Answered step by step

Verified Expert Solution

Question

1 Approved Answer

UMITA (Malaysia)'s normal trading currency is MYR. Today, The company was informed by Big M (USA) that it had won a USD 10,000,000 bid

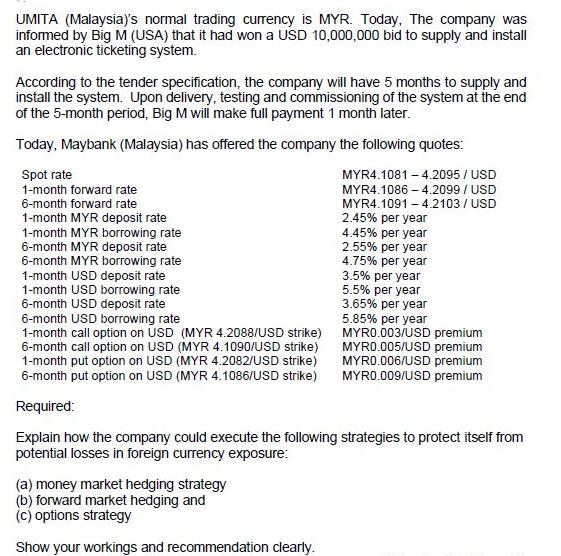

UMITA (Malaysia)'s normal trading currency is MYR. Today, The company was informed by Big M (USA) that it had won a USD 10,000,000 bid to supply and install an electronic ticketing system. According to the tender specification, the company will have 5 months to supply and install the system. Upon delivery, testing and commissioning of the system at the end of the 5-month period, Big M will make full payment 1 month later. Today, Maybank (Malaysia) has offered the company the following quotes: Spot rate MYR4.1081 -4.2095 / USD MYR4.1086 -4.2099 / USD MYR4.1091 -4.2103/USD 2.45% per year 4.45% per year 2.55% per year 1-month forward rate 6-month forward rate 1-month MYR deposit rate 1-month MYR borrowing rate 6-month MYR deposit rate 6-month MYR borrowing rate 1-month USD deposit rate 1-month USD borrowing rate 6-month USD deposit rate 6-month USD borrowing rate 4.75% per year 3.5% per year 5.5% per year 3.65% per year 5.85% per year MYR0.003/USD premium 1-month call option on USD (MYR 4.2088/USD strike) 6-month call option on USD (MYR 4.1090/USD strike) 1-month put option on USD (MYR 4.2082/USD strike) 6-month put option on USD (MYR 4.1086/USD strike) MYR0.005/USD premium MYR0.006/USD premium MYR0.009/USD premium Required: Explain how the company could execute the following strategies to protect itself from potential losses in foreign currency exposure: (a) money market hedging strategy (b) forward market hedging and (c) options strategy Show your workings and recommendation clearly.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To protect itself from potential losses in foreign currency exposure the company can consider the following strategies a Money Market Hedging Strategy In a money market hedging strategy the company ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started