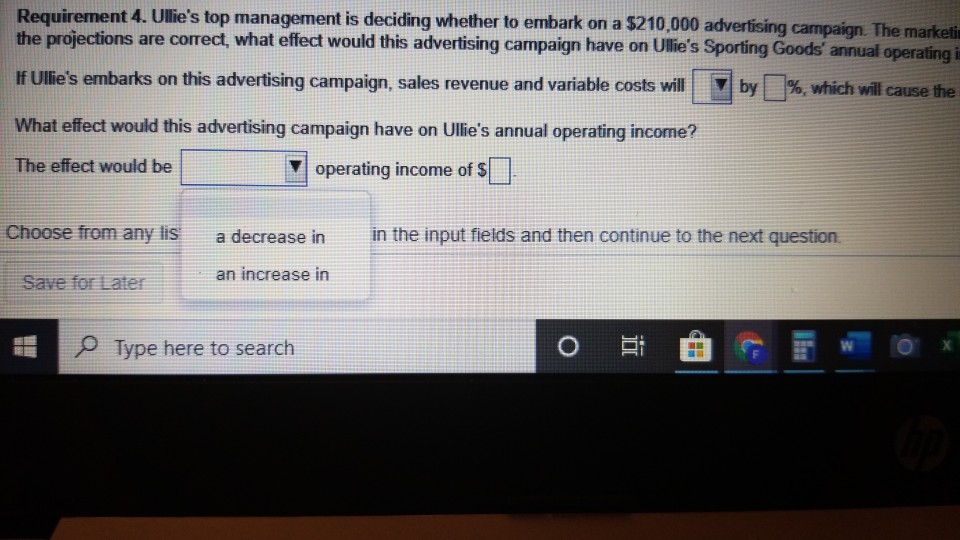

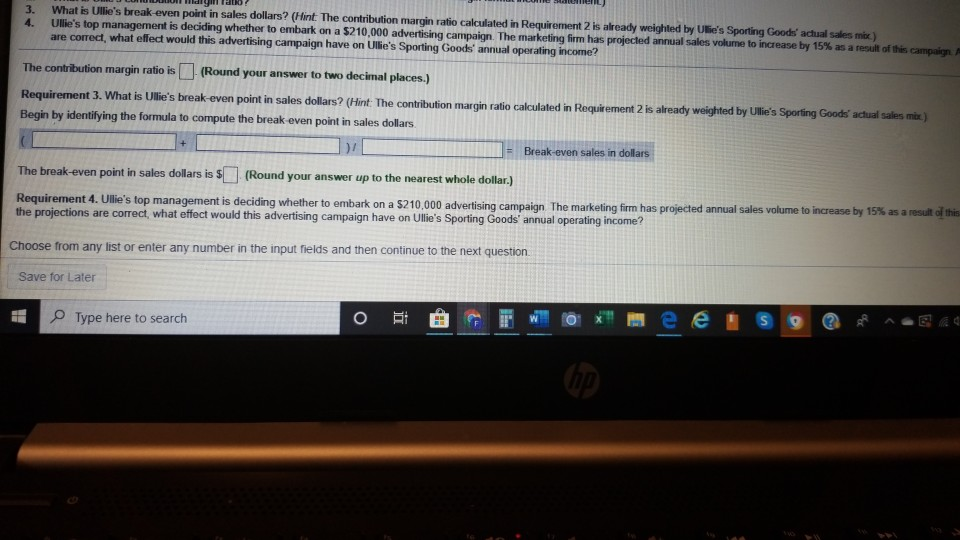

Ullie's Sporting Goods is a retailer of sporting equipment. Last year, Ullie's sales revenues totalled 56,600,000 Total expenses were $2,300,000. Of this amount, approximately 51,320,000 were variable, while the remainder were fixed. Since Ullie's Sporting Goods offers thousands of different products, its managers prefer to calculate the break even point in terms of sales dollars rather than units Requirements 1. What is Ullie's Sporting Goods current operating income? (Prepare a contribution margin format income statement) 2. What is Ullie's contribution margin ratio? 3. What is Ullie's break-even point in sales dollars? (Hint. The contribution margin ratio calculated in Requirement 2 is already weighted by Ullie's Sporting Goods' actual sales mix) Ullie's top management is deciding whether to embark on a $210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign. Assuming that the projections are corred, what effect would this advertising campaign have on Uillie's Sporting Goods annual operating income? 4. Requirement 1. What is Ulle's Sporting Goods' current operating income? (Prepare a contribution margin format income statement) Complete the contribution margin income statement (Enter losses with a minus sign or parentheses.) Ullie's Sporting Goods Contribution Margin Income Statement For the Year Ended December 31 Sales revenue Less Variable expenses Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Type here to search BE 4x * ENG 31 PM 2020-08-03 ES Ullie's Sporting Goods is a retailer of sporting equipment. Last yea fixed. Since Ullie's Sporting Goods offers thousands of different pre Requirements 1. What is Ullie's Sporting Goods' current operating income? (Pr 2. What is Ullie's contribution margin ratio? 3. What is Ullie's break-even point in sales dollars? (Hint. The co 4. Ullie's top management is deciding whether to embark on a $2 are correct, what effect would this advertising campaign have Contribution Margin Income Statement For the Year Ended December 31 Sales revenue Less: Variable expenses Contribution margin Less Fixed expenses Operating income loss) Danirnment? What in Illin' contribution marrin ratio Choose from any list or enter any number in the input fields and the Save for Later Type here to search (1) Requirement 2. What is Ullie's contribution margin ratio? Begin by identifying the formula to compute the contribution margin ratio. Contribution margin ratio The Contribution margin nd your answer to two decimal places.) Req Fixed costs in point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is Begi Operating income te the break-even point in sales dollars. Sales revenue Total variable cost 27 Break-even sales in dollars Variable cost Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later Type here to search 0 1. What is Ullie's Sporting Goods' current operating income? (Prepare a contribution margin format income statement) 2. What is Ullie's contribution margin ratio? 3. What is Ullie's break-even point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is already weighted by Ullie's Sporting Goods' actual sales mix) 4. Ullie's top management is deciding whether to embark on a $210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign. As are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? Requirement Z. What is Ullie's contribution margin ratio? Begin by identifying the formula to compute the contribution margin ratio Contribution margin ratio The contribution margin ratio is (Round your answer to two decimal places.) Requirement 3. What is Ullie's break-even point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is already weighted by Un's Sporting Goods actual sales mix) Begin by identifying the formula to compute the break-even point in sales dollars = Break-even sales in dollars Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Type here to search O e ei so 2 What is Ullie's contribution margin ratio? 3. What is Ullie's break even point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is already weighted by Ullie's Sporting Goods' actual sales mix) 4. Ullie's top management is deciding whether to embark on a 5210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign. Assuring the are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? 17 Break-evens-ies in dollars The break even point in sales dollars is $(Round your answer up to the nearest whole dollar.) Requirement. Ullie's top management is deciding whether to embark on a $210,000 advertising campaign The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign the projections are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? If Ullie's embarks on this advertising campaign, sales revenue and variable costs will by %, which will cause the contribution margin to by % Fixed costs will due to the adverti What effect would this advertising campaign have on Ullie's annual operating income The effect would be operating income of $ rise by 5 fall Choose from any list or enter any number in the input fields and then continue to the next question Save for Later OBI CH Type here to search IL e el is ** ENG 7 + Ulle's Sporting Goods is a retailer of sporting equipment. Last year, Ullie's sales revenues totalled $6,600,000. Total expenses were $2,300,000. Of this amount, approximately 51,320,000 were variable, while the remainder w fixed Since Ullie's Sporting Goods offers thousands of different products, its managers prefer to calculate the break even point in terms of sales dollars rather than units Requirements 1. What is Ullie's Sporting Goods' current operating income? (Prepare a contribution margin format income statement) 2. What is Uile's contribution margin ratio? 