Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unable to figure out the middle blacked-out values given the following information, what formula do I use to calculate the blacked out values? 1. At

Unable to figure out the middle blacked-out values given the following information, what formula do I use to calculate the blacked out values?

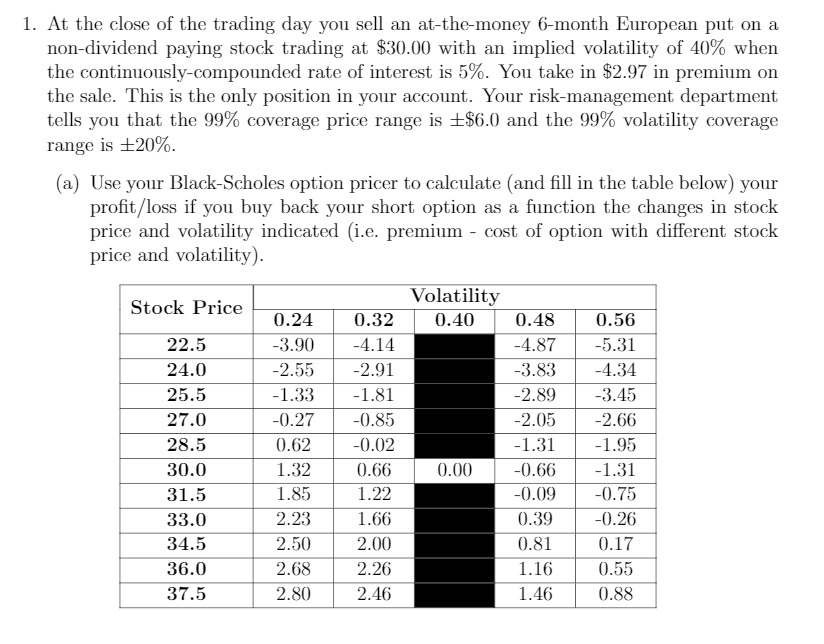

1. At the close of the trading day you sell an at-the-money 6-month European put on a non-dividend paying stock trading at $30.00 with an implied volatility of 40% when the continuously-compounded rate of interest is 5%. You take in $2.97 in premium on the sale. This is the only position in your account. Your risk-management department tells you that the 99% coverage price range is $6.0 and the 99% volatility coverage range is +20%. (a) Use your Black-Scholes option pricer to calculate and fill in the table below) your profit/loss if you buy back your short option as a function the changes in stock price and volatility indicated (i.e. premium - cost of option with different stock price and volatility). Stock Price Volatility 0.40 22.5 24.0 25.5 27.0 28.5 30.0 31.5 33.0 34.5 36.0 37.5 0.24 -3.90 -2.55 -1.33 -0.27 0.62 1.32 1.85 2.23 2.50 2.68 2.80 0.32 -4.14 -2.91 -1.81 -0.85 -0.02 0.66 1.22 1.66 2.00 2.26 2.46 0.48 -4.87 -3.83 -2.89 -2.05 -1.31 -0.66 -0.09 0.39 0.81 1.16 1.46 0.56 -5.31 -4.34 -3.45 -2.66 -1.95 -1.31 -0.75 -0.26 0.17 0.55 0.88 0.00 1. At the close of the trading day you sell an at-the-money 6-month European put on a non-dividend paying stock trading at $30.00 with an implied volatility of 40% when the continuously-compounded rate of interest is 5%. You take in $2.97 in premium on the sale. This is the only position in your account. Your risk-management department tells you that the 99% coverage price range is $6.0 and the 99% volatility coverage range is +20%. (a) Use your Black-Scholes option pricer to calculate and fill in the table below) your profit/loss if you buy back your short option as a function the changes in stock price and volatility indicated (i.e. premium - cost of option with different stock price and volatility). Stock Price Volatility 0.40 22.5 24.0 25.5 27.0 28.5 30.0 31.5 33.0 34.5 36.0 37.5 0.24 -3.90 -2.55 -1.33 -0.27 0.62 1.32 1.85 2.23 2.50 2.68 2.80 0.32 -4.14 -2.91 -1.81 -0.85 -0.02 0.66 1.22 1.66 2.00 2.26 2.46 0.48 -4.87 -3.83 -2.89 -2.05 -1.31 -0.66 -0.09 0.39 0.81 1.16 1.46 0.56 -5.31 -4.34 -3.45 -2.66 -1.95 -1.31 -0.75 -0.26 0.17 0.55 0.88 0.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started