Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Umar has adjusted gross income of RM28,000. During the year, Umar decided he needed a larger home. He purchased a home on a golf course

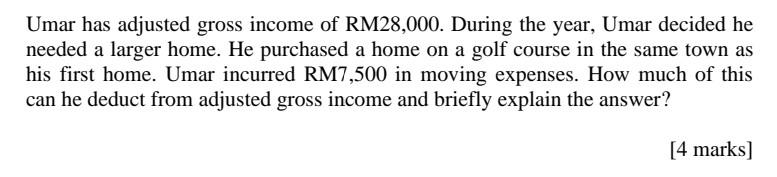

Umar has adjusted gross income of RM28,000. During the year, Umar decided he needed a larger home. He purchased a home on a golf course in the same town as his first home. Umar incurred RM7,500 in moving expenses. How much of this can he deduct from adjusted gross income and briefly explain the answer? [4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started