3. What is Ullie's break even point in sales dollars? (Hint. The contribution margin ratio calculated in Requirement 2 is already weighted by Ullie's Sporting Goods' actual sales mix) 4. Ullie's top management is deciding whether to embark on a 5210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign. Assuming that the proj are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? 7 = Break-even sales in dollars The break even point in sales dollars is $(Round your answer up to the nearest whole dollar.) Requirement 4. Ulie's top management is deciding whether to embark on a $210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign. Assuming the projections are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? 1 Ulle's embarks on this advertising campaign, sales revenue and variable costs will by %, which will cause the contribution margin to by % Fixed costs will by due to the advertising came What effect would this advertising campaign have on Ullie's annual operating income? increase The effect would be operating of $ decrease Choose from any list or enter any number in the input fields and then continue to the next question Save for Later OBI Type here to search 3 5 8 dx ENG 333 PM 2020-031 we the remainder were fixed. Since Ullie's Sporting Goods offers thousands of different products, its managers prefer to calculate the break even point in terms of sales dollars rather than units Requirements 1. What is Ullie's Sporting Goods' current operating income? (Prepare a contribution margin format income statement) 2. What is Ullie's contribution margin ratio? 3. What is lie's break even point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is already weighted by Ulie's Sporting Goods' actual sales mix) 4. Ule's top management is deciding whether to embark on a S210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign Assuming that the projections are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? Break-even sales in dollars The break-even point in sales dollars is S (Round your answer up to the nearest whole dollar.) Requirement 4. Ule's top management is deciding whether to embark on a S210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign. Assuming that the projections are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? Ulie's embarks on this advertising campaign, sales revenue and variable costs will by %, which will cause the contribution margin to by % Fixed costs will by s due to the advertising campaign What effect would this advertising campaign have on Lille's annual operating income? fall The effect would be operating income of rise Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Type here to search 15 3 0x ENG 333 PM 2020-08-03 5 8 Requirement 4. Ullie's top management is deciding whether to embark on a $210,000 advertising campaign. The marketin the projections are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating i If Ullie's embarks on this advertising campaign, sales revenue and variable costs will by %, which will cause the What effect would this advertising campaign have on Ullie's annual operating income? The effect would be operating income of $ Choose from any lis in the input fields and then continue to the next question a decrease in an increase in Save for Later . o Type here to search O 3. What is Ullie's break even point in sales dollars? (Hint. The contribution margin ratio calculated in Requirement 2 is already weighted by Vlie's Sporting Goods' actual sales mix) 4. Ullie's top management is deciding whether to embark on a $210,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 15% as a result of this campaign are correct, what effect would this advertising campaign have on Uillie's Sporting Goods' annual operating income? The contribution margin ratio is (Round your answer to two decimal places.) Requirement 3. What is Ullie's break-even point in sales dollars? (Hint: The contribution margin ratio calculated in Requirement 2 is already weighted by Ullie's Sporting Goods' actual sales mix) Begin by identifying the formula to compute the break even point in sales dollars. Break-even sales in dollars The break-even point in sales dollars is $(Round your answer up to the nearest whole dollar.) Requirement 4. Ullie's top management is deciding whether to embark on a 5210,000 advertising campaign The marketing firm has projected annual sales volume to increase by 15% as a result of this the projections are correct, what effect would this advertising campaign have on Ullie's Sporting Goods' annual operating income? Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Type here to search ORI e es

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started