Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required Construct and analyze Sellit Inc. Balance Sheet based on transactions related to obtaining financing and acquiring assets on the first day the company is

Required

Required

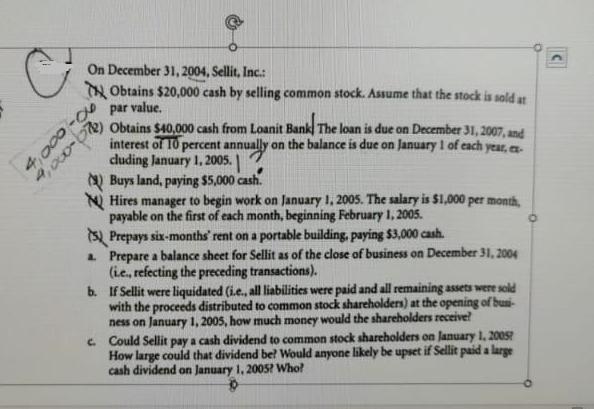

Construct and analyze Sellit Inc. Balance Sheet based on transactions related to obtaining financing and acquiring assets on the first day the company is started.

4,000 4,000- On December 31, 2004, Sellit, Inc.: Obtains $20,000 cash by selling common stock. Assume that the stock is sold at par value. Obtains $40,000 cash from Loanit Bank The loan is due on December 31, 2007, and interest of 10 percent annually on the balance is due on January 1 of each year, ex- cluding January 1, 2005. | Buys land, paying $5,000 cash. Hires manager to begin work on January 1, 2005. The salary is $1,000 per month, payable on the first of each month, beginning February 1, 2005. 5) Prepays six-months' rent on a portable building, paying $3,000 cash. a. Prepare a balance sheet for Sellit as of the close of business on December 31, 2004 (ie., refecting the preceding transactions). b. If Sellit were liquidated (i.e., all liabilities were paid and all remaining assets were sold with the proceeds distributed to common stock shareholders) at the opening of busi- ness on January 1, 2005, how much money would the shareholders receive? c. Could Sellit pay a cash dividend to common stock shareholders on January 1, 2005 How large could that dividend be? Would anyone likely be upset if Sellit paid a large cash dividend on January 1, 2005? Who? O C

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Balance Sheet for Sellit Inc as of December 31 2004 Assets Cash 20000 from selling common stock Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started