Question

Ulysses buys 500 shares of a security, currently trading at $22 per share, that his brokerage firm has designated as option-eligible (ie. allows for

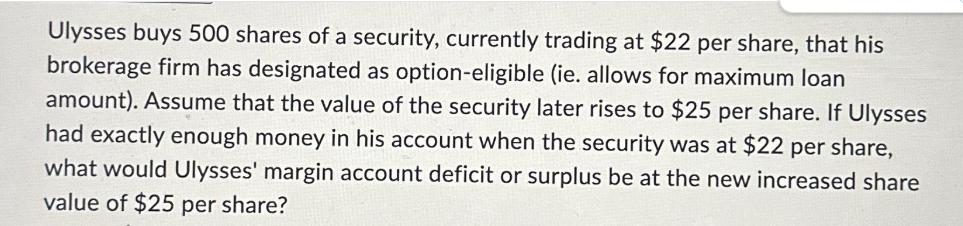

Ulysses buys 500 shares of a security, currently trading at $22 per share, that his brokerage firm has designated as option-eligible (ie. allows for maximum loan amount). Assume that the value of the security later rises to $25 per share. If Ulysses had exactly enough money in his account when the security was at $22 per share, what would Ulysses' margin account deficit or surplus be at the new increased share value of $25 per share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears there might be some typos in your question so Ill do my best to interpret it and provide an answer based on the information given Ulysses p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App