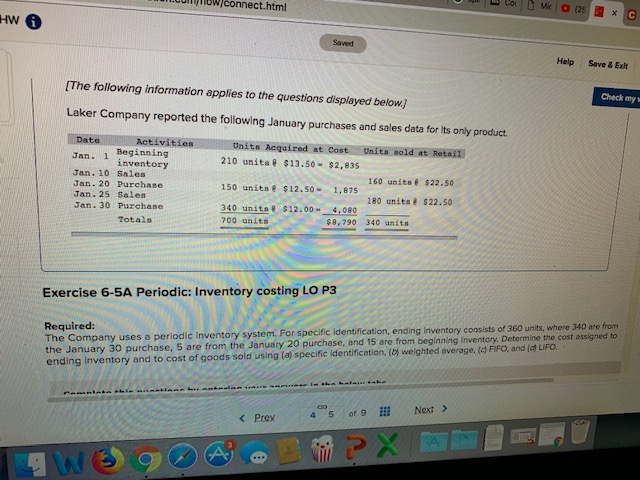

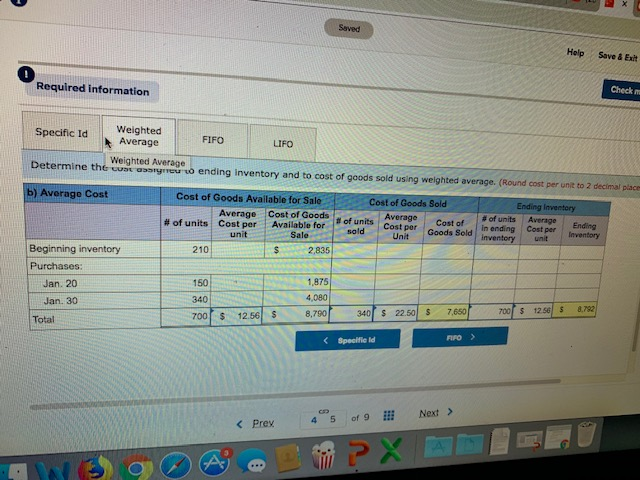

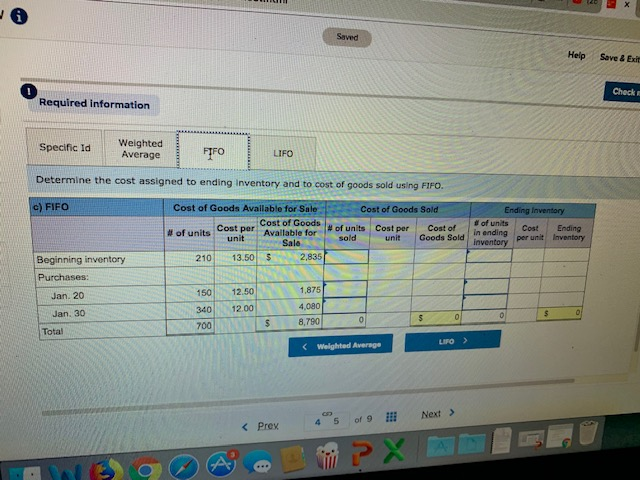

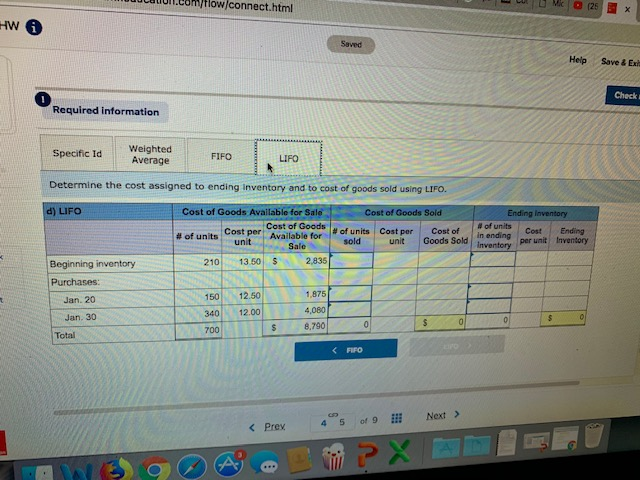

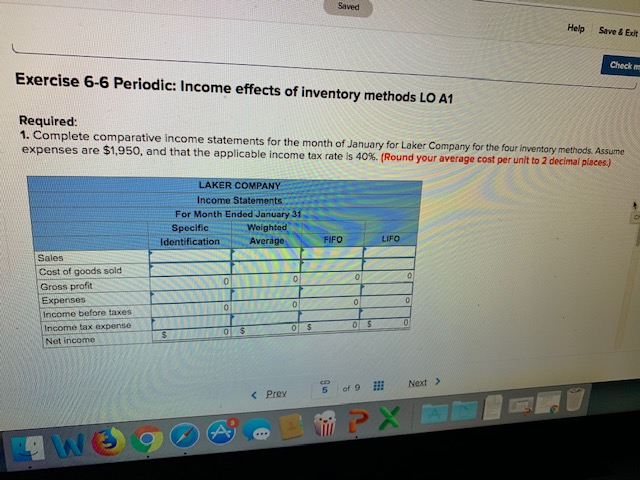

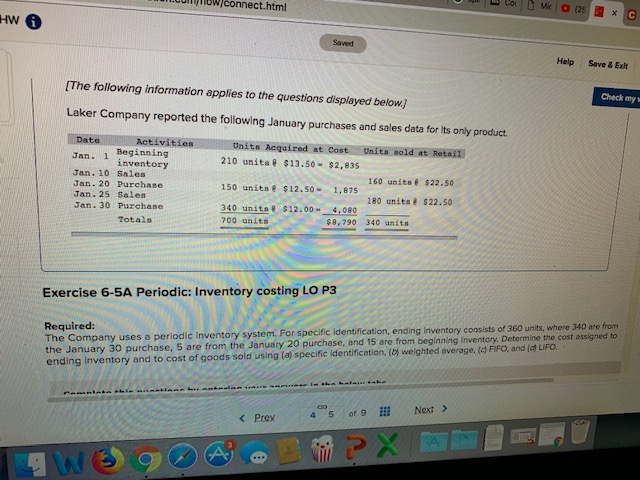

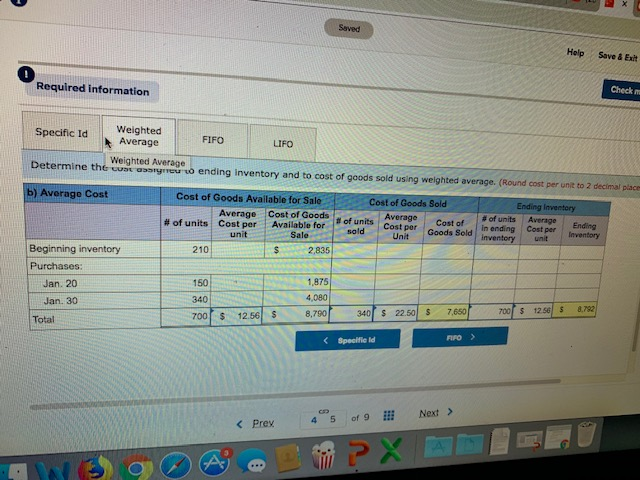

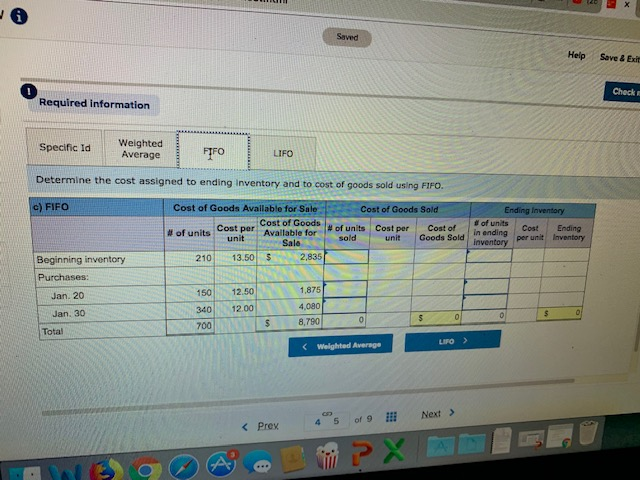

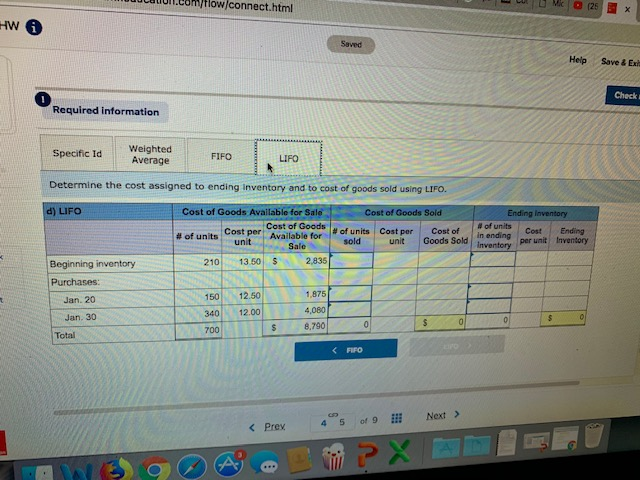

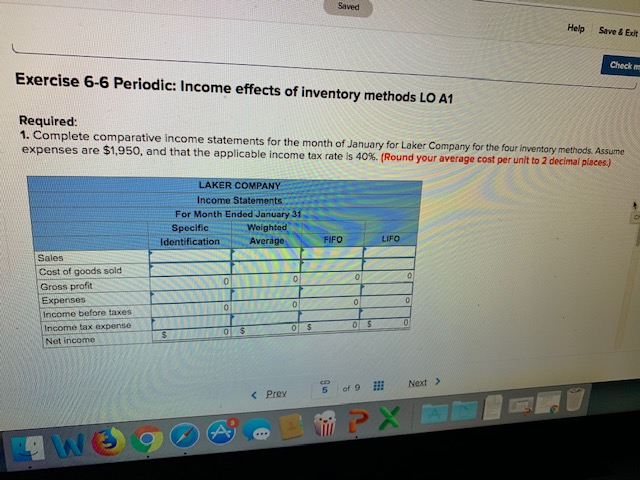

ullpnoW)connect.html HW Saved Help Save&Exit The following information applies to the questions displayed below] Laker Company reported the following January purchases and sales data for its only product Check myw DateActivities Jan. 1 Beginning Jan. 10 Sales Jan- 20 Purchase Tan. 25 Sales Jan. 30 Purchase Units Aequired at Cost Unita sold at Retail 210 units $13.50- $2,835 150 units $12.s0- 1,875 340 units @ $12.00- 4,080 inventory 160 units $22.50 180 units$22.50 Totals 700 units $8,790 340 unita Exercise 6-5A Periodic: Inventory costing LO P3 The Company uses a periodic inventory system. For specific Identification, ending in the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inven ending inventory and to cost