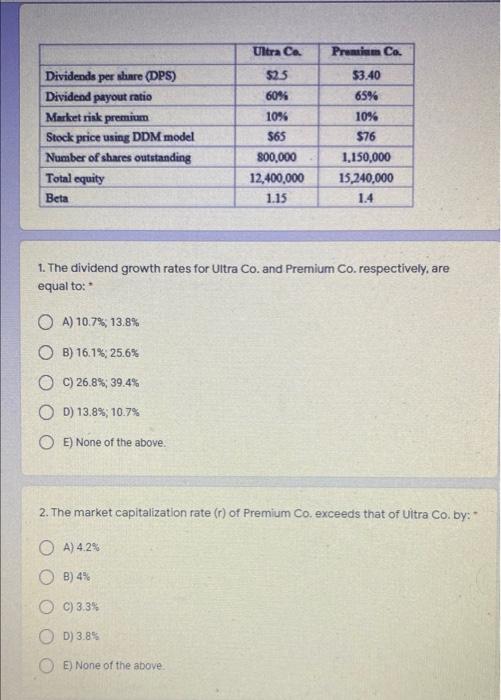

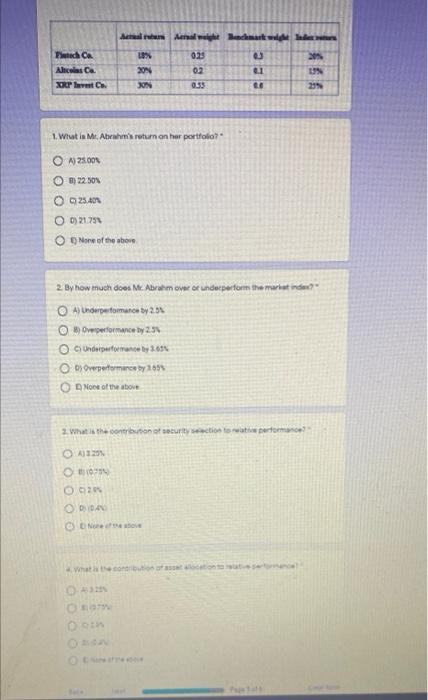

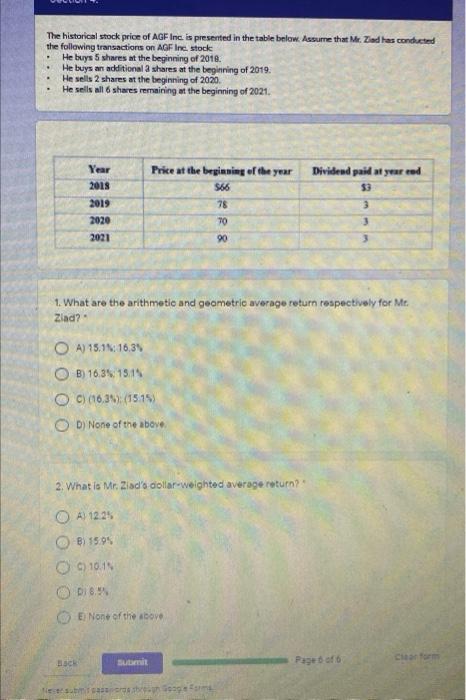

Ultra Ca Premium Co. Dividends per sbre (DPS) Dividend payout ratio Market risk premium Stock price using DDM model Number of shares outstanding Total equity Beta 523 60% 10% $65 800,000 12,400,000 1.15 $3.40 65% 10% $76 1,150,000 15,240,000 1.4 1. The dividend growth rates for Ultra Co. and Premium Co. respectively, are equal to: OA) 10.7% 13.8% OB) 16.1%; 25.6% OC) 26.8%; 39.4% OD) 13.8%; 10.7% OE) None of the above. 2. The market capitalization rate () of Premium Co. exceeds that of Ultra Co. by: OA) 4.2% B) 4% C) 3.3% OD) 3.8% E) None of the above Acara en del Patch CA Alcosca XRP Bert ON 2014 0.23 0.2 0335 Bee UN 23 1. What in Mt. Abrah's return on her portfolio O 25.000 m) 22.50 Q 25.401 O 0) 21751 None of the shown 2. By how much does Mc Abramover or underperform the market inden? OA) Ungerpartomance by 2.51 Overperformance by 2.3 O i Underperformance by20 Operformance by 2018 None of the above 2. What is the contributions to water A320 090 20 DOAN C New como D The historical stock price of AGF Inc. is presented in the table below. Assume that Mr. Ziad has conducted the following transactions on AGF Inc. stock He buys 5 shares at the beginning of 2018 He buys an additional a shares at the beginning of 2019. He sells 2 shares at the beginning of 2020 He sells all 6 shares remaining at the beginning of 2021. Year 2018 2019 2020 2021 Price at the beginning of the year 566 78 Dividend paid a year end $3 3 70 3 90 1. What are the arithmetic and geometrie average return respectively for Mr. Zlad? O A) 15,9N, 16.31 O B) 16.35 15:18 OC) (16.34% (1515) OD) None of the above 2. What is Mr. Ziad's dollar-weighted average return? O A 1225 OB) 1595 OC)10.11 6. Ei None of the above CH Page of ests.cat Ultra Ca Premium Co. Dividends per sbre (DPS) Dividend payout ratio Market risk premium Stock price using DDM model Number of shares outstanding Total equity Beta 523 60% 10% $65 800,000 12,400,000 1.15 $3.40 65% 10% $76 1,150,000 15,240,000 1.4 1. The dividend growth rates for Ultra Co. and Premium Co. respectively, are equal to: OA) 10.7% 13.8% OB) 16.1%; 25.6% OC) 26.8%; 39.4% OD) 13.8%; 10.7% OE) None of the above. 2. The market capitalization rate () of Premium Co. exceeds that of Ultra Co. by: OA) 4.2% B) 4% C) 3.3% OD) 3.8% E) None of the above Acara en del Patch CA Alcosca XRP Bert ON 2014 0.23 0.2 0335 Bee UN 23 1. What in Mt. Abrah's return on her portfolio O 25.000 m) 22.50 Q 25.401 O 0) 21751 None of the shown 2. By how much does Mc Abramover or underperform the market inden? OA) Ungerpartomance by 2.51 Overperformance by 2.3 O i Underperformance by20 Operformance by 2018 None of the above 2. What is the contributions to water A320 090 20 DOAN C New como D The historical stock price of AGF Inc. is presented in the table below. Assume that Mr. Ziad has conducted the following transactions on AGF Inc. stock He buys 5 shares at the beginning of 2018 He buys an additional a shares at the beginning of 2019. He sells 2 shares at the beginning of 2020 He sells all 6 shares remaining at the beginning of 2021. Year 2018 2019 2020 2021 Price at the beginning of the year 566 78 Dividend paid a year end $3 3 70 3 90 1. What are the arithmetic and geometrie average return respectively for Mr. Zlad? O A) 15,9N, 16.31 O B) 16.35 15:18 OC) (16.34% (1515) OD) None of the above 2. What is Mr. Ziad's dollar-weighted average return? O A 1225 OB) 1595 OC)10.11 6. Ei None of the above CH Page of ests.cat