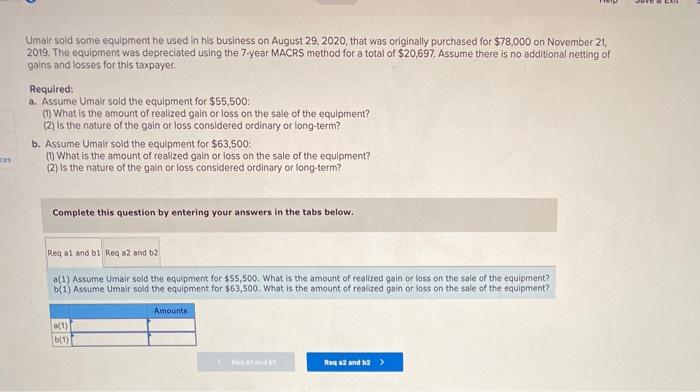

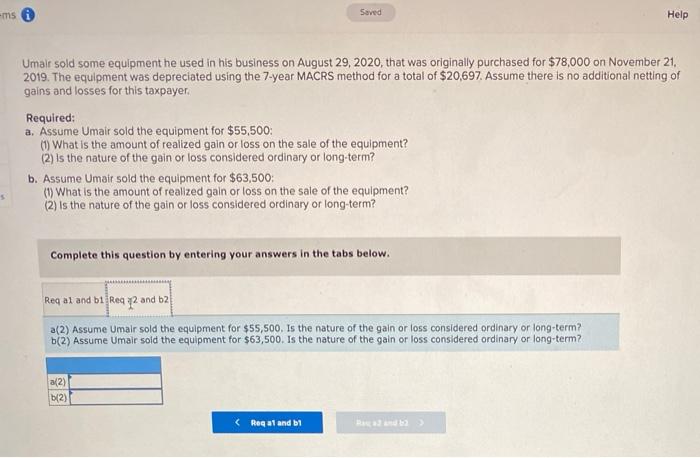

Umalt sold some equipment he used in his business on August 29, 2020, that was originally purchased for $78,000 on November 21 2019. The equipment was depreciated using the 7-year MACRS method for a total of $20,697. Assume there is no additional netting of gains and losses for this taxpayer. Required: a. Assume Umair sold the equipment for $55,500 m) What is the amount of realized gain or loss on the sale of the equipment? (2) Is the nature of the gain or loss considered ordinary or long-term? b. Assume Umalt sold the equipment for $63,500 (0) What is the amount of realized gain or loss on the sale of the equipment? (2) Is the nature of the gain or loss considered ordinary or long-term? ces Complete this question by entering your answers in the tabs below. Req ai and bi Reg a2 and 2 a(1) Assume Umair sold the equipment for $55,500. What is the amount of realized gain or loss on the sale of the equipment? (1) Assume Umair sold the equipment for $63,500. What is the amount of realized gain or loss on the sale of the equipment? Amounts (1) (5) and Rega2 and 2 > -ms Seved Help Umair sold some equipment he used in his business on August 29, 2020, that was originally purchased for $78,000 on November 21, 2019. The equipment was depreciated using the 7-year MACRS method for a total of $20,697. Assume there is no additional netting of gains and losses for this taxpayer Required: a. Assume Umair sold the equipment for $55,500: (1) What is the amount of realized gain or loss on the sale of the equipment? (2) Is the nature of the gain or loss considered ordinary or long-term? b. Assume Umair sold the equipment for $63,500: (1) What is the amount of realized gain or loss on the sale of the equipment? (2) Is the nature of the gain or loss considered ordinary or long-term? 5 Complete this question by entering your answers in the tabs below. Regal and b1 Reqp2 and b2 a(2) Assume Umair sold the equipment for $55,500. Is the nature of the gain or loss considered ordinary or long-term? b(2) Assume Umair sold the equipment for $63,500. Is the nature of the gain or loss considered ordinary or long-term? a(2) (2)