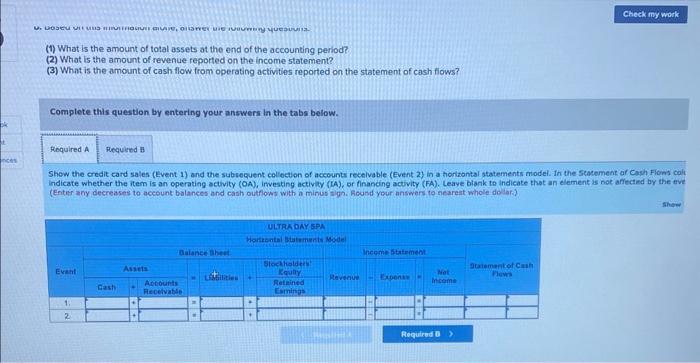

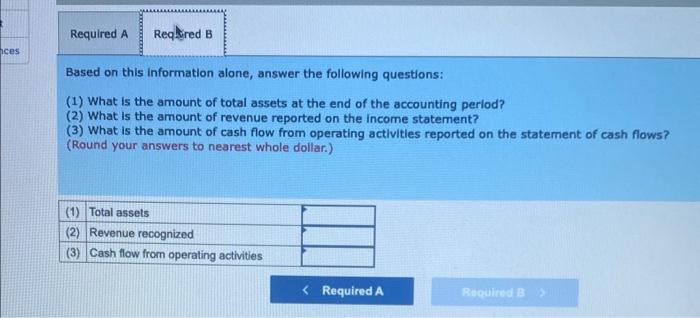

Ultra Day Spa provided $93,700 of services during Year 1. All customers paid for the services with credit cards. Ultra submitted the credit card receipts to the credit card company immediately. The credit card company paid Ultra cash in the amount of face value less a 2 percent service charge. Required a. Show the credit card sales (Event 1) and the subsequent collection of accounts receivable (Event 2) in a horizontal statements model. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Leave blank to indicate that an element is not affected by the event. b. Based on this information alone, answer the following questions: (1) What is the amount of total assets at the end of the accounting period? (2) What is the amount of revenue reported on the income statement? (3) What is the amount of cash flow from operating activities reported on the statement of cash flows? (1) What is the amount of total assets at the end of the accounting period? (2) What is the amount of revenue reported on the income statement? (3) What is the amount of cash flow from operating activities reported on the statement of cash flows? Complete this question by entering your answers in the tabs below. Show the credit card sales (Event 1) and the subsecuent coliection of accounts recelvable (Event 2) in a horizontal statements model. In the Seatement ai Cash Flons coli indicate whether the item is an operating activity (OA), investing activily (LA), or financing activity (FA). Leaye blark to indicate that an element is not affectied by the eve: (Enter any decreases to account balances and cash outflows with a minus sign. Reond your answers to neareat whole dolar.) Based on this information alone, answer the following questions: (1) What is the amount of total assets at the end of the accounting period? (2) What is the amount of revenue reported on the income statement? (3) What is the amount of cash flow from operating activitles reported on the statement of cash flows? (Round your answers to nearest whole dollar.)