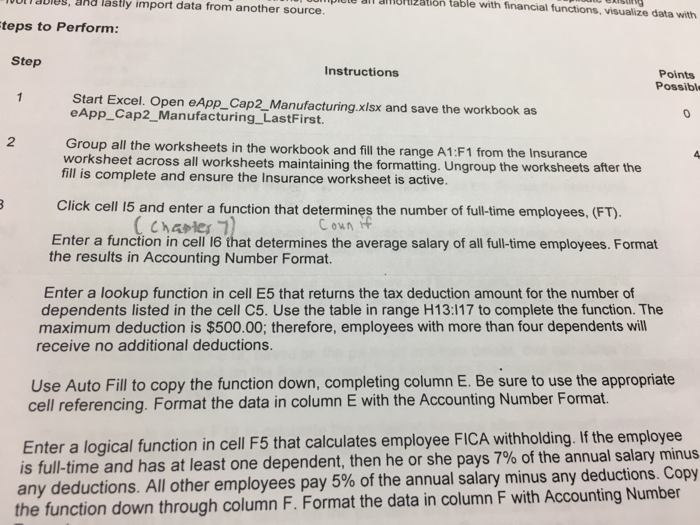

UlTaDie, and lastly import plule anoRization table data from another source. ail with financial functions, visualize data with teps to Perform: Step Instructions Points Possibl Start Excel. Open eApp_Cap2_Manufacturing.xlsx and save the workbook as eApp_Cap2-Manufacturing-LastFirst. 0 2 Group all the worksheets in the workbook and fill the range A1:F1 from the Insurance worksheet across all worksheets maintaining the formatting. Ungroup the worksheets after the fill is complete and ensure the Insurance worksheet is active. Click cell 15 and enter a function that determines the number of full-time employees, (FT). Enter a function in cell 16 that determines the average salary of all full-time employees. Format the results in Accounting Number Format. Enter a lookup function in cell E5 that returns the tax deduction amount for the number of dependents listed in the cell C5. Use the table in range H13:117 to complete the function. The maximum deduction is $500.00; therefore, employees with more than four dependents will receive no additional deductions. Use Auto Fill to copy the function down, completing column E. Be sure to use the appropriate cell referencing. Format the data in column E with the Accounting Number Format. Enter a logical function in cell F5 that calculates employee FICA withholding.If the employee is full-time and has at least one dependent, then he or she pays 7% of the annual salary minus s any deductions. Copy any deductions. All other employees pay 5% of the annual salary minu the function down through column F. Format the data in column F with Accounting Number UlTaDie, and lastly import plule anoRization table data from another source. ail with financial functions, visualize data with teps to Perform: Step Instructions Points Possibl Start Excel. Open eApp_Cap2_Manufacturing.xlsx and save the workbook as eApp_Cap2-Manufacturing-LastFirst. 0 2 Group all the worksheets in the workbook and fill the range A1:F1 from the Insurance worksheet across all worksheets maintaining the formatting. Ungroup the worksheets after the fill is complete and ensure the Insurance worksheet is active. Click cell 15 and enter a function that determines the number of full-time employees, (FT). Enter a function in cell 16 that determines the average salary of all full-time employees. Format the results in Accounting Number Format. Enter a lookup function in cell E5 that returns the tax deduction amount for the number of dependents listed in the cell C5. Use the table in range H13:117 to complete the function. The maximum deduction is $500.00; therefore, employees with more than four dependents will receive no additional deductions. Use Auto Fill to copy the function down, completing column E. Be sure to use the appropriate cell referencing. Format the data in column E with the Accounting Number Format. Enter a logical function in cell F5 that calculates employee FICA withholding.If the employee is full-time and has at least one dependent, then he or she pays 7% of the annual salary minus s any deductions. Copy any deductions. All other employees pay 5% of the annual salary minu the function down through column F. Format the data in column F with Accounting Number