of goods sold using (a) specific identification, (ol weighted overage, (c)FIR, andat LFO Required: entory consists of 360 unilts, where 340 are from 4 S of9 Next > Saved Holp Save& Exit 0 Required information Check m Specific IdWeighted FIFO Average Weighted Average LIFO Determine the cost ossgrieu to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal place b) Average Cost Cost of Goods Available for Sale Average Cost of Goods Cost per | Available for | # of units Cost of Goods Sold Average Cost per | Cost ofin ending Cost per Inventory | # ofunits # of units Cost of unit sold- Sale inventoryunit Beginning inventory Purchases 210 2,835 ,875 4,080 8,790 Jan. 20 150 Jan. 30 340 700 12503 .710340 8 3.5 5 TAUS70 5 397 700 s 12.56 S 22.50 7650 700 1256 $8,782 Total Specifie ld Saved Help Save & Exit 0 Check Required information Specific Id Weighted Average TFO LIFO . mine the cost assigned to ending inventory and to cost of goods sold using FIro. c) FIFO Cost of Goods Avallable for Sale of units Cost per Goods 2,835 Cost of Goods Sold Cost per unit Cost of Goods : # of units Available for cost per unit Cost of Cost Ending in ending per unit Inventory of units sold Sale Beginning inventory 210 13.50 $ Purchases Jan. 20 Jan. 30 150 12.50 340 12.00 700 1,875 4,080 8,790 Total LIFO > Welghted Average Prey 4 5 of 9 Next > ucuuun.com flow/connect.html Saved Help Save & Exb Check Required information Weighted Specific Id Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using LIFO Cost of Goods Available for Sale # of units . un per Availablefor d) LIFO Cost of Goods Sold ofunits Inventory per unit Inventory #of units. Cost per Cost of unit Avai sold Sale unit Goods Sold in ending Cost Beginning inventory 210 13.50 S2,835 Purchases 150 12.50 340 12.00 700 Jan. 20 1,875 Jan. 30 4,080 8,780 Total Saved Help Save & Exit Check m Exercise 6-6 Periodic: Income effects of inventory methods LO A1 Required 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods Assume expenses are $1,950, and that the applicable income tax rate is 40%. (Round your average cost per unit to 2 decimal places) LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Average Identification FIFO LIFO Sales Cost of goods sold Gross profit Expens85 Income before taxes Income tax expense Net income 0 S